Africa Outlook: Profitability and growth remain bleak until internal protectionism is removed

Africa's airline sector has continued to struggle and lag other regions. Another year of slow growth and unprofitability is expected in 2016. The region still has huge potential but this can only be untapped through structural changes and liberalisation. Government "meddling" is also an endemic constraint.

Over the last decade Africa's airline sector has consistently achieved roughly break even results. While global airline profitability has improved significantly over the last three years and is expected to improve further in 2016, the performance of the African airline sector remains lacklustre.

The major exception is Ethiopian Airlines, which has emerged as the largest airline group in Africa following consistent profitability and growth. Ethiopian has generated net profits of about USD800 million over the last eight years. During this same period the rest of Africa's airline sector has incurred losses of about USD1.5 billion, resulting in approximately USD700 million in losses when including Ethiopian. Its enlightened management has been supported by good government and sensible infrastructure, with plans for a new airport city under way.

|

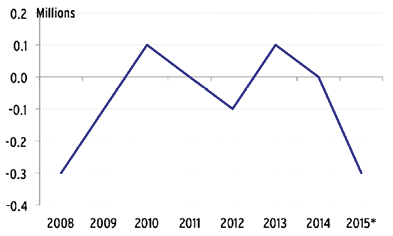

Annual net profits/losses (in USD billion) for African airlines:

|

The global industry has now accrued three consecutive years of improved profitability following a roughly break even result in 2012. But Africa has not improved at all. Excluding Ethiopian, industry losses over the last three years amount to over USD500 million. 2016 will likely continue along the same trend line. IATA projects record profitability for the global industry in 2016 but another slight loss for Africa. The latest IATA forecast predicts Africa will be the only unprofitable region in 2016.

Ethiopian is confident it will be able to continue to grow its profits as it continues to expand rapidly, which will further widen the gap with Africa's other main airline groups. Ethiopian has already doubled in size over the last five years and plans more double digit growth in 2016. A supportive government has been critical to Ethiopian's success while other major African flag carriers have been set back by government meddling.

Ethiopian will have yet another year of milestones in 2016 as it becomes Africa's first A350 operator. The carrier also plans to launch services to New York, which will become its fourth North American destination after Washington, Toronto and Los Angeles. Los Angeles was launched in Jun-2015.

But Ethiopian has been focusing most of its expansion on Asia, where it is able to leverage its Addis Ababa hub to meet growing demand for Asia-Africa traffic, particularly from China. The Ethiopia-Asia market is relatively small but Ethiopian's Addis Ababa hub is ideally positioned for connecting traffic from Asia to Africa.

Asia has driven most of Ethiopian's growth over the last several years, including growth regionally within Africa as a huge increase in Asian passengers has enabled expansion of the African network. Ethiopian aims to launch in 2016 Chengdu, which will be its fourth destination in China. It is also looking at adding Ho Chi Minh, Jakarta and Singapore, which would extend Ethiopian's Asian network to 15 destinations. Tokyo and Manila were launched in 2015.

Ethiopian is already by far the largest African carrier in Asia and also now has the largest African network with about 50 international destinations. This excludes its Togo-based affiliate ASKY, which gives the group access to almost 20 destination in West Africa. Ethiopian also has a stake in Malawian, a smaller flag carrier with just six destinations, and is looking at several potential airline investments elsewhere in Africa.

|

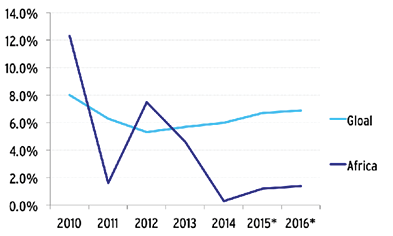

Africa vs global industry year over year RPK growth: 2010 to 2016*

|

Ethiopian's rapid growth has also been an exception to the general trend in Africa. Overall RPK growth for Africa was only about 1% in 2015 and was flat in 2014, making it the slowest growing region in the world both years. For 2016 IATA is forecasting RPK growth in Africa of again only slightly more than 1%. Globally RPKs grew by 6% in 2014 and are projected to growth by 7% in 2015 and 2016.

While Ethiopian has quickly doubled in size traffic has been flat or only grown modestly at Africa's other main airline groups - South African Airways (SAA), EgyptAir, Royal Air Maroc (RAM) and Kenya Airways. SAA, EgyptAir and Kenya Airways have all been highly unprofitable and are again in restructuring mode.

SAA has been highly unprofitable for the last three years driven by large losses to its long haul operation. A long overdue restructuring of its long haul operation was implemented in 2014 but SAA is again in crisis. Another capital injection is needed following another change in leadership. While there is still talk of a return to profitability within three years the real outlook, at least for the short term, remains bleak. More changes are necessary along with a commitment to a deeper restructuring without government meddling. Government interference has been SAA's Achilles heel for years and now seems to be derailing its latest restructuring plan, which could have made huge progress in fixing longstanding woes, had the former management team had the chance to proceed with full implementation.

EgyptAir has incurred losses of almost USD2 billion over the last five years as Egypt has suffered from political instability. Several restructurings have been attempted and the ailing flag carrier is planning to implement in 2016 yet another restructuring plan. The new business plan envisions a resumption of long haul growth, including new widebody orders, aided by an increased focus on transit traffic. But the outlook for EgyptAir remains relatively bleak as security issues have once impacted Egypt's tourism industry. Transit traffic is generally low yielding and highly competitive, which will make it difficult for EgyptAir to meet its goal of returning to profitability in 2017.

2016 will also be a restructuring year for Kenya Airways following three years of losses and a particularly dismal FY2015. Again security issues have been a substantial hindrance. The ailing flag carrier is now seeking a capital injection as it attempts a turnaround.

As with SAA and EgyptAir the short term outlook for Kenya Airways is relatively bleak. There is still an opportunity for Kenya Airways to tap into the rapid growth in the Asia-Africa market as its Nairobi hub is well positioned for transit traffic. But at this point it will be hard to catch up with rival Ethiopian, which has benefited from a more stable environment in Ethiopia.

Royal Air Maroc is now in a much stronger position, having completed a restructuring and returned to profitability. While RAM is not about to match Ethiopian's rapid ascent it is also in expansion mode.RAM plans to launch services in 2016 to Rio de Janeiro and Washington Dulles, which will become only its fourth and fifth long haul destinations after Montreal, New York and Sao Paulo. Expansion of its African network is also planned as RAM, which has traditionally been focused primarily on Europe, works to improve regional connections. Africa growth is expected to accelerate under a new joint venture with Qatar Airways; RAM's joining Qatar on the Casablanca-Doha route in Sep-2015 will mean Qatar uses Casablanca as a hub for parts of Africa. Qatar could become a strategic investor in RAM, reinforcing an emerging trend which could see Gulf carriers make new investments or increase existing investments in African carriers.

A major aircraft order is likely in 2016 in line with RAM's new business plan to more than double the fleet by 2029. RAM is also seeking to become only the fifth African airline to join a global alliance with a potential decision in 2016. RAM has been discussing a joint venture with Iberia, bringing it closer to oneworld after the deal with Qatar. oneworld does not yet have any African members; SAA, EgyptAir and Ethiopian are in Star while Kenya Airways is in SkyTeam.

There are only four other airlines or airline groups in Africa with more than 20 aircraft - Air Algerie, Tunisair, South Africa's Comair and Nigeria's Arik Air. It is an extremely fragmented market with several small generally unprofitable airlines that lack the scale to compete with foreign carriers.

Security issues have become a big issue for Tunisair, Air Algerie and most airlines in North Africa. Nigeria also has security issues and has been set back by government policies which are not favourable to aviation growth. Comair has been successful but has limited opportunities to expand due to unfavourable government policies which has resulted in an un-level playing field in South Africa.

Some smaller African carriers have ambitious plans to expand, which in theory could improve their competitive position over the long run. For example Rwandair will take its first widebody aircraft in 2016, joining a fleet that consists of only eight narrowbody and regional aircraft.

Smaller African flag carriers generally face a challenging future. Expansion may seem strategically necessary but will result in higher exposure to competition with foreign carriers. Even some of Africa's larger airlines have struggled to compete, particularly as the Gulf carriers and Turkish Airlines have rapidly expanded in Africa.

LCCs have also been extremely slow at penetrating the African airline sector. There are currently only about 60 aircraft operated by African LCCs. About two thirds of the continent's LCC aircraft operate in the domestic South African market, where they now account for about 50% of total seat capacity.

The rest of Africa has experienced a wave of LCC start-ups over the last couple of years and there are now almost 10 African LCCs outside South Africa. But the new LCCs are all very small and still account for less than 3% of capacity in Africa's regional international market.

In 2016 there will be further LCC growth outside South Africa, including from fastjet. The pan-African LCC group was finally able to launch its second affiliate in 2015 and is aiming to launch at least one more affiliate in 2016. But the rate of LCC expansion will remain slow and there will likely continue to be as many regulatory setbacks as victories. The recent setback at LCC group flyafrica.com, which suspended operations in late 2015, are just the latest example in an industry that always seems to take two step backwards for every step forward.

Africa remains an extremely restrictive environment for LCCs - or any new competitor. The lack of liberalisation is clearly in the countries' mutual interests. Fares are extremely high within Africa, stalling economic linkage. Moreover, the protectionism is producing no useful outcome. The airlines protected by the policies are generally struggling, with losses continuing to mount even with low fuel prices.

Africa should not be the least profitable and slowest growing region; the continent has enormous potential - and poor air services are largely responsible for its failure to achieve it. Only by liberalising, removing government meddling and encouraging growth through initiatives such as reduced taxes and charges can the huge potential of Africa's airline sector be realised.

Africa should not be the least profitable and slowest growing region; the continent has enormous potential - and poor air services are largely responsible for its failure to achieve it. Only by liberalising, removing government meddling and encouraging growth through initiatives such as reduced taxes and charges can the huge potential of Africa's airline sector be realised.

Governments should be encouraging start-ups and supporting existing airlines and improving infrastructure. The prevailing attitude towards aviation as a way to generate revenue through taxes continues to impede growth.

African governments are also generally overly protective of national carriers and local markets. An Africa wide liberalisation initiative has gone nowhere in 15 years. Any movement is unlikely since possible implementation of the Yamoussoukro Declaration again hit a roadblock in 2015. Regional open skies agreements are starting to become more common and provide welcome relief in certain markets but have a relatively limited impact to the overall African industry.

For now unfortunately the outlook remains relatively grim. With a small number of exceptions Africa's airlines will continue to languish and struggle to turn the corner. For 2016, and indeed through until 2020, there is little to suggest that Africa's airline system will even begin to achieve the potential that is so apparent.