Africa and Australasia offer a bridge between Asia and Latin America

In the truly global long-haul market, one fledging transit location in the Asia-Latin America market is Africa. In terms of scale this offers at best only long-term potential.

There are a growing number of Africa-Asia services, mainly led by Ethiopian Airlines, which wants to leverage its Addis Ababa hub geography in eastern Africa to funnel traffic to the rest of the continent. Ethiopian expects most of its growth to be eastwards to Asia.

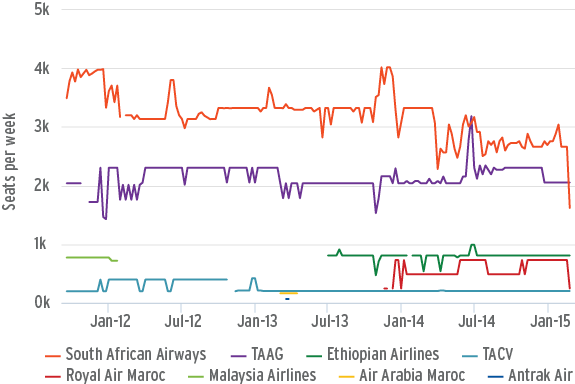

Over the years, carriers have exited the Africa-Latin America market including Varig (Johannesburg-Cape Town-Sao Paulo), Malaysia Airlines (Kuala Lumpur-Johannesburg-Cape Town-Buenos Aires, with the Johannesburg sector later dropped) and a stint from Aerolineas Argentinas (Johannesburg-Buenos Aires) that did not last a year. There have also been occasional charters as well as flights from TACV and TAAG, but the latter is focused on the local market and often operated with only one weekly flight.

Despite several withdrawals, regularly scheduled frequency between Africa and Latin America has grown, mostly due to South African Airways increasing from about five weekly flights in 2004 (all Johannesburg-Sao Paulo) to 12 weekly in 2014 (almost all Johannesburg-Sao Paulo with some Johannesburg-Buenos Aires). Those that have exited - Aerolineas, Malaysia and Varig - seldom had more than two weekly flights. Further, Ethiopian in 2013 launched a three times weekly Addis Ababa-Lome-Rio De Janeiro-Sao Paulo service; this service now omits Rio, providing a faster link to Sao Paulo.

AFRICA to Latin America, seats per week, one way

The challenges between Africa and Latin America are multiple. Trade links are limited and lack of aeropolitical deregulation in Africa makes intra-Africa flights - necessary to feed a possible route - expensive, quickly giving a cost advantage to Gulf or European airlines, even if it means a doubling or tripling of journey time.

The challenges between Africa and Latin America are multiple. Trade links are limited and lack of aeropolitical deregulation in Africa makes intra-Africa flights - necessary to feed a possible route - expensive, quickly giving a cost advantage to Gulf or European airlines, even if it means a doubling or tripling of journey time.

There is also the question of a hub. Buenos Aires is a relatively straight 10 hour flight from South Africa, theoretically providing somewhat efficient connections. Sao Paulo, however, is northwest of South Africa, meaning backtracking comes into play if going beyond Sao Paulo to Chile or Argentina, or travelling south to Johannesburg only to go northwest to Sao Paulo. European or Gulf airlines come into favour with wider networks and stronger reputations.

Geographically convenient Buenos Aires is no longer the favoured hub in Latin America. Argentina's economy has weakened while partner options are slim. Brazil is the continent's leading economy, but Brazil has one main international carrier, TAM, followed by airlines that are either domestically focused or have a very small regional international network. It seems South Africa-Brazil traffic can be accommodated on a non-stop South Africa-Brazil service, but going beyond either country makes it more likely a passenger will take a European or Gulf carrier.

Johannesburg may be a workable hub for SAA from Africa to Latin America, but it does not have a strong Asia-Latin America hub proposition. South African Airways' Asian network is confined to Beijing and Hong Kong (both served from Johannesburg), giving SAA limited pull to feed Latin America.

Beyond Beijing, SAA only codeshares to Shanghai with Air China. SAA hopes to have an expanded codeshare relationship with Air China. Beyond Hong Kong, SAA works with fellow Star carriers, such as ANA to Japan, but these relationships are limited and intra-Asia fares can be expensive. This limits SAA's reach in the wider North Asian market, as well as not giving it exposure in the smaller Southeast Asia market.

SAA's Asia-Latin America proposition is possible with decent connecting times from Beijing and Hong Kong to Sao Paulo, but on the return to Beijing there is a lengthy layover. Further, like all of SAA's long-haul network, Beijing and Hong Kong are loss making, Beijing excessively so, but the service is seen by the South African government as strategic and will stay. While partnerships may help, SAA believes only new-generation aircraft will give it a chance to be profitable.

Ethiopian Airlines' foray into Latin America offers much greater potential, thanks to geography and Ethiopian's Asian network. In 2013 Ethiopian launched its three-weekly service from Addis Ababa to Rio de Janeiro, continuing to Sao Paulo via Lome in the West African country of Togo. Addis' geography has previously precluded non-stop service.

Ethiopian has an investment in Togo's ASKY, and the thought was ASKY could provide feed from around West Africa for Ethiopian's Latin American service. ASKY and Ethiopian have a limited codeshare relationship. Technically, Ethiopian's 787-8s should have the capability for a non-stop service on the 10,000 km Addis Ababa-Sao Paulo route, but the altitude of Addis rules out an eastbound routing; Ethiopian's 787s are currently dedicated to services to Asia, Europe, India and the US.

Ethiopian has a stronger Asian network than SAA, reaching eight points: Bangkok, Beijing, Guangzhou, Hong Kong and Shanghai are non-stop, while Seoul is linked with Hong Kong, and Kuala Lumpur and Singapore are both linked to Bangkok.

The more northerly the Asian destination, the shorter the distance via Addis and Lome than Johannesburg - although Ethiopian's service entails two stops in Africa. Further, Ethiopian has limited frequencies to Latin America and Asia. Leveraging Asian services, an East African hub at Addis and a West African hub at Lome, allows Ethiopian a number of markets to work with to support a Latin American service.

Prospects will be stronger, but not necessarily guaranteed, with more Asian and African growth. But the absence of a Star Alliance partner in Latin America is a substantial handicap.

Africa's only other long-haul airline of note, Kenya Airways, had a management plan in 2012 that called for it to serve every inhabited continent by 2017. Kenya's Latin America footprint was to be in Sao Paulo, with a three-weekly 787 service.

The plan is already behind schedule: Kuala Lumpur and Bangalore were to be launched in 2013/2014 but have not, while 2014/2015 launches of Beijing, Sao Paulo and Berlin do not appear to be moving forward.

Strategy development at African carriers is highly fluid, but it looks unlikely that many elements of this plan will be realised. Kenya also has a smaller footprint in Asia, reaching only Bangkok, Guangzhou and Hong Kong - three destinations to Ethiopian's eight.

Australia and New Zealand are also vying to be transit hubs from Asia to Latin America. Their existing combined share of traffic is small, at under 1%. However, both probably lack the scale to develop this market. Asian services would need to be boosted, but it is the link to Latin America that is most limiting. For much of last decade, service was provided on the Latin American side, with LAN offering a Santiago-Auckland-Sydney service and Aerolineas Argentinas a similar Buenos Aires-Auckland-Sydney service.

After launching a Buenos Aires route in 2008, Qantas shifted its focus to Santiago in 2012, gaining codeshares to allow beyond gateway access and growing closer with fellow oneworld partner LAN in what is a small but solid relationship.

Protectionism and Argentina's near-disastrous economy drove Qantas out but that could not insulate Aerolineas, which exited the Southwest Pacific in Apr-2014. That left a oneworld alliance in control with no viable alternative routing.

Even before Aerolineas withdrew, Sydney was LAN's top market for a year. Such success might invite competition, but this is unlikely from the Latin American side. Of the few other long-haul carriers, TAM is with LAN in the LATAM group, and the other carriers on the continent are focused on bigger long-haul markets.

TAM's shift to oneworld has disrupted the Latin America plans of more than one Star airline. From the South Pacific side, there is an interested Air New Zealand, that has seen the potential for a few years - as has Auckland Airport and the New Zealand government - to link Latin American with Asia. Air NZ has fewer Asian links than Qantas.

The factors are not yet aligning for Air NZ though. Latin American markets such as Lima that could be reached unrestricted do not have enough point to point traffic. Air NZ could, however, potentially work with fellow Star member, Avianca (formerly TACA), which has a hub in Lima with domestic and good regional international connectivity; and with the right connections, tapping into Japan-Peru demand would help this work.

Santiago is also in Air NZ's favour but a LAN partnership would be unlikely, plus having a third carrier on the Australasia-Santiago route could be overkill. Buenos Aires also has a geographic advantage but would need support from the still-weak Aerolineas, which has not warmed to partnerships. Brazil is an interesting destination market and could be linked to Asia, but range could be problematic.

Air NZ remains interested in serving Latin America, but only if it can be done sustainably. Partnerships - likely more than one - will be necessary. Air NZ's new partnership with SIA raises the interesting scenario of SIA serving Latin America via Auckland, but SIA is not focusing its partnership with ANZ on Latin America. Besides, local Spain-Latin America traffic - the routing SIA currently uses - is more financially appealing than local New Zealand-Latin America traffic.

The New Zealand government hopes liberalising air service agreements will help the country become an Asia-Latin America hub, but the reality for New Zealand is it needs a strong hub carrier (and feed at each end) to facilitate such a role. There may be incremental traffic - including through non-New Zealand carriers such as Cathay and LAN - but it will not be until Air NZ is ready that hub prospects can emerge.

The same is true for Australia: Qantas would need to be a larger player before Australia can become an Asian-Latin American hub. Qantas launched a "Sydney Connect" offering between Santiago and its seven Asian points that provides a night's accommodation in Sydney; the Santiago service arrives in Sydney in the evening but all of its Asian flights except Tokyo leave Sydney in the morning.

The same is true for Australia: Qantas would need to be a larger player before Australia can become an Asian-Latin American hub. Qantas launched a "Sydney Connect" offering between Santiago and its seven Asian points that provides a night's accommodation in Sydney; the Santiago service arrives in Sydney in the evening but all of its Asian flights except Tokyo leave Sydney in the morning.

A night's stopover, even if free, involves a time disadvantage on top of Qantas serving Santiago only three times weekly (four times weekly in the peak southern summer), only offering a one-stop product from Asia to the single point of Santiago, and local Asia-Australia and Australia-Latin America fares already being high. Asia-Latin America traffic can be a filler for Qantas but with yield implications and, at least until the service is daily, of limited upside.

For a hub role to develop in the Asia-Latin America market, there will need to be considerable growth in the Australia/NZ-Asia and Australia/NZ-Latin America third and fourth freedom markets. Once third and fourth freedom traffic is secured, sixth freedom traffic can be added. Air NZ and Qantas are not set up the way Gulf carriers are to have sixth freedom traffic as core.

This blending of third, fourth and sixth freedom service (even, ideally with fifth freedom rights) is a common refrain in establishing viable services between North Asia and Latin America.

For example, Vancouver is far from Australia or New Zealand but shares its southerly peers' aspirations - and market challenges.

This is summed up by a statement in 2013 from the airport: "BC (British Colombia) does not have the market size to support a simple back- and-forth service between Vancouver and cities such as Xiamen, Wuhan, and Hangzhou. But if Vancouver serves as an intermediary point between China and cities in the US and South America - that combination of markets makes a service viable."

The proposition is enticing, especially since Canada - unlike the US - would not require transit visas, a major hurdle holding back the US from growing Asia-Latin America traffic.

Asia-Latin America traffic, even accounting for growth, is still too low volume for transfer traffic to sustain new Vancouver-Asia services. A prospective Vancouver-Asia route would need solid end-to-end demand before filler Latin American traffic can be added. There are other practical constraints: flag carrier Air Canada shows limited interest in Latin America, reducing opportunities for its own Asia-Latin America traffic or for working with Asian partners.

Asian airline partners would have only limited opportunities to transfer passengers via Canada to Latin American partners thanks to Canada's restrictive bilateral regime that has, for example, significantly limited Copa's presence in Latin America.