India’s aviation market surges but supply side constraints are emerging

India is currently one of the fastest growing aviation markets in the world. A combination of strong GDP growth of around 7.5% and the decline in oil prices, which has supported lower fares, is driving year on year domestic traffic growth of around 20%.

International traffic growth is close to 8%, in line with the average compound annual growth rate over the last decade, but it could arguably be higher if market access for foreign carriers were liberalised. India is currently served by 70 foreign airlines and five Indian airlines, with the latter having a market share of around 36%. Dubai is the busiest route from India and Emirates is the leading foreign airline in the market.

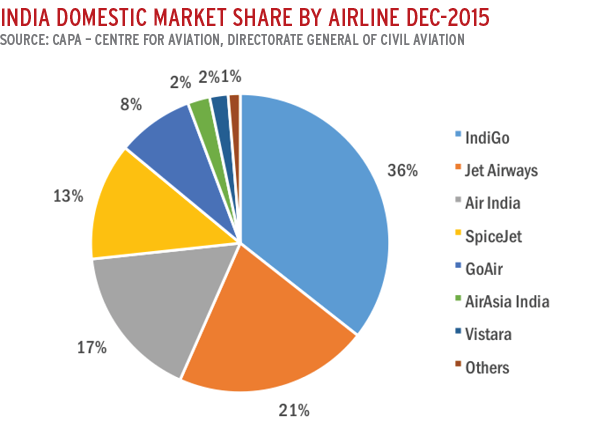

In 2015, IndiGo was the largest carrier in the domestic market with a passenger share of 35.6%, followed by Jet Airways at 21.0%. LCCs accounted for 59.0% of domestic traffic. The average load factor across the industry was 82.5%.

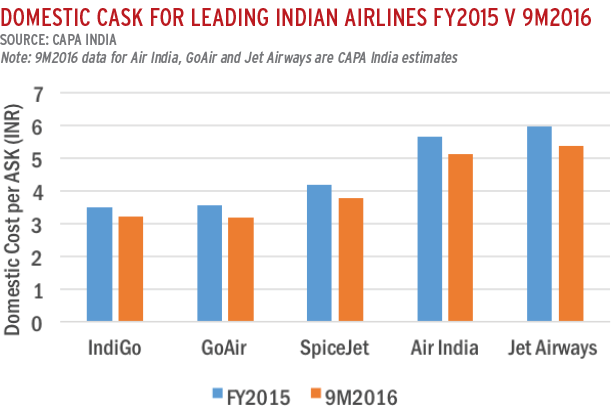

Over the past year traffic has grown ahead of capacity, which together with lower fuel prices has created a more favourable operating environment for airlines. Combined industry losses are expected to decline by more than 75% from USD1.3 billion in FY2015 to USD250-300 million in FY2016 (to 31-Mar-2016). The three leading LCCs, IndiGo, SpiceJet and GoAir, are expected to report a combined profit of USD340-375 million.

Jet Airways is expected to be the only profitable full service carrier and could announce full year net earnings in excess of USD100 million. Air India will, as always, be the major source of red ink at around USD600 million. Nevertheless, this will be its lowest net loss in several years, and the carrier is likely to post an operating profit, dragged down by its high interest burden. The newer airlines in the market, Air Costa, AirAsia India and Vistara, are expected to post combined losses of USD75-80 million.

Jet Airways is expected to be the only profitable full service carrier and could announce full year net earnings in excess of USD100 million. Air India will, as always, be the major source of red ink at around USD600 million. Nevertheless, this will be its lowest net loss in several years, and the carrier is likely to post an operating profit, dragged down by its high interest burden. The newer airlines in the market, Air Costa, AirAsia India and Vistara, are expected to post combined losses of USD75-80 million.

The improved performance is to be welcomed although it is largely the result of good fortune resulting from lower oil prices, rather than any substantial structural enhancement.

During the last year, India's airlines have received a total of USD750 million of equity, of which USD490 million was accounted for by government infusions into Air India. A further USD460 million of debt funding was raised, almost two-thirds of which was external commercial borrowing by Air India. Overall industry debt has declined slightly over the last year from USD12.6 billion to USD11.8 billion. More than 90% of this debt is accounted for by full service carriers.

The improvement in airline financial performance has been the key strategic highlight of the last year. This includes the dramatic turnaround at SpiceJet, an airline that was on the verge of closure in Dec-2014 but which has since posted four consecutive quarters of profit. In addition there have been visible financial and operational improvements at Jet Airways.

Meanwhile IndiGo, which has been India's most profitable airline in recent years, completed a highly successful listing in Nov-2015 and is on track to post a record profit of USD275-300 million in FY2016.

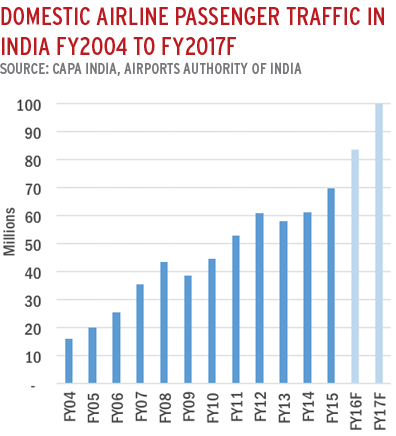

For FY2017 (to 31-Mar-2017), domestic traffic is again expected to grow at around 20%, which could push passenger numbers across the 100 million threshold. This would make the domestic market six times larger than it was in FY2004 when the most recent wave of liberalisation commenced. International traffic is expected to continue to expand at a steady growth rate of close to 10%, however it could rise faster if bilaterals are opened up and if the five year/20 aircraft rule is abolished.

For FY2017 (to 31-Mar-2017), domestic traffic is again expected to grow at around 20%, which could push passenger numbers across the 100 million threshold. This would make the domestic market six times larger than it was in FY2004 when the most recent wave of liberalisation commenced. International traffic is expected to continue to expand at a steady growth rate of close to 10%, however it could rise faster if bilaterals are opened up and if the five year/20 aircraft rule is abolished.

The four largest private airlines in the country, IndiGo, Jet Airways, SpiceJet and GoAir, are all expected to remain profitable in FY2017, however carriers will need to remain alert to potential downward pressure on yields as a result of expected rapid capacity increases. Other risks include the possibility of fuel prices rising, further depreciation of the INR and non-fuel costs increasing as a result of complacency arising in a low oil price environment. Airlines with appropriate liquidity may consider entering into fuel hedging contracts. Another challenge for full service carriers in particular is the muted growth in corporate travel, especially in business class. The robust headline economic growth figures do not appear to be translating into a strong desire among businesses to travel more actively.

The coming year is expected to see a significant acceleration in capacity deployment. Subject to the delivery of A320neos on schedule, Indian carriers could induct 50-60 aircraft in the 12 months to 31-Mar-2017, with more than half of these accounted for by IndiGo and GoAir.

Some of these deliveries will be used for modernisation rather than growth, for example GoAir could replace all 19 of its current aircraft to have an all neo fleet by the end of FY2017. Nevertheless, increased capacity could depress average yields by 5% or more.

Airlines are expected to seek up to USD1.4 billion of debt and equity funding in FY2017, of which half could be accounted for by Air India. Jet Airways could raise USD300-400 million via Etihad in the form of a quasi-debt instrument, SpiceJet is also likely to seek additional funding and GoAir is expected to launch an IPO.

Recent start-ups AirAsia India and Vistara are also likely to require additional funding. Timely recapitalisation will be key for airlines and delays could create challenges.

On international routes several airlines are consistently experiencing load factors in excess of 85%-90%, particularly during the peak third quarter, indicating that capacity is constrained. Several airlines including for example Air Arabia, Emirates, Cathay Pacific, flydubai, Qatar Airways, Singapore Airlines and Turkish Airlines have expressed interest in operating additional services and routes to India as and when increased entitlements are available. Some liberalisation may be possible over the coming months, but for those carriers that are most keen to increase access to the market the number of additional seats granted may be modest, at least in the short term, unless good cause can be demonstrated.

On international routes several airlines are consistently experiencing load factors in excess of 85%-90%, particularly during the peak third quarter, indicating that capacity is constrained. Several airlines including for example Air Arabia, Emirates, Cathay Pacific, flydubai, Qatar Airways, Singapore Airlines and Turkish Airlines have expressed interest in operating additional services and routes to India as and when increased entitlements are available. Some liberalisation may be possible over the coming months, but for those carriers that are most keen to increase access to the market the number of additional seats granted may be modest, at least in the short term, unless good cause can be demonstrated.

Indian airlines AirAsia India and Vistara are keen to launch international routes but are prevented from doing so by the restrictive regulation which requires that start-up airlines must operate domestic services for at least five years and reach a fleet size of 20 aircraft before they are permitted to operate overseas.

While the short and long term growth outlook in India is very positive, there are potential supply-side constraints which could curb the expansion of traffic. Key issues to be addressed include the availability of airport infrastructure, airspace and skills.

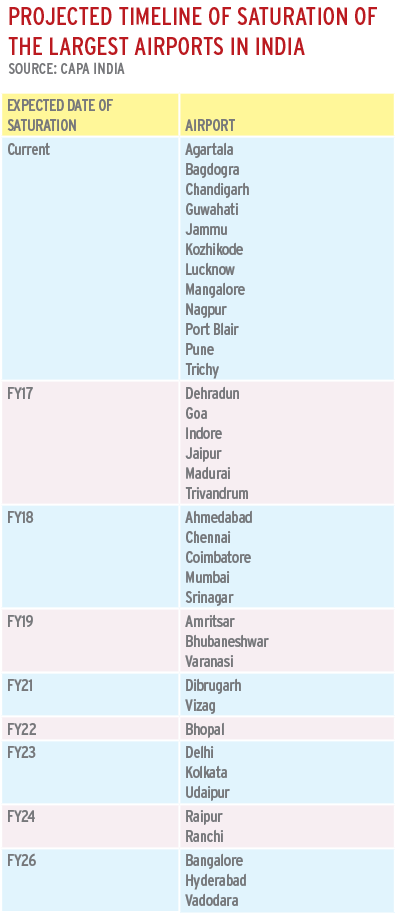

Two metro airports, Mumbai and Chennai are approaching saturation, while all six metro cities are expected to need second airports by FY2025. Even if all of the current airport sites in India are built out to their full design capacity and a second airport is opened in Mumbai, some 40% of unconstrained demand in India in FY2025 could be choked off in the absence of any new airports being developed.

The situation at non-metro airports is similarly challenging. Amongst the 30 largest non-metro airports operated by the Airports Authority of India, 40% are already estimated to be operating over their design capacities. Even allowing for the fact that airports may be able to stretch their operations to 20% above their official capacities (although this is not a given), virtually all of the remaining 60% of airports will reach their capacity thresholds within the next 10 years.

Several non-metro airports in key centres e.g. Goa, Jammu, Pune, Srinagar and Vizag operate as civil enclaves within defence facilities which places restrictions on their operations. This does not provide an environment that is conducive to growth.

Several non-metro airports in key centres e.g. Goa, Jammu, Pune, Srinagar and Vizag operate as civil enclaves within defence facilities which places restrictions on their operations. This does not provide an environment that is conducive to growth.

The economic repercussions of an airport capacity crunch would be extremely painful for India's economy. Tourists and business travellers would have to be turned away and Indian manufacturers would be unable to export their goods. To meet projected demand India will require almost 50 new airports to be constructed in the next 10-15 years with an investment of close to USD40 billion including access infrastructure.

Despite significant improvements in the management of India's airspace in recent years, a transformational action plan is needed - with a focus on expertise, resources and technology - but this is currently missing and long overdue. Corporatisation of air navigation services is necessary to create the appropriate enabling framework. Closer integration is also required between terminal and airspace capacity planning, rather than being done independently.

Otherwise India will increasingly face issues as in Chennai where the airside capacity is significantly less than the terminal capacity, making some of the investment that has been made in the latter redundant.

Availability of skilled resources is another potential choke point for India's growth. Retention of trained and qualified manpower is an industry-wide challenge and one that will become more acute given the projected growth rates.

Although the industry focus tends to be on the availability of pilots and engineers, the requirement is across the board, including management and administrative roles, as well as in-airport operations, commercial activities, retail, safety and security, air traffic management - essentially at all levels.

Meanwhile India continues to await the release of its new civil aviation policy. More than most countries, the intrusive role of government in India, with its overhang of protectionism, has been a massive commercial drag. The draft version of the policy released in late 2015 showed encouraging intent, but many aspects required greater detail to be able to assess the true impact.

India's aviation market clearly has strong underlying fundamentals and it is currently experiencing a positive external environment.

If policy and infrastructure issues can be addressed the market has the potential to be one of the world's key growth markets over the coming years. The onus now lies with the government to seize this opportunity.