Latin America Outlook: Mexico the only bright spot in a sombre outlook

Economic pressures that emerged in Latin America during 2014 intensified during 2015, driven by the dire situation in Brazil, which is now moving from recession to depression. Once a powerhouse of the region, Brazil's economy contracted sharply in 2015. Additionally, the country's inflation soared and its currency has plummeted. Brazil's weakness has created ripple effects throughout South America, affecting all the large airline groups operating in the region.

Currencies of other countries in Latin America also weakened throughout 2015, adding another layer to the economic challenges airlines faced as they worked to adjust to their new reality. Those adjustments include keeping capacity in check and deferring aircraft deliveries until some signs emerge that a steady recovery has begun.

Original forecasts for GDP growth in Latin America during 2015 were 2.2%. As conditions worsened, projections indicated a 0.1% contraction. Some countries are expected to make modest economic improvements in 2016; but continued headwinds in Brazil will undoubtedly limit the speed of Latin America's economic recovery.

Brazil's economy contracted approximately 3% in 2015, and its inflation was forecast to rise above 10%. During 3Q2015 the BRL's average depreciation against the USD was 55%. IATA estimates that during 1H2015 airlines operating in the country accumulated losses of USD500 million. Conditions only grew worse in the second half of the year as some modest recovery in corporate demand appeared to deteriorate.

Gol CEO Paulo Kakinoff declared the Brazilian aviation industry was facing one of the hardest periods in the last decade. The airline's losses for the nine months ending Sep-2015 skyrocketed 55% to BRL3.2 billion (USD857 million) driven largely by currency pressure. At the end of Sep-2015, nearly 49% of its expenses were denominated in the USD.

After the merger of LAN and TAM to form LATAM Airlines Group, Brazil is now the company's largest domestic market among the countries where it operates. LATAM posted a USD203 million loss for the 9M ending Sep-2015 and endured a 32% fall in Brazil passenger unit revenues (measured in US cents).

LATAM's capacity in the Brazilian domestic market fell 2% to 4% in 2015 compared with flat growth to a 1% decline for Gol. The less drastic reduction for Gol stems from its decision to start cutting its capacity growth before TAM engaged in its reductions. Gol estimates that between 2011 and 2014, it cut supply in the Brazilian domestic market by 14%.

For 2016, LATAM plans to slash capacity within Brazil by 6% to 9%, and projects flat to 3% growth in its overall system supply. At the end of 2015 Gol had not offered its capacity projections for 2016, but concluded on an industry-wide level that "the capacity reduction movement would continue over 2016", according to Mr Kakinoff.

Brazil's third and fourth largest airlines Azul and Avianca Brazil had been growing at a breakneck pace prior to the country's economic recession. Both still posted ASK growth for the 9M ending Sep-2015, with Azul growing supply nearly 5% and Avianca Brazil expanding by 14%. Each airline did slow capacity growth from the same year-ago period. Azul's supply jumped 39% for the same period in 2014 and Avianca Brazil's growth slowed from an increase of 23%.

Traffic grew faster than supply in the Brazilian domestic market for the first nine months of 2015. The country's airlines posted a nearly 4% increase in RPKs and ASK growth of 3%. Load factors were reasonably stable, falling 1ppt to 79%. However, the unit revenue performance by Gol and LATAM indicate that pricing remains weak in the market, so all of Brazil's major airlines are likely feeling the effects of the country's economic fragility. The Brazil 2016 Olympics can be expected to add further to airline woes as, typically, tourist traffic slows during the month or so of the Games.

Brazil's severe economic weakness did not deter Hainan Airlines' owner HNA Group from detailing plans near the end of 2015 to take an approximately 24% stake in Azul for USD450 million. It is a crucial investment for Azul, which has abandoned the pursuit of an IPO three times during the last couple of years, and has a steady stream of aircraft deliveries starting in 2016 with A320neos followed by the commencement of A350 widebody deliveries in 2017.

Although the investment opens up the door for deepening links between China and Latin America, the cooperation is likely to be an evolutionary process given Brazil's economic state.

Worsening economic conditions resulted in most of the largest airline groups working with suppliers to defer planned aircraft deliveries and revise their capital expenditure projections. Gol has worked with Boeing to adjust its delivery schedule for 2016-2017 to accept four 737 narrowbodies instead of the original 15 planned deliveries. Additionally, Gol is expanding the number of aircraft it subleases to foreign airlines during the shoulder periods in South America. It plans to sublease 12 of its narrowbodies in 2016, compared with seven in 2015.

Copa Airlines grew its fleet by a net number of two 737-800s during 2015. It took nine new aircraft deliveries, subleased two of its existing 737s and returned five jets with lease expirations. It is deferring one delivery scheduled for 2016 and one for 2017, which results in just one 737 delivery scheduled for 2016. Near the end of 2015 the company offered preliminary capacity guidance of 3% growth in 2016, which is below the 5% increase the company recorded during 2015.

Avianca has also postponed five of 11 aircraft deliveries scheduled for 2016, and is in the process of disposing of 12 Embraer E190s. As of mid-2015 the company had grounded four of the jets, and planned to phase out the remaining aircraft within 18 months. It aims to either sublease or sell the jets. With the aircraft deferrals and the grounding of the Embraer aircraft, Avianca projects its CapEx will drop by 50% year-on-year in 2016.

LATAM is working to reduce its fleet commitments by 40% between 2016 and 2018, and expects a USD3 billion reduction in capital expenditures for that period. As of Sep-2015, the company had already achieved USD1.8 billion of the planned decrease.

Mexico's airlines start 2016 with a more positive outlook than many of their Latin American counterparts. Conditions in the country's domestic market steadily improved during 2015. Its GDP grew approximately 2.3% in 2015 and is forecast to expand by 2.9% in 2016. Between Jan-2015 and Sep-2015, 27 million passengers travelled in the Mexican domestic market compared with 24 million the year prior.

Mexico's airlines start 2016 with a more positive outlook than many of their Latin American counterparts. Conditions in the country's domestic market steadily improved during 2015. Its GDP grew approximately 2.3% in 2015 and is forecast to expand by 2.9% in 2016. Between Jan-2015 and Sep-2015, 27 million passengers travelled in the Mexican domestic market compared with 24 million the year prior.

Due in part to solid demand, Mexican low cost airline Volaris revised its 2015 domestic capacity growth upwards throughout the year. Its original estimates were system growth of 10% to 12% with a 2% to 4% increase in domestic supply. Its growth targets expanded to a 15% to 18% rise in system supply with a 9% to 11% increase in domestic capacity. However, its overall capacity growth in 2015 was still weighted toward international expansion, with a 33% to 36% increase in international supply year on year.

Volaris marked a milestone in 2015 when it launched its first international flights outside the US transborder market. It added service from Cancun to Guatemala and San Juan, and new service between Guadalajara and San Jose, Costa Rica. Although the airline has branched out to Central America, the region still only accounts for a small part of Volaris' international capacity, roughly 5% of its seats as of mid Nov-2015. The airline believes numerous opportunities remain in the US transborder market, and will direct the bulk of its international growth to the region for the foreseeable future.

As Volaris examines potential new US routes, its rival VivaAerobus pulled back from a promising transborder push in 2015. It cut six short-lived US routes, leaving just a single transborder flight between Cancun and Houston. The drawdown triggers some questions about VivaAerobus' strategy. It remains the fourth largest domestic airline in Mexico, and with the cuts its presence in the US transborder market is essentially non-existent.

The airline is currently undergoing a fleet transition from 737 Classics to new Airbus narrowbodies. VivaAerobus could offer more clues to its network strategy in 2016 as its fleet upgrades continue.

Aeromexico plans to grow its 2016 system capacity in the high single digits, and similar to 2015, will likely direct the bulk of that growth to international markets. Aeromexico aims to forge even deeper ties with fellow SkyTeam member Delta Air Lines after the two companies detailed their intentions to form a joint venture once the relaxed bilateral agreement between the US and Mexico takes effect in early 2016.

Delta also wants to up its stake in Aeromexico to as much as 49%, a signal that the US airline wants to exert more influence over Aeromexico as the Mexican market continues to open up.

Although Brazil's currency plunge during 2013 was the deepest, other countries in South America also endured significant devaluation of their currencies. During 3Q2015 LATAM Airlines Group cited a 50% devaluation of the Colombian COP and a 17% decline of the Chilean CLP. Unit revenue declines in those markets were mostly driven by currency devaluation, company management explained.

Using Chile as an example, LATAM explained that yields in the local currency remained healthy in 3Q2015 compared to the year ago period. Colombia's largest airline Avianca cut its domestic supply by 4% in 2H2015, and in Sep-2015 the company noted that by adjusting its capacity levels, average fares denominated in COP were at comparable levels or higher than 3Q2014.

Avianca has the benefit of having most of its ASKs deployed into and from markets that are more stable - Colombia, Peru and Central America. Although its yields were pressured throughout 2015, its revenues for the 9M ending Sep-2015 remained relatively stable, dropping from USD3.5 billion to USD3.3 billion year-on-year.

Peru's domestic market grew by a healthy 10% rate in 1H2015; but Avianca has cut two domestic markets, which put it in a tie with Peruvian airlines for second place market share behind LAN Peru during 1H2015. Avianca and Peruvian each held a 13% share and LAN Peru's share was 62%. The cuts seem part of a broader willingness by Avianca to sacrifice some market share for yield improvement.

Peru's domestic market grew by a healthy 10% rate in 1H2015; but Avianca has cut two domestic markets, which put it in a tie with Peruvian airlines for second place market share behind LAN Peru during 1H2015. Avianca and Peruvian each held a 13% share and LAN Peru's share was 62%. The cuts seem part of a broader willingness by Avianca to sacrifice some market share for yield improvement.

Avianca's main rival in Colombia and Peru, LATAM, plans to grow capacity in its Spanish speaking countries - Argentina, Colombia, Chile, Peru and Ecuador - by 6% to 8% in 2016 compared with 2% to 4% in 2015. The justification for the higher growth is that GDP in most of those markets is expanding between 2% and 4%. LATAM also explained that its historical growth rates in those markets have been 10% to 12%, so its up to 8% planned growth falls below those levels.

One market that remains uncertain as 2016 begins is Argentina. At the end of 2015 Mauricio Marci was elected president; he is an opposition leader to former president Cristina Fernández de Kirchner. Although he is expected to ease some protectionist measures of the Kirchner government, Mr Marci has reportedly pledged to keep Aerolineas Argentinas under state control.

Ms Kirchner's government essentially closed off access to Argentina's domestic market to other airlines, and it is not certain if Mr Marci will adopt the same measures. Buses still form the core of domestic travel in Argentina, making it ideal for new low cost entry. In the meantime, Aerolineas Argentinas is showing some signs of financial progress, narrowing its operating losses for the 9M ending Sep-2015 by nearly 66% to USD94 million.

Economic uncertainty will remain the dominant feature of Latin American airline performance during 2016 - even with the adjustments airlines are making to withstand the tough conditions within the region. It will take some time for revenue trends to reach levels airlines enjoyed prior to the region's economic downturn. For now, all those companies can do is go into holding mode and keep adjusting their businesses to the current economic reality, which continues to cast dark clouds over the region. This is a dramatic turnaround for a region that just five years ago was considered one of the most promising areas for explosive growth in the aviation industry. The potential is still there; but it now looks as if it will be 2017 before more of it is realised.

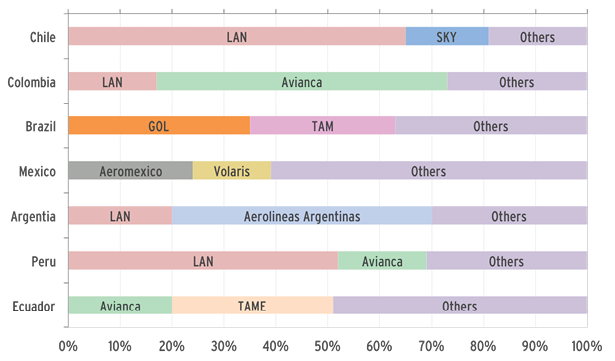

Top airlines in the largest Latin American markets (% of system seats): 11-Jan-2016 to 17-Jan-2016

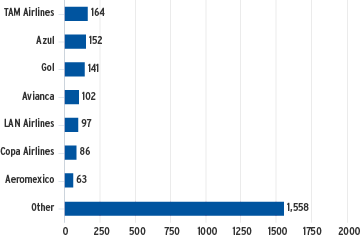

Fleet by airline in Latin America