Latin America’s outlook brightens after a difficult 2014 - but some markets remain challenging

Overall there are still huge prospects for growth in Latin America despite the recent headwinds. Slumping resources prices are hurting and the gloss has fallen off many of the region's emerging markets. But as fuel prices fall, the region's leading groups and its relatively small number of LCCs are eager to reaccelerate expansion.

The Latin American airline sector faces mixed prospects for 2015, although the economic outlook for the region is generally more positive compared to 2014. But continuing weakness in Argentina, Brazil and Venezuela is casting a cloud over other markets that are expected to chart solid growth, including Panama and Peru.

The region's GDP growth in 2015 is forecast at 2.2%, a welcome uptick from the projected 1.2% for 2014. Panama has the highest estimated growth of 7%, with Bolivia, Peru, Colombia and Nicaragua all expected to have growth of close to 5%. Latin America's two unstable economies - Argentina and Venezuela - face economic contraction of approximately 1.5% and 1%.

Despite the still tenuous economic outlook for Latin America, many of the region's main airline groups are planning to grow capacity in 2015, with varying strategies of deployment. But they are generally looking to capitalise on growth in the strong markets while carefully limiting their exposure to the more volatile countries.

Economic growth in Mexico began to rebound slowly in 2014 and its GDP growth is expected to rise further from 2.4% in 2014 to 3.5% in 2015. But underlying the positive momentum is a weak yield environment, which has created challenges for Mexico's two publicly traded airlines, Aeromexico and Volaris. During 3Q2014, Volaris opted to trade load factor to recover yields, leading to a return to profitability after recording a loss in 1H2014.

Aeromexico has the benefit of a more extensive international network to help combat some of the domestic weakness in Mexico, and the airline is planning to leverage its larger network breadth and partnership roster in 2015. Aeromexico is continuing its international push in 2015, reflected in planned new service from Mexico City to Toronto, Boston, Panama City and Medellin.

The airline also can combat some of the domestic weakness through its partnership with Delta Air Lines, which feeds passengers through Aeromexico's Mexico City hub, and provides Aeromexico with some connecting revenue to offset sagging domestic fares.

All of Mexico's largest airlines seem to be turning their attention to international markets during 2015 where demand is holding steady, and presumably pricing is more favourable. For the first 10 months of 2014, Mexican airlines grew their international passenger traffic 15% year-on-year.

The bulk of Volaris' 10% to 12% systemwide capacity growth in 2015 is being directed toward international markets. The airline launched a steady stream of new US routes in 2014 including Guadalajara to Reno and Fort Lauderdale and Mexico City to Fort Lauderdale. Volaris also added flights from Guadalajara and Chihuahua to Denver and Guadalajara to Portland.

Volaris' fellow low-cost airline, VivaAerobus, is also planning to broaden its international reach in 2015. After opting to focus on domestic growth, VivaAerobus returned to the US in late 2014 with new service to Houston from Guadalajara and Cancun and from Monterrey to Las Vegas. During Mar-2015, VivaAerobus plans to introduce service from Guadalajara and Monterrey to Dallas/Fort Worth.

Mexican hybrid carrier Interjet also added new transborder service in 2014 including Monterrey-Houston. Interjet is the only airline among Mexico's new breed of LCCs to operate international service to markets outside the US.

With the rush to the transborder space, Mexico's airlines need to carefully ensure they do not create a scenario of oversupply, which would erode some of the pricing traction they hope to maintain in those markets.

Brazil's two major airlines, Gol and TAM, are forecasting flat growth in the Brazilian domestic market for 2015, as they work to keep an overall rational supply-demand balance that has been in place for much of the past year. According to Brazil's ANAC, during the first 10 months of 2014, domestic capacity was essentially flat year-on-year as traffic grew by 5%.

TAM recently unveiled a new regional push beginning in 2015, with the intent to add four to six new regional destinations annually. The airline, part of the powerful LATAM Airlines Group, is in discussions with regional manufacturers to acquire aircraft to support the expansion. It has outlined advanced discussions with Brazilian airframer Embraer over the purchase 18 EJet2 regional aircraft.

Brazil's other high profile airline - Azul - capped off an ambitious 2014 with plans to reignite an IPO that it shelved in 2013 due to weak market conditions. But it is not clear if the environment has sufficiently improved for the airline to cash in on its aspirations to become a publicly traded company.

During late 2014, Azul introduced its first international service from its headquarters at Campinas Viracopos to Orlando and Fort Lauderdale. The third route of Azul's new long-haul low-cost operation, Campinas to New York JFK, will be launched in 2015.

Azul committed to acquire six A330s and five A350s in 2014 for its new long-haul operation and also ordered 63 A320neo narrowbodies for delivery beginning in 2016. The airline, which previously only operated ATR turboprops and Embraer regional jets, is embarking on a period of rapid expansion.

But the expansion comes at a time when Brazil's middle class citizens may be slowing their discretionary spend as the economy retracts and inflation remains high. Azul is obviously pursuing long-term strategic growth but it could face pressures over the short term if demand in Brazil begins to falter.

The Copa and Avianca groups should benefit from better economic prospects during 2015 in their main home markets of Panama and Colombia. Copa plans to expand capacity by 7% in 2015 but it has warned that its load factor and unit revenues will drop compared to 2014 due to its pull-down of capacity in Venezuela and its redeployment to other markets.

All airlines have cut service to Venezuela to mitigate funds frozen in the country, and Copa's has reduced its capacity to Venezuela by approximately 50%. It will take time for the capacity Copa has redeployed to other markets to spool up, creating pressure on the airline's financial results.

Avianca stands to benefit as the leading airline in Colombia. The group's total capacity is rising 5% to 7% in 2015 compared with 5% to 6% growth in 2014. Avianca has hubs in Bogota, San Salvador and Lima, giving the airline prime positioning in Latin American countries whose economic prospects are more favourable than the geographies of its competitors.

Avianca stands to benefit as the leading airline in Colombia. The group's total capacity is rising 5% to 7% in 2015 compared with 5% to 6% growth in 2014. Avianca has hubs in Bogota, San Salvador and Lima, giving the airline prime positioning in Latin American countries whose economic prospects are more favourable than the geographies of its competitors.

Colombia remains on solid footing despite the decline in oil prices at the end of 2014. The country's domestic market grew 6% year-on-year in the first 10 months of 2014, with Avianca recording 9% growth and LAN Colombia posting an 8% increase. LATAM Airlines Group remarked that Colombia was its best performing market in 3Q2014.

Colombia's only LCC, VivaColombia, also pursued further domestic expansion in 2014 while launching its first batch of international routes. The Viva Group, which also includes Mexico's third and smallest LCC VivaAerobus, is planning to establish new affiliates in 2015 in Latin American markets that do not currently have any local LCCs.

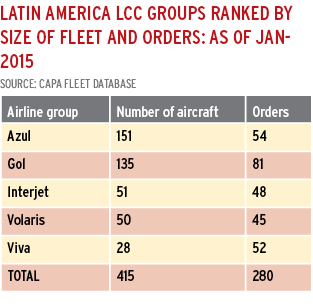

Latin America's LCC market is about to blossom, even though there are currently only six LCCs in only three countries. The region remains significantly underpenetrated outside the Brazilian and Mexican domestic markets, where LCCs now account for more than 60% of capacity.

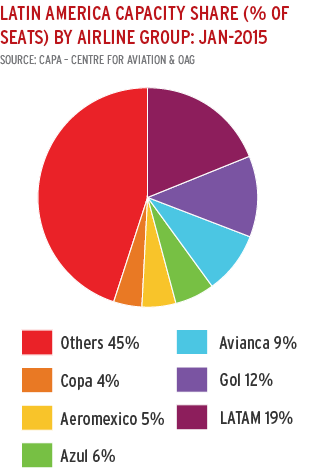

LCCs today account for only 20% of Latin America's total fleet, which consists of approximately 2100 aircraft. But the LCCs account for nearly half of the total 630 orders, an indication the LCC penetration rate in Latin America - particularly outside the relatively mature domestic Brazilian and Mexican markets - will increase significantly.

LATAM battled currency weakness in Argentina and Chile throughout 2014, which pressured its financial results. LATAM also faced competitive capacity pressure on its intra-regional South American routes and long-haul markets to and from South America.

Despite Chile's currency fluctuations, its GDP growth forecast for 2015 is 3% compared with 2% growth in 2014, which should bode well for LAN as it remains the largest airline in the country by a wide margin. Data from the Chilean government show that Chile's domestic passengers increased by 4% in the first 10 months of 2014 to approximately 8 million.

LATAM is projecting higher capacity growth in 2015 of 2% to 4% compared with flat to 2% growth in 2014. It estimates 4% to 6% growth both in regional and long-haul international markets and its Spanish speaking domestic markets - Chile, Peru, Argentina, Colombia and Ecuador.

Some of LATAM's higher capacity growth is driven by aircraft up-gauging. It is taking delivery of seven Boeing 787-9 aircraft in 2015, which have roughly 50 more seats than its 787-8s. LATAM also plans to add 15 larger-gauge A321s to its fleet.

The landmark LAN-TAM merger has so far produced disappointing results but the long-term outlook for LATAM remains relatively bright. LATAM is now one of the 10 largest airline groups in the world and should be able to leverage its nearly 20% share of the Latin American market as market conditions in the region improve.

Once a powerful growth engine, Latin America has faced headwinds during the last couple of years after the economies of some major growth markets began to sputter. But IATA forecast that collectively, the airlines operating in the region should produce a USD1 billion profit during 2015 and a net profit margin of 2.6%.

If those estimates come to fruition, it would be an improvement from the projected USD700 million profit Latin American airlines posted in 2014, and a welcome sign that the region's airlines are taking the necessary steps to withstand and navigate through slower economic growth, which could linger for quite some time.