Latin America’s airport infrastructure - a pointer to the longer term upside for aviation

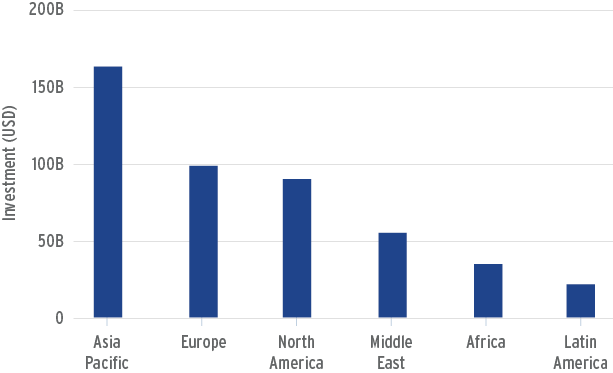

While construction of terminals, runways and other infrastructure at existing airports in Latin America is at a lower level as measured by turnover than in any other region, there are a number of significant projects under way, some of them overtly linked to a second or third wave of privatisation activity across the continent.

Yet even though Brazil is the fifth most populous country in the world, the total South American population in 2014 will be only 390 million. Even adding in Mexico's 120 million residents - which brings the region's population to 510 million - and other smaller Central America states, the number of residents is still merely half that of Africa, which stands at 1.069 billion in 2014.

Moreover, there is still a huge propensity to use road transport throughout the continent, and specifically buses rather than trains, as opposed to air transport.

Total airport construction and development activity is lowest in Latin America, (USD) as of AUG-2014 (EXISTING AIRPORTS)

Mexico is a prime example of travellers' attachment to surface transport, as Brazil's airlines discovered to their cost during the recent FIFA World Cup; business travellers deserted the airlines during the tournament and were not replaced to the expected degree by indigenous and visiting football supporters, many of whom made long journeys between venues by bus.

In the run up to the 2014 World Cup, much of the construction activity was focused on Brazil of course, with most of the airport (and stadium) projects being completed on time despite concerns being voiced by the relevant authorities over a protracted period.

Six airports in Brazil are wholly or partly privatised - but Infraero retains a stake. Five airports in and around Sao Paulo, Rio de Janeiro, Brasilia and Belo Horizonte have been partially disengaged from state operator Infraero's system into concession agreements, though Infraero retains a minority share in each case, and additionally a new airport has been constructed at Natal; the Natal Aluzio Alves International Airport, also known as São Gonçalo do Amarante Airport. It opened for operations on 31-May-2014 and was the first airport in the country to receive a private operator's concession with 100% private equity ownership. Managed by the Inframerica consortium, it was a sort of privatisation benchmark for what might eventually become the norm.

Inframerica was also successful in the auction for the concession to expand, maintain and operate Brasilia International Airport for 25 years. All the works under the concession contract were completed in time for the World Cup, in May-2014.

Another successful construction contract was carried out at Sao Paulo's Guarulhos Airport, Latin America's busiest. A new USD1.3 billion terminal was delivered on time in May-2014, boosting capacity by 12 million passengers per annum (ppa). The concessionaire in this case was a consortium led by Brazil's Invepar and South Africa's ACSA.

Belo Horizonte Tancredo Neves Airport's operations were transferred to concessionaire BH Airport on 12-Aug-2014. It now has 21 months to construct the airport's second terminal as per the concession agreement. In total BRL1.5 billion (USD660 million) will be invested over the 30 year concession, including the construction of a new passenger terminal which will expand capacity by 100% to 20 million ppa.

The concessionaire at Rio de Janeiro's Galeao Airport, Aeroporto Rio de Janeiro, completed essential construction works in time for the World Cup, but not without a struggle, and will now inject BRL2 billion (USD888 million) of a planned total investment of BRL5 billion (USD2.2 billion) in improvements by the start of the 2016 Olympic Games.

But things did not go so smoothly at Campinas Viracopos Airport outside Sao Paulo, where concessionaire Aeroportos Brasil Viracopos is facing a fine which could reach BRL170 million (USD76 million) plus BRL1.7 million (USD754,988) per day of delay, as per the concession agreement, for failing to complete expansion works on time. ABV plans to complete the remainder of its expansion works by the end of Oct-2014. The expansion will boost airport capacity to 22 million passengers per annum, well above the 10 million passengers expected in 2014.

Private Sector Investors in Brazil's Privatised and Semi-Privatised Airports

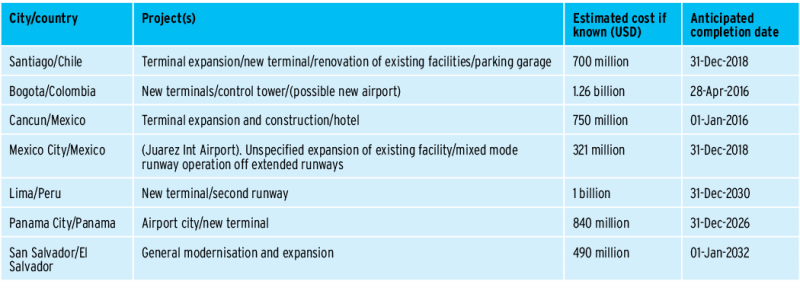

Major airport construction projects at existing Latin American airports (ex-Brazil)

There is, however, little appetite in government for further Brazilian privatisation. The future for airport construction projects in Brazil is unclear beyond the concessioned airports, despite pressure from air transport organisations. And the General Election in Oct-2014 leaves open the strategy likely to be followed by a new government. But Infraero itself remains very active, investing in 270 regional airports to improve facilities.

According to CAPA's Airport Construction and Capex Database, there are currently 55 known projects under way at existing airports in Brazil (including multiple regional projects as above classed as one) to the value of USD11.5 billion, while the total for Latin America is 171 projects, including 11 countrywide multi-airport projects again classed as one, to a value of USD24.6 billion.

As for new-build/green or brown field airports, out of 266 that are known to us globally, 33 of them are in Latin America. Again Brazil dominates but with a strong showing from Peru and Ecuador, and from Honduras in Central America.

Outside Brazil, the main single construction activity in Latin America can be found across the entire region, particularly in Chile, Colombia, Mexico, Peru, Panama and San Salvador.

In addition, many countries such as Argentina, Bolivia, Colombia, the Dominican Republic, Mexico, Panama, Peru and Venezuela have similar multi-regional airport modernisation schemes to those of Brazil, provided usually by the public sector but also by the private one in some cases.

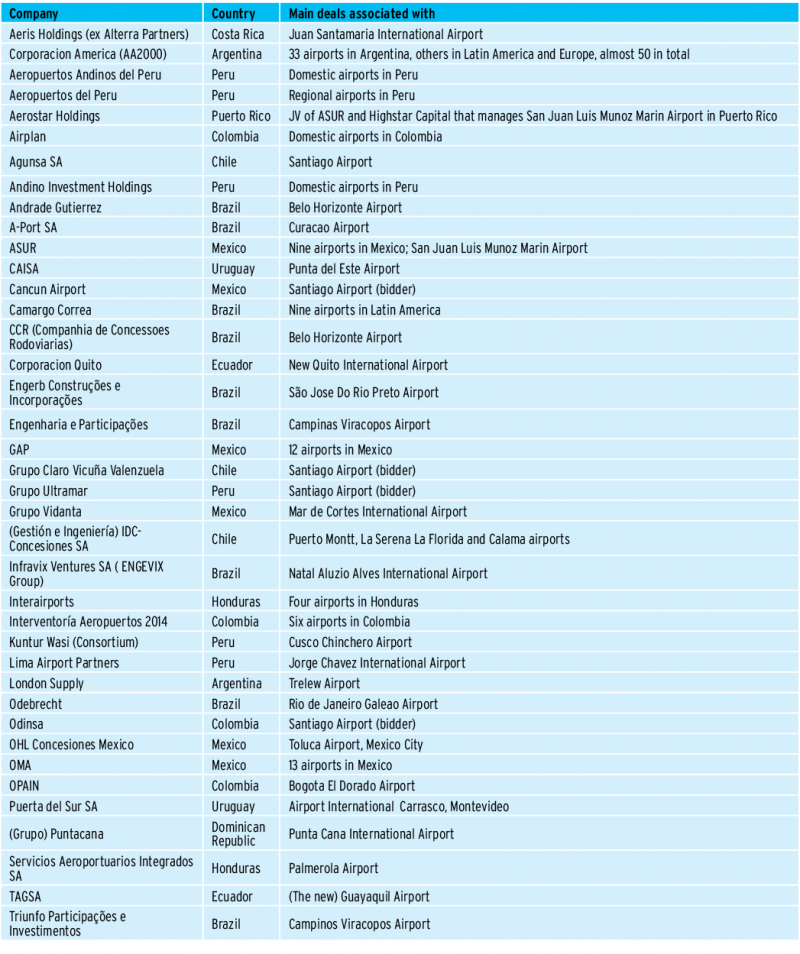

European and US airport investors are still active in Latin America, but more local organisations are in evidence. In the late 1990s airport investors were flocking to Latin America like gold prospectors to the Klondike. The level of privatisation activity was, for a while, greater than in other continents. Leading the pack were global giants such as Aeroports de Paris, AENA, Flughafen Zurich and TBI, together with Vancouver, Miami and San Francisco airports from North America and construction companies such as Bechtel.

The first country to embrace privatisation of its airports was Bolivia, in 1996, followed by Argentina and Mexico (Brazil was a latecomer). Of the 19 airport deals that took place between 1996 and 1998, six of them were in Central and South America. In 1998-99 the number of deals there ballooned as 33 airports were privatised by lease in Argentina and a similar lease process began on three packets of Mexican airports - except Mexico City - which ultimately led to IPOs on two of the groups that were formed to manage and invest in them.

What attracted foreign investors was a very high projected rate of GDP growth in South America of 7% or more over a five-year period, the beginnings of deregulation in the airline industry in some countries and demographic trends that prompted a greater level of travel by younger people.

But economies can be impacted by both internal and external events. Mexico's rapid growth in the aviation sector was halted by a combination of hurricanes, the H1N1 virus and over-supply while the entire region suffered along with the rest of the world in the wake of the Sep-2001 terror attacks in the US.

Latin American airport investors*

Some foreign investors suffered culture shock too. A number of western investors found it difficult to adapt to Latin America's special characteristics, others were put off by suggestions of corruption within deal agreements, while all of them have had to adjust to fluctuating economies across the continent - not to mention concerns about unpredictable actions by governments, most notoriously Venezuela's withholding of foreign currency transactions, trapping cash within that country.

As a consequence, interest in the region declined for a while in favour of others but it has been fired up again by the World Cup and forthcoming Olympic Games in Brazil, where most of the activity has been during the last three years. The difference today is that home based investors as well as constructors are playing a significant role, either alone or in consortia. Indeed it seemed as if every construction and mining company in Brazil was seeking an investment partner a few years ago as they attempted to clamber aboard the airport privatisation and construction bandwagon.

The renewed popularity of the region is emphasised by the response to two deals, the now finalised USD500 million Cusco Chinchero BOT project in Peru, which initially attracted 20 potential investors globally, and the USD655 million Santiago Airport expansion project, which involves construction of a new passenger terminal and renovation of the existing terminal and for which there are already 20 pre-qualified bidders, some of whom are mentioned in the table (opposite page).

The industry will be hoping that investment interest will continue. Even where airline concerns may exist about high pricing levels for airport sales, there is a great need for expansion of aviation infrastructure if the industry is to achieve its true growth potential.