Russia’s slowdown overhangs Eastern European growth, but Turkey still sparkles

In geographical terms, most countries in the eastern part of the European continent are classified as developing or emerging economies. IMF forecasts GDP growth of 2.9% for emerging Europe in 2015, hardly rocket-fuelled by comparison with emerging markets in other parts of the world, but certainly faster than the 1.8% growth forecast for the European Union and 1.3% for the eurozone countries.

Russia's economy, however, is unlikely to see much growth at all in 2015, hampered by economic sanctions and falling oil prices.

Economic growth in Eastern Europe overall should continue to outpace that in Western Europe, but the ongoing geopolitical situation arising from Russia's involvement in Ukraine and the oil price outlook are major sources of uncertainty overshadowing the region into 2015.

Higher economic growth and lower rates of penetration of air travel drive faster traffic growth in the eastern part of the continent. EUROCONTROL forecasts for the number of flights in 2015 anticipate growth of 4% or more for most of the countries in the east, compared with 3% or less in the west and an average of 2.4% across the continent.

Among the major aviation countries in the geographical east of Europe, EUROCONTROL forecasts growth in the number of flights to be 6.0% in Turkey, 4.9% in Poland and 3.4% in Greece. Passenger traffic growth in Europe as a whole, in RPK terms, is typically 2-3 ppts higher than flight growth as a result of larger aircraft and load factor improvements.

The largest airline group in geographical Eastern Europe, Turkish Airlines (THY) returned to a path of improving underlying profitability in 3Q2014 after four quarters of year-on-year declines. This mainly turned on improving unit revenues, reflecting slightly slower capacity growth than in the first two quarters. THY's 3Q2014 operating margin was higher than those of any of Western Europe's Big Three legacy airline groups. Nevertheless, continued double digit capacity growth in 2015 - its fleet plan implies an increase in seat numbers of around 15% - and geopolitical events may put renewed pressure on unit revenues this year.

The largest airline group in geographical Eastern Europe, Turkish Airlines (THY) returned to a path of improving underlying profitability in 3Q2014 after four quarters of year-on-year declines. This mainly turned on improving unit revenues, reflecting slightly slower capacity growth than in the first two quarters. THY's 3Q2014 operating margin was higher than those of any of Western Europe's Big Three legacy airline groups. Nevertheless, continued double digit capacity growth in 2015 - its fleet plan implies an increase in seat numbers of around 15% - and geopolitical events may put renewed pressure on unit revenues this year.

THY has developed a hub strategy that allowed it to carry more international-international transfer passengers in 2013 than Etihad carried on its entire network, with particular strength in attracting European passengers into its networks in Asia, Middle East and Africa, where six of the 15 destinations that THY plans to add in 2015 will be. Complemented by a sizeable domestic and point to point international market, THY is certainly capable of delivering annual profit growth.

Pegasus Airlines is one of only three ultra low-cost airlines in Europe and the only one with a significant presence in Turkey. The more stable yield outlook that emerged from its 3Q2014 results, after four quarters of falling RASK, was helped by a relative slowing of its capacity growth in addition to less aggressive pricing by Turkish Airlines at its Sabiha Gokcen hub. However, competition between Turkey's two biggest airlines will continue, as THY plans to grow its fleet based at Sabiha Gokcen to 100 aircraft.

Pegasus' unit cost advantage should position it for further profitable growth. Pegasus' 9M2014 operating margin ranked third in Europe behind Ryanair and Aegean.

Aeroflot Group suffered a drop in its operating profit in the first nine months of 2014, in spite of 10% growth in passenger numbers. Demand on international routes fell as a result of the geopolitical backdrop, forcing Aeroflot to focus its growth in the domestic market, where growth remained strong, but this contributed to weakening unit revenues.

Geopolitical events also led to the cessation of Aeroflot's fledgling LCC subsidiary Dobrolet in Aug-2014, as a result of economic sanctions imposed by the European Union. However, the group acted rapidly in launching a new low-cost venture, Pobeda, which started operating between Moscow Vnukovo and Volgograd in Dec-2014.

By the end of 2014, Pobeda had seven routes in Russia's domestic market, where there are no other LCCs, and a fleet of four Boeing 737-800s. It plans to increase these numbers to 47 routes (including international) and 37 aircraft by 2018, by which time Pobeda aims to carry 10 million passengers annually.

Aegean Airlines Group continued its run of good financial results in 2014, recording the second highest operating margin in Europe for the first nine months, demonstrating the success of its acquisition of Olympic Air in 2013. Double digit capacity growth, particularly in the domestic Greek market and on international routes from Athens, led to downward pressure on RASK, but Aegean successfully cut CASK even more quickly to drive up its margins. In 2015, competition between Aegean and Ryanair, which is growing fast in Greece, should intensify and extend to Cyprus.

LOT Polish Airlines' receipt of state aid was finally cleared by the European Commission in late 2014, although the airline only plans to take EUR30 million of the EUR90 million approved, after better than expected results. LOT has made significant progress with unit cost reduction over the past two years, reducing headcount and negotiating improved labour flexibility.

Its restructuring has also involved capacity cuts, particularly to destinations between Poland and Western Europe, which are dominated by low-cost carriers. LOT is focusing on offering connectivity between Central/Eastern European and Asia and North America, as well as with other parts of Europe.

LOT expects further reductions in CASK in 2015, to narrow the remaining gap with LCCs, and then to be positioned for growth in 2016. LOT is reported to be considering a new order for narrowbody aircraft in 1Q2015, with four manufacturers featuring in its thinking - Boeing, Airbus, Bombardier, Embraer - to replace its ageing 737 fleet and its Embraer regional jets.

LOT's limited long-haul network enjoys some strong market positions, but is small and it must continue to rely on codeshare partners, mainly in the Star Alliance, for intercontinental destinations. Its long-haul fleet of six 787-8 aircraft, with two more due to be delivered in 2015 and 2016, provides a significant unit cost advantage over the older Airbus equipment that it replaced, although its leasing of one 787 to other airlines such as Air Europa and Norwegian suggests that it may not need the two additional aircraft.

In 2014, ultra low-cost carrier Wizz Air pulled out of a planned initial public offering (IPO) of its shares, which would have seen it floated on the London Stock Exchange. Investor appetite was dulled by geopolitical issues, a fuel price spike and profit warnings from other airlines, rather than any problems at the airline itself. Indeed, CAPA analysis of Wizz Air's most recent accounts show that it is one of Europe's most profitable airlines, with significant cash reserves. With lower fuel prices, an IPO could come back onto the agenda in 2015.

Wizz Air's low costs, wide network in Central/Eastern Europe and the shrinking of many national airlines should indeed give Wizz Air plenty of opportunity for further profitable growth. At the same time, other LCCs are also seizing the opportunity in Central/Eastern Europe, most notably Ryanair, which has even lower unit costs than Wizz Air. Although much of Wizz Air's 2015 growth plans avoid direct competition from Ryanair - or, indeed, any other airline - it seems likely that the two will encounter each other more frequently as time passes.

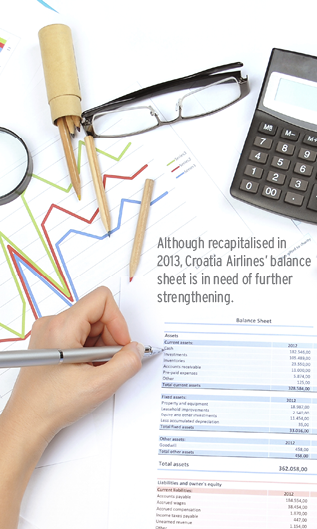

In 4Q2014, the government of Croatia made a decision to revive the on-off privatisation of Croatia Airlines, perhaps encouraged by the carrier's profit growth in 9M2014. However, Croatia Airlines still has one of the highest levels of CASK in Europe and needs further cost cuts. Although recapitalised in 2013, Croatia Airlines' balance sheet is in need of further strengthening, with four Airbus A319s due for delivery in 2015 and the possibility of a further order of aircraft to fill the gap between its Airbus fleet and its Bombardier Q-400s.

Any strategic interest in Croatia Airlines' network is likely to focus on its international connections into Europe. However, other major European airlines already have better European networks and, in many cases, are already eating into Croatia Airlines' market share (particularly LCCs).

It may be of greatest interest to a non-European airline bidder that can build on Croatia Airlines' continental platform and marry this to its own long-haul network. Finding such a bidder may not be so easy, especially given that Etihad currently has a very busy agenda with a number of European equity investments already.