Middle East Outlook: Gulf-led expansion continues, despite the oil price slump

Aviation in the Middle East is set for another year of healthy growth in 2016. The region's largest airlines will continue to dominate growth and profits, as well as the strategic landscape, but fortunes for the region's smaller carriers are brightening. The main macro factors shaping the regional outlook are continued low oil prices - a boon to airlines, but a concern for some economies - the evolution of the regional security/political situation and the lifting of sanctions on Iran. Slowing growth in major export partners could also weigh on the outlook.

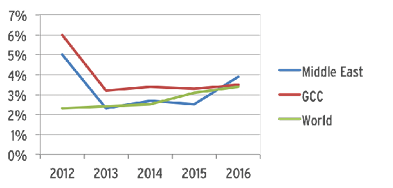

The regional economic outlook is improving, with 2016 projections for GDP of growth between 3.6% and 3.9%, a notable improvement on recent sluggish gains. GCC economies are expected to remain mostly healthy.

|

Middle East, GCC and world GDP growth forecast

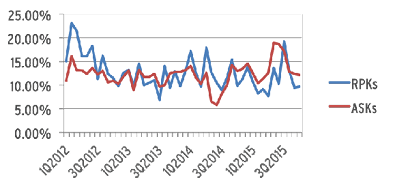

Middle East ASKs and RPKs: 1Q2012-3Q2015

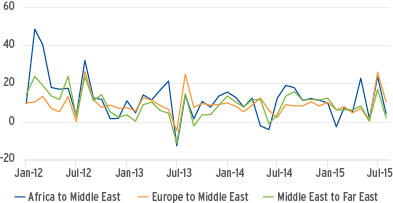

Middle East premium traffic growth: 1Q2012 to Jul-2015

|

Regional air travel demand is forecast to expand at around 11%-12%, roughly in line with capacity growth of 11.5%-12.5%. The strong economic development, along with young and expanding populations, the region's favourable geography and the aviation-friendly investment plans and policies of governments are all driving growth.

A major downside risk is a further slowdown in China, particularly for oil-dependent economies, as China accounts for almost 10% of all Middle East exports. Oil also threatens to drag down several major regional economies. Most outlooks project a modest price recovery, to USD60-USD65 per barrel, although volatility remains high and the outlook is uncertain.

Airlines are enjoying the effects of lower fuel costs and the traffic stimulated by lower fares. However, major oil exporters - including Kuwait, Oman, the UAE, Saudi Arabia and Qatar - have lowered GDP forecasts and are cutting public spending, potentially slowing travel demand. Subsidy cuts have been the favoured tool response, which could threaten subsidies at some government-owned carriers.

Regional development spending plans - including USD145 billion in airport projects underway or in planning - remain largely intact. Ongoing airport construction in oil exporters will be financed through deficit spending, accumulated fiscal reserves or tapping debt markets.

The political and security instability eased over 2015, but there is no end in sight for regional conflicts. Syria, Iraq and Lebanon are among the worst affected, and neighbouring Jordan is suffering. Crucially, the GCC states have remained mostly isolated, although Yemen's civil war has drawn in Saudi Arabia. Even with the present tensions, intra-regional travel and tourism continue to grow, particularly to 'islands of stability' such as the UAE and Qatar.

The protracted regional uncertainty has resulted in spare regional capacity, putting yield margin pressure on short-haul markets. Long-haul yields are expected to moderate in 2016, with the exception of premium travel markets, which are buoyed by improving business confidence. The Gulf carriers have progressively captured a share of Europe-Asia business markets, and no slow down in premium travel in markets linked with the Middle East is anticipated.

The lifting of sanctions against Iran will contribute positively to both regional stability and economic growth. Iran is the region's second largest economy and growth is forecast to double to 2% in 2016 (and accelerate after that).

Iran's airlines face a situation perhaps unique in aviation history. Western embargoes have left them saddled with ancient fleets and aircraft grounded for want of spares. 300 aircraft are expected to join their fleets within five years, followed by another 200 over the next five.

The initial focus for Iranian carriers will be on introducing new aircraft - primarily leased narrowbodies - to add more domestic and intra-regional routes, before shifting to more ambitious plans for widebodies. New start-ups have already been announced, showing the confidence in the market.

The large airlines of the Gulf will dominate regional growth in 2016. Emirates, Qatar Airways, Saudia and Etihad Airways will take more than half of 2016 aircraft deliveries, primarily high capacity widebodies. As a result, these carriers will contribute to nearly two thirds of regional seat capacity growth.

The UAE is the region's largest and most mature market, and its carriers plan major expansion in 2016. Emirates alone will add 36 new aircraft - 20 A380s and 16 Boeing 777s - while retiring 26 older and smaller aircraft. The airline plans major network additions in China, India, the US and Australia, along with up gauging key routes to A380s. A fleet order is anticipated for 2016, after it cancelled orders for 70 A350s in 2014.

Etihad Airways' organic expansion is not as rapid, with four A380s and a handful of other widebodies due in 2016. However, it will be busy bedding in its equity partnerships, which have aroused vocal opposition from some EU carriers and renewed interest from European competition authorities. Etihad's 'equity alliance' covers stakes in eight airlines and is increasingly behaving like an integrated partnership, exemplified by its collective USD700 million capital raising. Etihad is still building relationships, signing an MoU with Montenegro Airlines and expanding MRO cooperation with Air France-KLM in Nov-2015.

Emirates is also expanding partner relationships. A codeshare was signed with Malaysia Airlines in Dec-2015 and Emirates plans to expand its alliance agreement with Qantas, adding more destinations thanks to an expanded UAE-Australia bilateral to come into effect later in 2016.

|

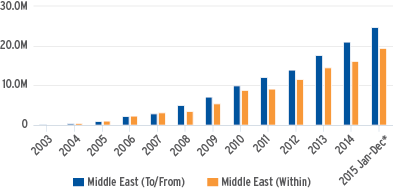

Middle East regional seat growth: 2003-2015

|

The UAE's LCC market is no less competitive than that of tis full service carriers. flydubai wrested the title of the Middle East's largest LCC form Air Arabia in 2015, plans to expand its fleet from 43 to 50 aircraft in 2016, as well as adding at least 20 new routes. In Oct-2015, it opened a second base at Dubai World Central, 15km from its DXB main hub. This complicates it operations, but provides long-term space to grow.

For its part, Air Arabia added 21 routes in the first nine months of 2015 and will continue this rate of expansion into 2016. Its new hubs in Ras Al Khaimah and Jordan will be a focus and the pan-Arabian group is considering a 49% share in an Indian charter carrier. A deal is hoped for in 2016, although the Indian regulatory situation remains unpredictable. Air Arabia is also due to make a major fleet order, with its last eight A320s due to be delivered by the end of 2016.

LCCs now operate almost 20% of regional capacity, but airlines in the segment are increasingly focused outside of the Middle East, attracted by better yields. They are also blocked from some regional markets due to failures to liberalise air services regimes and the favoured status of flag carriers for route allocations.

Elsewhere in the Gulf, Qatar Airways will add 30 new aircraft in 2016, half of them narrowbodies. The airline already has nine new routes set for 2016, including destinations in Australia, the UK, the US, China and India. New A350s and 787s will be deployed on premium heavy routes to Europe, the US and Australia. After acquiring 10% of IAG in 2015, Qatar Airway is already looking at more foreign investment opportunities, with Royal Air Maroc identified as a target. Once acquisitions are complete, the carrier will then turn its attention to a fresh fleet purchase, adding to the 200-plus already on order.

Two new competitors - SaudiGulf and Al Maha Airways - will potentially enter the Saudi Arabian market in 2016. These will prove more of a concern for flynas than Saudia, which intends to push into more long haul markets in 2016. The airline is in the closing stage of is five year fleet renewal, with eight 787s due in the next 12 months. It will also phase out its Embraer regional jets, replacing them with narrowbodies to alleviate domestic airport capacity issues.

Saudia's slow motion privatisation process will continue in 2016, focusing on catering and ground services. The mainline passenger business is being prepared for partial privatisation, but the process is being dragged out as long as possible. Saudi Arabia is also accelerating airport privatisation, now due to start in 1Q2016, partially to reduce the financial burden of its airports.

For the three Gulf sixth freedom carriers, North America will remain a prime strategic target. Gulf-US capacity expanded rapidly 2015 and Emirates and Qatar have both announced intentions to continue pushing into the market. Qatar Airways will add Atlanta, Boston and Los Angeles, taking its US network to 10 cities, matching Emirates. Emirates signed a codeshare agreement with Alaska Airlines in Oct-2015 and plans to add another 275,000 US seats in 2016, to go along with the 600,000 added in 2015.

For the three Gulf sixth freedom carriers, North America will remain a prime strategic target. Gulf-US capacity expanded rapidly 2015 and Emirates and Qatar have both announced intentions to continue pushing into the market. Qatar Airways will add Atlanta, Boston and Los Angeles, taking its US network to 10 cities, matching Emirates. Emirates signed a codeshare agreement with Alaska Airlines in Oct-2015 and plans to add another 275,000 US seats in 2016, to go along with the 600,000 added in 2015.

It is also considering more trans-Atlantic routes to the US, threatening US and European carriers. Etihad Airways yet to announce any 2016 US routes, but is up-gauging some destinations to A380s.

With so much capacity coming into the US market, the protectionist lobbying by the US 'Big 3' - Delta Air Lines, United Continental and American Airlines - and certain European airlines over Gulf airline competition is unlikely to disappear. The latest US airline tactic has been very public decisions to drop routes to the Gulf, on the grounds that they cannot operate profitably against "subsidised" competition.

Canada too, which has had a near-closed door policy towards the Gulf 3 (and to Turkish Airlines), is reviewing its policy and, with a new government in place, may well begin to relax its attitude to new entry.

Europe is in the process of forming its own answers to the competitive question of the Gulf carriers via its new external aviation policy. As in the US, regulators appear reluctant to take sides on the debate over unfair competition. The new policy expresses "concerns" about the way the Gulf carriers operate.

The EC believes comprehensive aviation agreements between the EU and the GCC states would create "conditions that will allow further market development and growth based on common rules and transparency". The EC is seeking a mandate to negotiate new EU-level agreements with GCC states, with negotiations to start in 2016.

The EC believes comprehensive aviation agreements between the EU and the GCC states would create "conditions that will allow further market development and growth based on common rules and transparency". The EC is seeking a mandate to negotiate new EU-level agreements with GCC states, with negotiations to start in 2016.

Outside the Gulf, the outlook for Middle East airlines remains mixed. Most state-owned airlines remain overstaffed, underfinanced, and saddled with legacy fleets and/or weighed down by unwanted political interference. Despite this, there are signs of improvement, with restructuring narrowing, if not eliminating, losses for some carriers.

In Bahrain, Gulf Air has almost completed its latest round of restructuring and an IPO is in the works. The carrier still needs to end its losses and repay its debts - which it hopes to achieve by the end of 2016 - before it can attract investors. New routes in Asia and Europe are a possibility for 2016, provided aircraft are available. Gulf Air is looking at 50 new aircraft, with a 1H2016 order likely.

Oman Air continues developing as a long-haul premium niche player, and remains both expansionist and heavily loss making. It intends to add 20 destinations by the end of 2017, along with 15-20 aircraft. The airline received a USD320 million capital injection from the Oman government in Oct-2015, but still needs an organisational restructuring to improve efficiency and services.

Kuwait Airways restructured and downsized its network and shed older aircraft for leased A330s and A320s in 2015, its first new aircraft in close to a decade. The carrier remains heavily in the red and its new aircraft are for 2016. More aircraft - A320neos, A350s and 777s - wont arrive unit 2017/2018. Privatisation via a partial IPO is once again off the table, thanks to the Kuwaiti parliament.

|

Gulf carrier US capacity expansion growth: 2006-2016*

|

Local rival Jazeera Airways is maintaining a deliberately slow and steady growth path - mostly due to perceived market overcapacity - and is returning large amounts of cash to shareholders. The airline is immensely profitable for its size, but is recent rapid yield gains have slowed and further improvements will mostly be achieved on the costs side of the ledger.

Despite lingering macro-scale concerns, and the spectre of protectionism from North America and Europe, aviation in the Middle East continues its upswing, led by the large Gulf carriers. There is room for improvement though and action is required by regional governments to ensure gains are not lost.

The region's restrictive bilateral agreement and tight ownership/control regulations needs to be addressed. Private ownership of airlines is still rare and state-owned carriers retain favoured status with regional governments.

With several major hubs located within the small Gulf region, better ATM cooperation, military-civil coordination and opening of airspace for commercial use is vital. Ultimately, a pan-regional ATM body may provide a solution, but there is little apparent political will.

Air travel safety was a theme is 2015 and it will remain a regional and global concern for 2016. Ensuring safety and security is a continual process, but for Middle East aviation to continue to flourish, it is vital.