South Asia: Traffic up, losses down, but fundamental reforms remain incomplete

The last few years have been without doubt some of the most challenging in India's aviation history. Over-capacity, high input costs, intense competition and a negative policy and regulatory environment conspired to threaten the viability of virtually the entire aviation value chain.

India's airlines alone have lost more than USD10 billion combined since FY2009. Airline debt stands at around USD11.9 billion, rising to close to USD14 billion if liabilities to vendors are included. At an industry level airline debt is now equivalent to 120% of airline revenue, and in the case of some carriers such as Air India, it is more than twice revenue.

Over the past 12 months traffic has increased at double digit rates and losses have declined; but this has largely been a function of lower fuel prices. Little else has happened to contribute to the improved performance. Air India remains a massive drain on public funds and a disruptor of the industry.

With fuel prices expected to stay close to current levels and GDP projected to expand at 7.5% or higher, double digit traffic growth will continue. The coming year could therefore mark the beginning of a structural turnaround, subject to rational capacity deployment and pricing.

However, if India is to achieve a genuine, transformational step-change and claim its rightful place as one of the world's leading aviation markets, the onus in the coming year will be on the government to establish a clear vision and roadmap for the sector, supported by a comprehensive and enabling aviation policy.

However, if India is to achieve a genuine, transformational step-change and claim its rightful place as one of the world's leading aviation markets, the onus in the coming year will be on the government to establish a clear vision and roadmap for the sector, supported by a comprehensive and enabling aviation policy.

India's aviation market has been picking up speed. In the 12 months ended 31-Mar-2015 domestic traffic was up 13.9% year-on-year. The first half of FY2016 saw this increase to 19.9%. International traffic growth slowed marginally from 9.0% to 8.2% during the respective periods, but this was in large part due to the fact that several carriers are constrained from growing by bilateral restrictions. As a result, a number of foreign airlines are regularly operating with load factors above 90% on routes to India.

IndiGo has been the key driver of domestic traffic growth. IndiGo carried more than half of the incremental domestic passengers in India during FY2015. As a result, its market share soared to 36.4% by the end of the financial year, widening the gap between itself and the second largest carrier, Jet Airways, which had a market share of 25.4%.

IndiGo's domestic market share will almost certainly cross 40% during FY2016 and could approach 45%-50% within the next two years based on CAPA's proprietary capacity forecasting models. The carrier could expand more aggressively in the near term in order to further consolidate its leading position in the domestic market.

Jet Airways was the fastest expanding Indian carrier on international routes with its passenger traffic up 20.6% in FY2015. The airline is now clearly prioritising growth on international routes following its partnership with Etihad. Its capacity on domestic routes is expected to remain stable or possibly even contract marginally.

FY2016 should achieve traffic growth of above 15% for domestic and around 8%-10% for international. This would result in domestic traffic passing 80 million passengers, while international would approach 55 million. And in FY2017 domestic growth is once again projected to be in the 15%-20% range, with international continuing its steady growth trajectory at 10%-12%, subject to the award of increased bilateral entitlements.

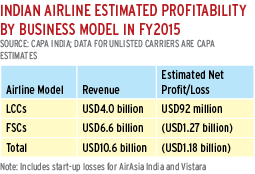

Indian airline losses declined by 30% to USD1.18 billion in FY2015, largely due to lower fuel prices. This result was achieved on revenue of USD10.6 billion. LCCs continue to outperform FSCs.

|

|

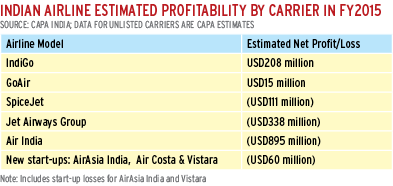

IndiGo posted its highest ever profit in FY2015 of USD208 million, representing a net margin of 9.2%. GoAir is the only other carrier understood to have been in the black, with an estimated profit of USD15 million, close to its peak result posted in FY2013. The rest of the industry is estimated to have lost around a combined USD1.4 billion, of which USD895 million was accounted for by Air India.

Recent start-ups (commencing services within the last two years), which include a full service carrier (Vistara), a LCC (AirAsia India) and a regional carrier (Air Costa), all performed below expectations.

AirAsia India has had a slow and uninspiring start in the market in contrast to expectations. The airline's start-up capital of USD30 million proved to be insufficient as AirAsia India significantly underestimated the market dynamics and competitive response which greeted its entry into the market. However, if the 5/20 rule is abolished this will lead to a significant change in dynamics at AirAsia India as the carrier has always been keen to launch international operations. In such a scenario, AirAsia India will become a critical component of the group's pan-Asia network and could drive significant traffic to the other franchises.

Vistara's first year of operations has also been very challenging, with very substantial losses accumulated. But improvements could emerge as the airline reconfigures aircraft to reduce the amount of real estate allocated to business class. The premium economy strategy on domestic routes may also have to be re-assessed unless there is a dramatic change in performance.

As is the case with AirAsia India, abolition of the 5/20 rule should pave the way for Vistara to commence international operations, which were central to its original business plan.

Aggregate airline losses could reduce by a further 55-60% in FY2016 to around USD430-530 million. IndiGo and GoAir are both expected to report 20-30% higher profits, while Jet Airways and SpiceJet could turnaround from a combined loss of USD450 million to a profit of USD115-140 million. Air India is expected to reduce its losses by USD100-150 million but that will still leave around USD750-800 million of red ink.

A failure to maintain pricing discipline is the key risk to improved financials, while fuel and currency risks are ever present.

Profitability may come under pressure in FY2017 due to the heightened possibility of discounting. The current financial year is likely to end with fewer aircraft inductions than at any time over the last decade. But this is set to change with 50-60 aircraft scheduled for delivery in FY2017. Combined with carriers striving to increase aircraft utilisation, airlines may come under pressure to sacrifice yields to fill the resultant capacity.

While balance sheets remain weak in the case of several airlines, significant capitalisation - to the value of almost USD2.0 billion - will be required over the next 12 months of which Air India will account for USD1.3 billion; Jet Airways USD250-300 million; SpiceJet USD200 million; GoAir USD150 million; and others USD100 million.

After IndiGo's successful IPO which was over-subscribed, GoAir is likely to be the next airline that seeks to raise capital through a float. The airline is expected to aim to raise USD150 million through an IPO which could take place in the first half of CY2016. AirAsia India may also go down this path after achieving profitability.

Indian airlines could order up to 250 aircraft in the first few months of 2016. Vistara could place firm orders and options for up to 100 aircraft, while SpiceJet is considering an order for up to 150 aircraft, including options. Air India was evaluating an order for 50 A320neos but this has been shelved for now. Instead the carrier is likely to expand by leasing a combination of A320s, ATRs and 737-800s (for Air India Express), with a decision likely by the end of FY2016.

Planned start-up carrier, Premier Airways, is expected to place an order for 40 narrowbodies in 3Q or 4Q of FY2017. A number of regional airlines are preparing to launch but any meaningful capacity impact is unlikely until late FY2017. However, one large JV airline with pan-India and international ambitions is also in the pipeline.

The Government of India is expected to take a more liberal approach to bilateral access for foreign carriers. This was indicated by the draft civil aviation policy which has set a goal of open skies on a reciprocal basis by 2020. Even if this target is not met, India is expected to open up agreements with several markets over the coming months. Expected abolition of the 5/20 rule will necessitate a more liberal stance as Indian carriers will be more likely to utilise their seat entitlements.

However there is a Catch 22 element to this: those who want greatest liberalisation are likely to receive least. There will only be modest increases in entitlements for airlines including Emirates, flydubai, Qatar Airways, Air Arabia and Turkish Airlines.

The country's airports handled 190 million passengers in FY2015, more than three times higher than the 59 million passengers handled just 10 years earlier. India's two largest airports, Delhi and Mumbai both grew at close to the national average of 12.5% year on year, but the three PPP airports in southern India, Bangalore, Cochin and Hyderabad, all experienced growth of around 20%.

As a result, Bangalore overtook Chennai to become the largest airport in south India with just over 15 million passengers. Meanwhile Bangalore, Cochin and Hyderabad also outperformed the market in terms of cargo volumes with double digit growth, while air freight activity at Chennai was flat, up just 0.9% year on year.

Hyderabad may overtake Kolkata this year to become the fifth largest airport in India and could move ahead of Chennai in the next couple of years if the latter continues to under-perform. Cochin Airport has been a consistent out-performer. It is an under-stated but dynamic airport which for the last three years running has had the strongest growth amongst the top seven airports in the country. The airport operator has also demonstrated an ability to develop new infrastructure more cost effectively than others.

Meanwhile, airport investors continue to face further frustrating delays to the award of greenfield PPP concessions. The two major projects at Navi Mumbai and Goa Mopa have continued to miss published timelines for their tender processes.

Despite the fact that four consortia were shortlisted for the Navi Mumbai Airport project in Jan-2015, the agency managing the tender has since announced that the successful party will not be selected until Apr-2016. There may be further delays as land acquisition is yet to be completed.

The Draft Civil Aviation Policy released in Oct-2015 suggests the government is serious about delivering genuine change and meaningful outcomes. The focus on liberalisation, ease of doing business, reducing costs and regional connectivity was welcomed. Certain sectors such as MROs and helicopters will be very pleased with the policy.

However, some critical issues remain unaddressed. For example, more emphasis had been needed towards addressing the negative fiscal environment which airlines face - notably the sales tax on ATF, service tax on fares, airports charges, withholding tax on aircraft leases. And the policy contains no reference to the future of Air India. The government's ownership of the national carrier negatively influences policy decisions and continues to cost the Indian taxpayer around a billion dollars each year. Meanwhile, without a hard bottom line, it continues to disrupt the private sector operators. Clarity on what the government plans to do has a massive bearing on the industry.

Safety remains a major issue too, yet the draft policy does not sufficiently move the regulator towards the structural change that is required to ensure improvements in the sector. Institutional strengthening at the Ministry of Civil Aviation is also required because the outcomes of the draft policy will depend on implementation capability. To move from a document to develop detailed sectoral plans and to implement them at a time of fast growth and increasing complexity will require much greater management capabilities.

The past few years have been without doubt some of the most challenging in India's aviation history. But with fuel prices expected to stay close to current levels and GDP projected to expand at 7.5% or higher, 2016 should again achieve double digit traffic growth and losses should decline substantially. The coming year could therefore mark the beginning of a structural turnaround, subject to rational capacity deployment and pricing. However, if India is to achieve a genuine, transformational step-change and claim its rightful place as one of the world's leading aviation markets, it needs an enabling aviation policy.

The draft of the new policy due to come into effect in 2016 is certainly well intentioned but many issues remain unaddressed or require more thought. The final version may improve on what has come before, but may not be the best that it could be.

Elsewhere in South Asia, the election of a new government in Sri Lanka in Jan-2015 resulted in the exit of the CEO of SriLankan Airlines a few weeks later. A permanent replacement was not appointed for six months, resulting in a lack of direction during this period. However, with a new CEO now in place and a commitment from the government to reduce political interference in commercial decisions, the senior management of SriLankan Airlines can focus on developing a new strategy in 2016 to turnaround the loss-making carrier. This may include revisiting the order for eight wide body aircraft and replacing some of them with narrow bodies. The government will also need to take a decision on whether to merge the state-owned LCC, Mihin Lanka with SriLankan Airlines. Despite recent challenges, one of the key opportunities for airlines based in Sri Lanka is the strong and sustained double-digit growth in inbound visitor numbers that the market has experienced in recent years.

Upgrades continue at the country's major gateway, Colombo Bandaranaike International Airport. To relieve congestion at the primary airport there are plans to open up the general aviation airfield, Ratmalana Airport, to commercial services. However, Mattala International Airport in the south of the country has proven to be a white elephant with limited demand in the catchment area. In recognition of route viability challenges at the airport, one of the first actions taken by the new government was to suspend SriLankan Airlines services to Mattala. The airport is now served by just one or two services a day and one of the priorities for the government in the coming year is to develop a new business model. One of the options under consideration is the establishment of an MRO facility.

Pakistan's government intends to push ahead with plans to privatise at least 26% of Pakistan International Airlines by Jul-2016. The state-owned national carrier, which has the largest share of both the country's domestic and international markets, has been accumulating losses and debt for several years despite several attempts to restructure the airline. However, the plans have already met resistance from employees who are planning industrial action to protest against the proposed privatisation.

Pakistan's government intends to push ahead with plans to privatise at least 26% of Pakistan International Airlines by Jul-2016. The state-owned national carrier, which has the largest share of both the country's domestic and international markets, has been accumulating losses and debt for several years despite several attempts to restructure the airline. However, the plans have already met resistance from employees who are planning industrial action to protest against the proposed privatisation.

But 2016 should see some progress on airport infrastructure with two major greenfield airports expected to open, including the New Islamabad International Airport, which has been subject to repeated delays and significant cost over-runs and the New Gwadar International Airport, which was largely financed by the Chinese government. The Pakistan government also plans to invest more than USD420 million over two years commencing in 2016 on airport upgrades at Karachi, Lahore, Quetta and Peshawar.

Nepal's aviation industry will be looking to renew and rebuild in 2016 after a very challenging year. A severe earthquake in Apr-2015 not only caused significant loss of life and structural damage at that time, but has negatively impacted tourism arrivals since then, with corresponding economic repercussions. And a fuel shortage later in the year resulted in further disruption for airlines. In the coming year Kathmandu Airport is expected to proceed with planned upgrades, while Nepal Airlines having taken delivery of two new A320s in recent months, will evaluate the possible induction of the country's first wide body aircraft to connect longer haul markets.