More rational capacity management has continued after several years of imbalance

This is expected to continue, with Qantas cutting planned capacity growth in 2HFY2016 from 2% to between 0.5% and 1% citing weak demand and softening consumer confidence as Australia approaches a federal election in Jul-2016.

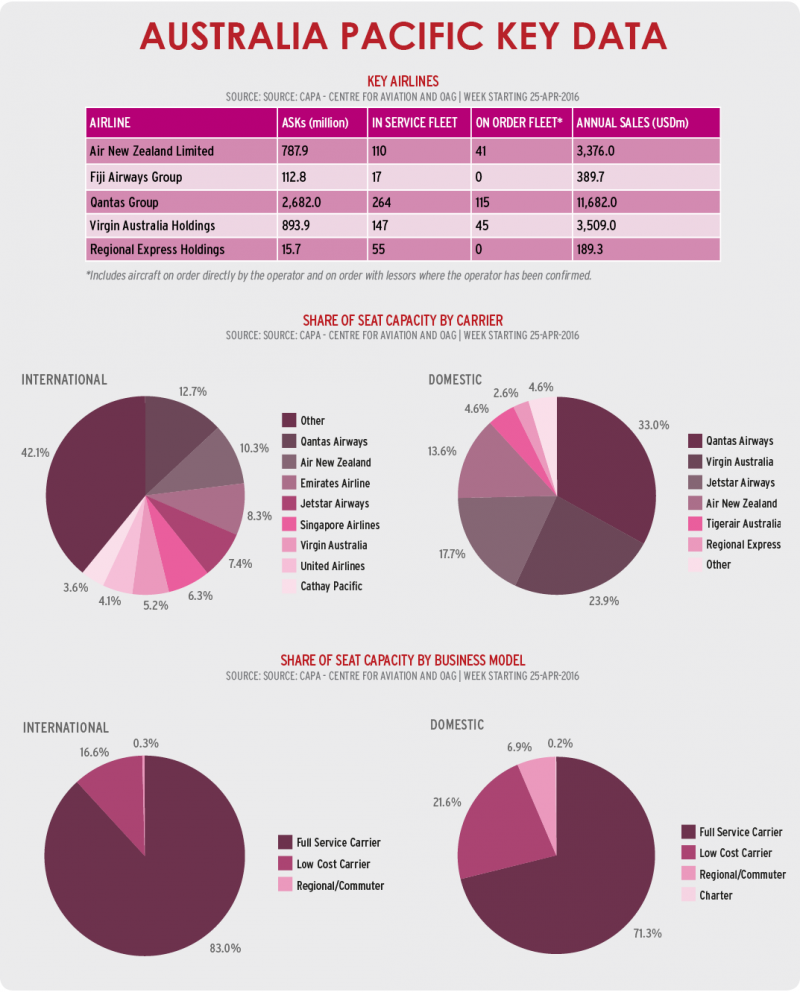

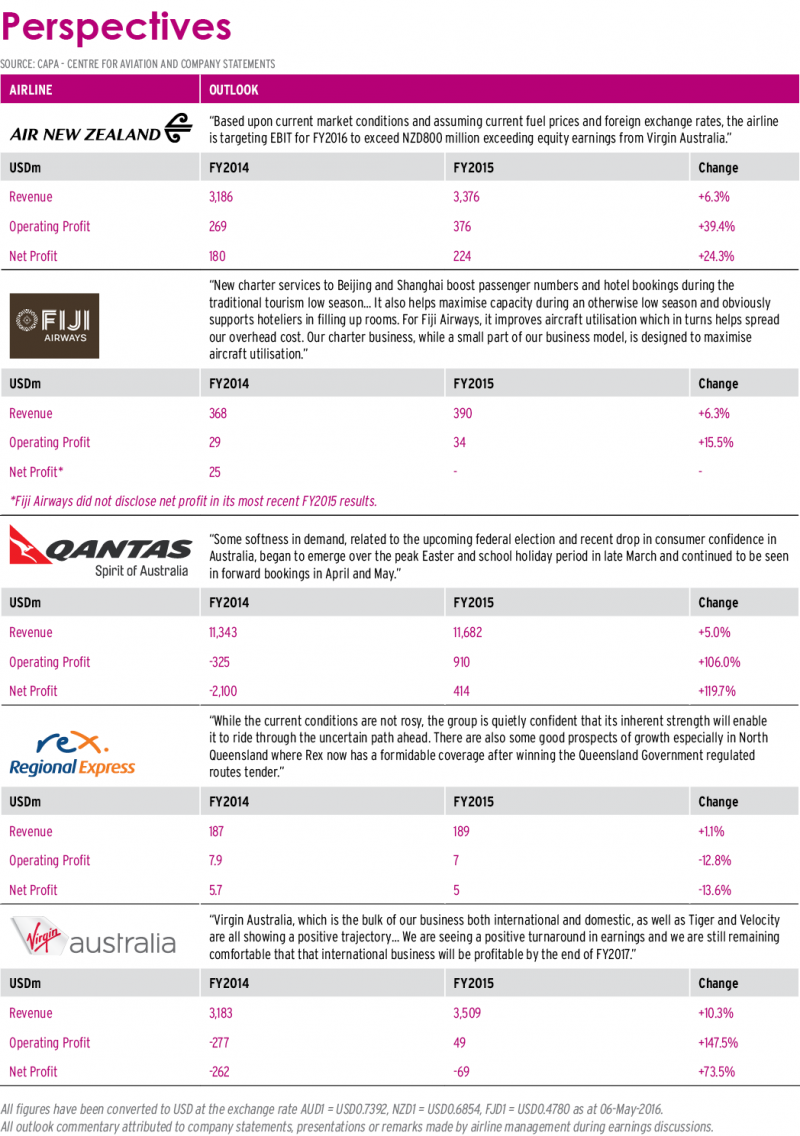

Qantas Group reported its best first half result in its history during 1HFY2016 (to 31-Dec-2015), reflecting its strong position following a tough but necessary restructuring over the last several years, with a net profit of almost USD500 million. The Australian flag carrier has achieved domestic CASK within <5% of Virgin Australia (although the former LCC Virgin disputes this figure), down from an almost 40% gap when Qantas established Jetstar in 2004. Jetstar Airways has also continued strong performance, with RASK growth of 10% and ancillary growth of 6% in 1HFY2016, alongside EBIT of USD189 million.

Virgin Australia has undertaken its own transformation, having moved from LCC to full service carrier, but continues to underperform despite a favourable operating environment with a USD45 million net profit in 1HFY2016. The downward trend of Virgin's cash balance also leaves an unlikely chance of further competitive clashes, either through additional capacity or product enhancements. Tigerair Australia is unlikely to expand, with Virgin either unwilling or unable to invest in expanding Tiger beyond its 14 A320s - excluding three Boeing 737-800s wet-leased for Indonesian operations.

Air New Zealand has continued a strong performance as it undertakes an ambitious long haul expansion - it will operate 15% more long haul flights in 2016 than a past recent high in 2005. This includes recent successful launches into Houston and Buenos Aires, with two new markets in Asia - Ho Chi Minh City and Manila - arriving in 2016. The carrier booked a USD223 million net profit in 1HFY2016, with healthy free cash flow, a solid balance sheet and a 7% CASK reduction over three years. Air New Zealand will further shore up its balance sheet with a planned disposal of its 25.9% stake in Virgin Australia which has required several capital injections (and may require more).

The full ramp-up of Jetstar's regional operations in New Zealand (Air New Zealand's core market, in which it has enjoyed a monopoly) during Feb-2016 has placed the operation "well ahead" of expectations with load factors and OTP reported at >80%, while New Zealand regional fares have fallen by 40%. Air New Zealand CEO Christopher Luxon noted Jetstar "hasn't impacted us as much" as expected, explaining: "We just have to keep the regional piece in a bit of perspective. From a domestic point of view, it is four aircraft versus Air New Zealand's 50 turboprops."

Fiji Airways has quietly expanded, with international ASKs up 35% year-on-year (y-o-y), largely through the addition of its first A330-300 and a new service to Singapore. A seasonal service to San Francisco will also come online during Jun-2016. The airline is increasingly also focusing on seasonal charter services into China - so far Beijing and Shanghai - as well as Taiwan to meet strong demand, though continued tropical weather activity - such as two cyclones so far in 2016 - provide a potential dampener for the year ahead.

Regional Express (Rex) has expanded significantly, with new operations in Western Australia and Queensland to 53 destinations (up from 36 year on year) and the additional of two new Saab 340B aircraft - but reported its first loss in its history with a USD8.2 million loss for 1HFY2016. But Rex's economics remain sound - the carrier reported increases in passengers, ASKs, its average fare and load factor as well as a rise in passenger revenue per ASK to AUD0.305, and while expecting a weak 2HFY2016 the carrier has weathered worse storms.