BRAZIL: It’s raining on their parade

Brazil's airlines must feel they are weathering almost the perfect storm in 2016. A tottering economy, political disarray, the prospect of a slowdown during the Aug-2016 Olympics - and now the Zika virus is frightening travellers. Yet the market is undergoing a flurry of investment which is likely to reshape Brazil's industry in the medium term.

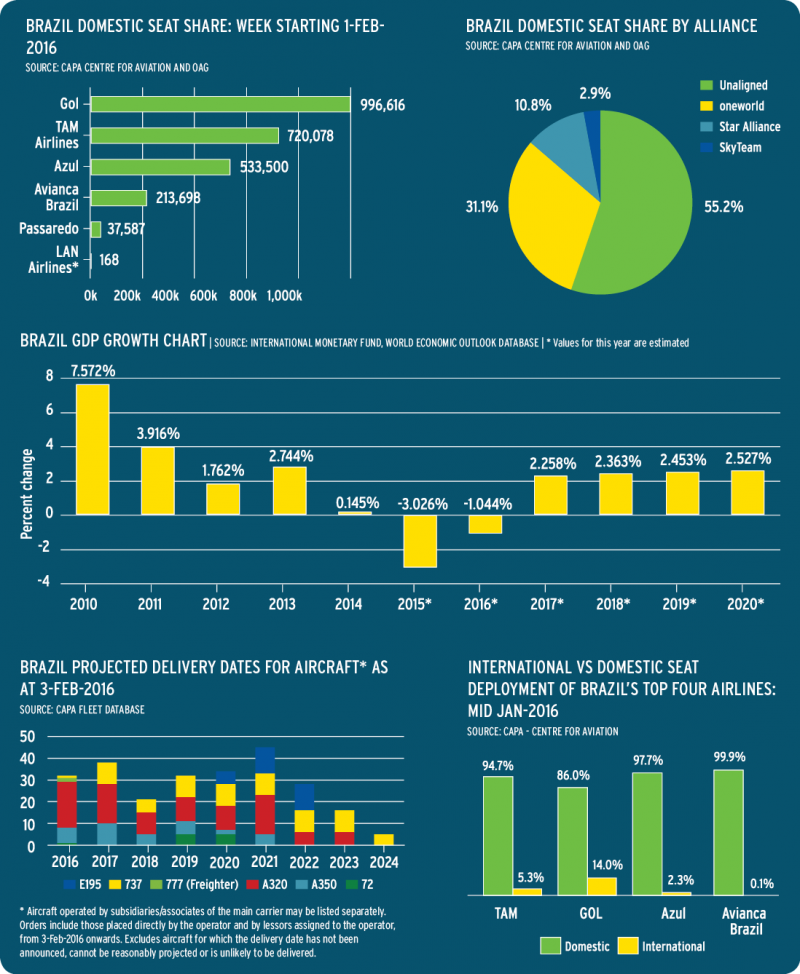

Just a few years ago, Brazil was one of the most promising emerging markets in commercial aviation, high on the prospect of hosting the soccer World Cup and the Olympics in quick succession. Its economy was strong and the country's middle class was expanding, along with its appetite to spend growing disposable income. But the tide began to turn swiftly in 2014, and by 2015 the country was in economic and political turmoil. Brazil's GDP contracted roughly 3% in 2015 and early predictions for 2016 indicate another decrease of approximately 2.5% to 3%.

Brazil is also suffering from an unemployment rate that could reach 10% in 2016 and inflation at an even higher level. Ratings agencies Standard & Poor's and Fitch ratings have both downgraded Brazil's debt to essentially junk status. At one point during 2015, the BRL depreciated 55% against the USD, and early projections suggest an average exchange of BRL4.25 for 2016.

Gridlock between Brazilian legislators and the administration of President Dilma Rousseff resulted in little movement by the government to improve Brazil's financial state during 2015. Needless to say, consumer confidence in Brazil is waning.

No airline operating within, or to and from Brazil has been spared the effects of the country's dire economic circumstances. At the time this report was compiled, Brazil's publicly traded airlines had not released full year financial results for 2015; but their performance for the nine months ending Sep-2015 provides clear insight into how the country's economic chaos is affecting the air transport sector.

After the merger of LAN and TAM to create regional powerhouse LATAM Airlines Group, Brazil is now the company's largest domestic market in South America. LATAM posted a USD203 million loss for the nine months ending Sep-2015 and endured a 32% fall in Brazil passenger unit revenues (measured in USD cents). Gol, which has posted annual losses since 2012, recorded a USD857 million loss for the same period. Its yields denominated in the BRL fell 9.3% for that period. LATAM, which pegs in yield in the USD, posted a 17.3% decline.

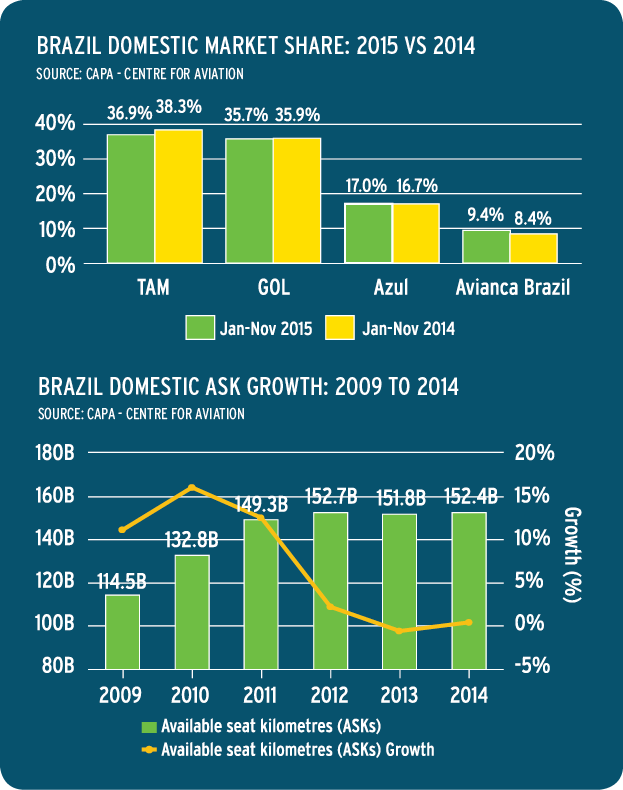

Brazil's domestic traffic fell 1.7% year on year from Jan-2015 to Nov-2015 (the latest data available as the this report was prepared). Collectively, the country's airlines posted a 1.5% drop in capacity. TAM's domestic capacity fell 1.8% for that time period while Gol's grew 1.2%. The country's third and fourth largest airlines slowed their capacity growth year on year. Azul increased its supply 4% compared with a jump of 38% the year prior. Avianca Brazil's capacity growth fell to 13% versus a nearly 23% rise for the same period in 2014.

Brazil's domestic traffic fell 1.7% year on year from Jan-2015 to Nov-2015 (the latest data available as the this report was prepared). Collectively, the country's airlines posted a 1.5% drop in capacity. TAM's domestic capacity fell 1.8% for that time period while Gol's grew 1.2%. The country's third and fourth largest airlines slowed their capacity growth year on year. Azul increased its supply 4% compared with a jump of 38% the year prior. Avianca Brazil's capacity growth fell to 13% versus a nearly 23% rise for the same period in 2014.

Avianca Brazil's total capacity growth for 2015 reportedly reached 15%, driven in part by a fleet upgauge programme in which smaller Fokker aircraft were replaced by larger capacity Airbus narrowbodies. However, company officials told news outlet Bloomberg that in hindsight the company likely would have not grown its capacity at those levels during 2015.

Despite Brazil's tough economic conditions, Avianca Brazil and Azul are still attempting to build market share within the country. Between Jan-2015 and Nov-2015 Avianca Brazil's market share increased from 8.4% to 9.9% year on year. Azul's share grew from 16.7% to 17%. During the last couple of years Gol and TAM have toggled between first and second place in Brazilian domestic market share. For the 11 month period ending Nov-2015, TAM's share fell from 38.3% to 36.9% year on year and Gol's slipped slightly from 35.9% to 35.7%.

The high probability of Brazil's economy contracting for a second consecutive year should necessitate further capacity rationalisation among the country's airlines in 2016. TAM has stated its capacity within Brazil's domestic market should fall between 6% and 9% in 2016 compared with a decline of 2% to 4% in 2015. LATAM aims to preserve optimal services for its corporate travellers as it works to rationalise supply with demand in the Brazilian domestic market.

Gol has not offered specific ASK guidance for full year 2016, but declared that its take-offs are dropping between 4% and 6% for 1H2016. Gol plans to manage its decrease in departures by reducing point to point flights and rationalising higher frequency routes hurt by the declining economy.

Both LATAM and Gol have also altered their short term fleet plans to combat weakness in the Brazilian market. Gol had adjusted its delivery schedule for Boeing 737 narrowbodies for the 2016-2017 timeframe. It now plans to take delivery of four single aisle jets in that time period compared with original projections of 15 deliveries. Gol also plans to enlarge the number of aircraft it subleases to other airlines during shoulder periods in South America from seven in 2015 to 12 in 2016.

In total, Brazilian airlines are scheduled to take delivery of 32 aircraft in 2016, according to CAPA's Fleet Database. Gol is accepting two 737s, and TAM is scheduled to take delivery of two 777 freighters. TAM is also taking delivery of seven Airbus A350 widebodies and 12 A320neo narrowbodies, largely for fleet replacement. LATAM's consolidated fleet is growing by a net of five aircraft in 2016. Projections show Azul is taking delivery of nine A320neo family aircraft.

Bloomberg has reported that Azul plans to cut capacity by 5% in 2016; but Avianca Brazil has not offered capacity guidance. Those two airlines did not escape the collapse in domestic pricing ushered in by the weak economy. Azul's planned capacity decrease begs the question of where the airline intends to deploy its new Airbus narrowbodies, and if new routes within South America may be in the offing.

None of Brazil's airlines are likely to be betting on a huge boost from the country's hosting of the summer Olympic Games in Aug-2016. The country was in an entirely different economic scenario in 2009 when it won the contest to host the event. After it secured the privilege to host the games, its GDP soared to 7.5% in 2010.

Airlines have some experience to draw from after observing traffic patterns during the FIFA World Cup soccer tournament hosted by Brazil in 2014. Most airlines saw little, if any, upside from the event.

A drop in corporate demand during the tournament impacted LATAM's 3Q2014 revenues by USD130 million. The company's rival Gol also made similar conclusions about the effects of the World Cup. Other airlines serving Brazil also encountered negative headwinds due to the tournament. Copa Airlines also cited a weakness in yields during Jul-2014 (when the bulk of the soccer matches were played) that stemmed from Brazilians who typically travelled during that time instead opting to stay in the country.

The Olympics could create similar pressures in corporate travel within Brazil and outbound leisure travel from the country. But one positive development is the country's decision to waive visa requirements from 01-Jun-2016 to 18-Sep-2018 for four countries - the US, Canada, Australia and Japan.

Brazil's lifting of the visa requirements is a welcome sign for a country that could use a healthy dose of tourism revenue. TAM, Azul and US airlines serving Brazil from Canada and the US should receive some benefit from the relaxation of visa requirements. The depreciation of the BRL against the USD obviously makes travel from the US attractive, and TAM and its oneworld partner American can capitalise on their codeshare partnership to exploit the demand generated by the Olympics. But the overall benefits to Brazilian airlines generated by the Olympics are difficult to predict.

No airline serving Brazil is predicting a significant improvement in the operating environment for the foreseeable future. Gol has declared the Brazilian aviation industry is facing one of the most difficult periods in the last decade. Although Gol and Azul have attempted to diversify into international markets during the last couple of years, each airline remains highly exposed to Brazil's weak domestic market.

As of mid Jan-2016, nearly 95% of Gol's seats were deployed into Brazil's domestic market. After a short lived, and unprofitable, attempt at operating long haul flights with widebodies during the last decade, Gol opted to focus on the Brazilian domestic market. In 2012 it returned to the US by adding flights to Orlando and Miami with a stop-over in the Dominican Republic.

Beginning in 2016 Gol is transitioning those flights to seasonal service. The airline cited falling ticket prices to the US as one driver of its shift to seasonal flights. Gol has estimated ticket prices between the US and Brazil dropped from an average of USD950 in 2014 to USD350 in late 2015.

Azul entered the US long haul market from Brazil in late 2014, and serves Orlando and Fort Lauderdale from its largest base and headquarters at Campinas Viracopos. It has pushed back plans to introduce flights from Campinas to New York JFK. As of mid Jan-2016, approximately 2.3% of Azul's seats were deployed to international markets.

Gol's international focus has now turned to the Caribbean and South America. It has stated its desire to launch flights to Havana, and cited additional opportunities for service to Argentina. During 2015 the airline introduced flights from Fortaleza and Natal to Buenos Aires, which joined numerous other services Gol operates between Brazil and Argentina. Gol also codeshares with Aerolineas Argentinas, and together the airlines accounted for approximately 58% of the seats on offer between Brazil and Argentina in mid Jan-2016.

TAM has the highest international seat deployment among Brazil's largest airlines, topping 14% for the mid Jan 2016 time period. LATAM has been expanding into long haul international markets as well as some select intra-South America routes during the last year. New international routes launched by TAM in 2015 included flights from its hub at Sao Paulo Guarulhos to Barcelona, Toronto (via New York JFK), Cancun, Punta del Este and Bogota, a hub for LAN.

TAM reaches a milestone in 2016 with the introduction of flights from Sao Paulo to Johannesburg, the first African route for a Latin American airline. In late 2015 TAM took delivery of its first A350 widebody, and plans to add seven of the jets to its fleet in 2016. LATAM has stated it would place the new jets on routes from Sao Paulo to Miami, Orlando and Madrid.

Avianca Brazil has the highest exposure to Brazil based on seat deployment. Nearly 100% of its seats were allotted to domestic routes in Jan-2016. At that time the airline's international offerings consisted of a single weekly flight to Bogota from Fortaleza. At this point, the airline has not offered any plans to grow outside of Brazil and the sparse service to Colombia; something it may need to reconsider as domestic conditions in Brazil show no signs of improving.

The airline has been able to expand its international scope through partnerships after formally joining the Star Alliance in 2015. It forged a codeshare with Star member Turkish Airlines during late 2015 covering some connections beyond Turkish Airlines' hub in Instanbul and Avianca Brazil's main base at Guarulhos. Turkish operates flights from Istanbul to Sao Paulo with continuing service to Buenos Aires.

In early 2016 Avianca Brazil and Ethiopian tabled a codeshare covering Ethiopian's flights to Sao Paulo from Addis Ababa and select Brazilian routes operated by Avianca Brazil. Brazil's fourth largest airline also stepped outside of Star to create a codeshare with SkyTeam member Air Europa. Routes covered under the partnership include Air Europa's service from Madrid to Sao Paulo and Salvador and five routes from Avianca Brazil's hub at Sao Paulo.

Since TAM's exit from Star in 2014 to join oneworld, the partnership landscape in Brazil has undergone rapid change. Avianca Brazil's ascent into Star was overshadowed by United's decision during 2015 to take a 5% stake in non-aligned Azul for USD100 million. Near the end of 2015 United and Azul launched a codeshare that entailed Azul placing its code on eight of United's US destinations. United is codesharing on six of Azul's routes from Sao Paulo Guarulhos.

The partnership obviously does not come close to filling the void of TAM's position in Star. TAM still has a leading 38% market share in the Brazilian domestic market compared with Azul's 17%. TAM also has the benefits of scale offered by the combined LATAM network to offer connections throughout South America.

Azul's largest base and headquarters is Campinas Viracopos, and Guarulhos is its third largest base measured by seat deployment. Most international airlines serving Brazil primarily use Guarulhos as their gateway to the country, followed by Rio de Janeiro Galeao. Avianca Brazil is the second largest operator at Guarulhos measured by seats, but it has yet to formally conclude a codeshare partnership with fellow Star partner United. Azul, meanwhile, also brokered an interline agreement with JetBlue in 2015.

Azul made other bold steps during 2015 to create a strong position for itself over the long term, and secure much needed equity as most investors shunned Brazilian companies.

Company founder and chairman David Neeleman and a group of investors were the successful bidders for another Star member, TAP Portugal, the largest airline between Western Europe and Brazil. Mr Neeleman outlined his aim to establish an alliance between Azul and TAP, and in late 2015 the airlines tabled a codeshare in which TAP aims to put its code on 20 of Azul's Brazilian flights while Azul is adding its code to 12 of TAP's flights between Portugal and Brazil.China's HNA Group - parent of Hainan Airlines - disclosed plans, in late 2015, to take a 24% stake in Azul for USD450 million. The equity infusions Azul collected in 2015 are crucial to funding its growth at a time when most investors have little appetite to take on risks associated with Brazilian companies. As of mid Jan-2016 Azul was operating a fleet of 151 ATR, Embraer and Airbus widebody aircraft. The company has 99 aircraft on order including 63 A320neo family narrowbodies, five A350 widebodies and 30 Embraer 195-E2 jets.

HNA is obviously taking the long view with its investment in Azul. Although conditions in the country's aviation market are remaining weak throughout 2016, Brazil has much upside once it regains solid economic footing. LATAM recently highlighted Brazil's untapped potential, pointing to average trips per capita of 0.56 in 2014. That compares to 2.68 for the United States and 3.73 for the United Kingdom.

Delta is also casting an eye on the long term potential for Brazil after upping its stake in Gol from 3% to 9% in 2015. Delta also guaranteed USD300 million of Gol's debt, secured by Gol's publicly traded loyalty programme Smiles. Delta stressed its financial support would bolster Gol's cash position to ensure the airline has ample liquidity to weather the difficult economic circumstances in Brazil.

The financial support offered to Gol by Delta is by no means a goodwill gesture. Delta aims to create an immunised joint venture with Gol once an open skies agreement between the US and Brazil takes effect. It is not clear if Gol feels as strongly about a joint venture, but Delta will no doubt attempt to exert its broadened influence with Gol to form a tie-up. Gol continues to maintain its stance that it prefers to remain independent from any of the three global airline alliances, but the deepened relationship with SkyTeam anchor member Delta raises some questions about the longevity of Gol's alliance independence.

LATAM did not sit idly by and watch its competitors jockeying for partnerships in 2015. It upped the stakes in early 2016 by unveiling plans to launch a trans-Atlantic joint venture with European airline group IAG, and create a second JV with American Airlines covering services between the US and Canada and six South American countries - Brazil, Chile, Colombia, Peru, Paraguay and Uruguay.

In early 2016 SkyTeam held the largest seat share between Europe and Latin America (excluding the Caribbean) at 37%, oneworld represented a 30% share and Star trailed third with a 24% share. If the joint venture is approved, oneworld would have the only immunised structure between Europe and Latin America, which would enable material unit revenue enhancements its non-immunised rivals would not enjoy.

Key for oneworld is LATAM's leading position as Latin America's largest airline. LATAM and IAG airlines British Airways and Iberia have an ability to market numerous beyond connections from LATAM's hubs in Sao Paulo, Lima, Santiago, Bogota and Brasilia.

LATAM has also indicated that the potential IAG joint venture would be beneficial to its plans to establish a hub in northeast Brazil. TAM outlined plans for a hub in that region of the country in mid-2015, and stated Fortaleza, Natal and Recife were potential candidates for the new venture.

TAM concluded a hub at one of those airports in northeastern Brazil would offer customers more direct access to trans-Atlantic markets, and allow for faster aircraft turn times, which would lower operating costs. Partnering with British Airways and Iberia obviously gives LATAM more network breadth to offer passengers travelling from its potential new hub.

Although LATAM and American were relatively quiet about a potential joint venture throughout 2015, a tie-up became inevitable given Delta's aggressive pursuit of an immunised joint venture with Gol. LATAM and American are already the two largest airlines operating between the US and South America, and together they represented nearly 64% of the seats available from the US to Brazil in Jan-2016. Given that concentration, some concessions may be necessary for LATAM and American to garner approval for their proposed joint venture.

For a country with such a dismal short term outlook, Brazil was certainly a hotbed of activity in 2015. Airlines based in the country and those serving Brazil are working furiously to ensure they retain a strategic market position once the economic environment improves. The jockeying reflects Brazil's still strategic importance over the long term, despite an intensely bleak short term outlook.

Brazil's largest airlines are faced with the task of striking a delicate balance of fortifying themselves to withstand a bleak economic environment while making the necessary investments to ensure successful longevity - a scenario whose outcome is tough to predict.