Europe: A good 2015, especially for the bigger airlines, with LCCs leading the way

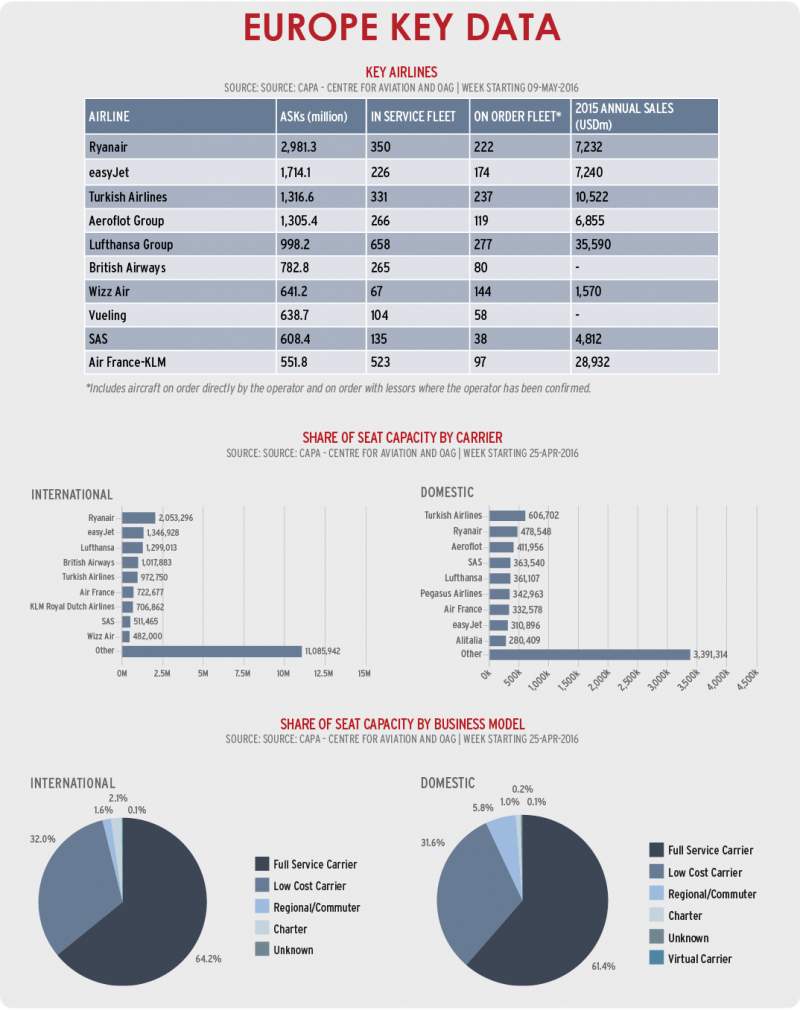

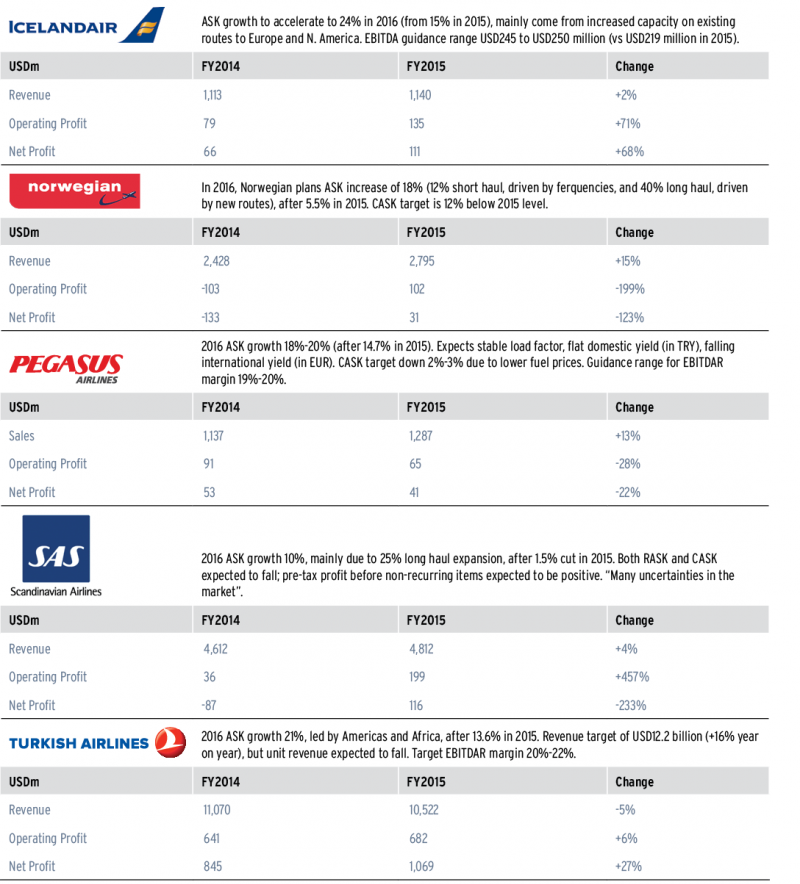

As with the other regions of the world, Europe's airlines had a good 2015. The aggregated operating profit of the 16 largest listed airline companies was one third higher than in 2015 (based on 12 groups that had already reported and analyst consensus forecasts for the remaining four). Their collective operating margin improved from 6.6% in 2014 to 9.7% in 2015.

However, IATA data suggest lower operating margins of 2.9% in 2014 and 5.3% in 2015 for European airlines as a whole. This is still a significant improvement, but the lower level of profitability for Europe overall than for the listed airline groups indicates that there is a large number of smaller, privately owned (often state owned) airlines making lower margins.

Lower fuel prices were a significant contributor to margin improvement in 2015 and this should again be a positive factor in 2016. European airlines generally have higher levels of fuel hedging than their counterparts in North America, where consolidation has helped to produce the highest airline operating margins of any world region. Low fuel hedging gave a more immediate further margin boost to North American airlines in 2015, while European airlines will enjoy greater year on year reductions in their fuel bills in 2016.

To some extent, the benefit of lower fuel prices is passed on to consumers in the form of lower fares, but most European airlines expect the net impact of these two factors to be beneficial to the bottom line in 2016. An important factor in this respect will be the balance of supply and demand.

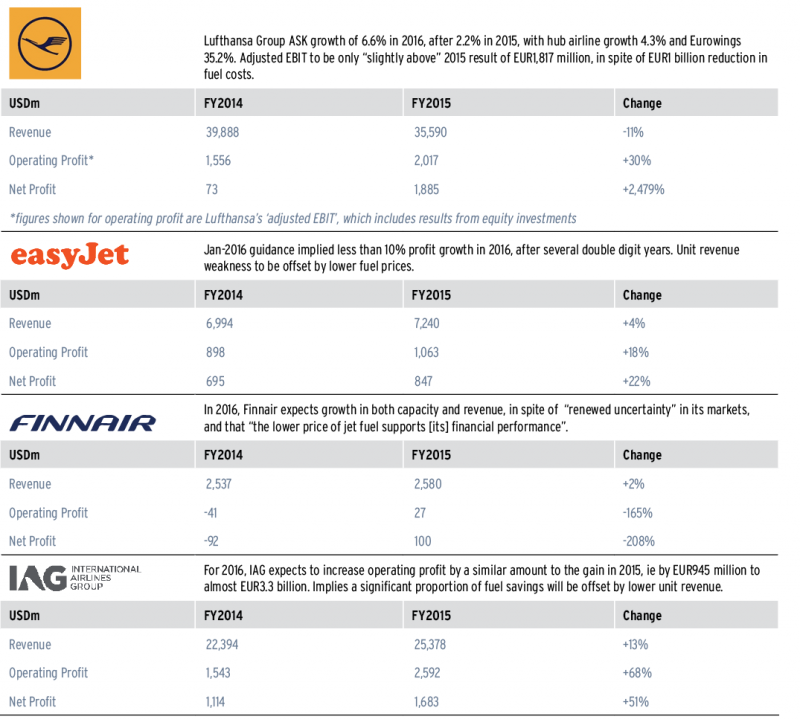

Data from OAG analysed by CAPA in Mar-2016 indicated that total seat growth from Europe is set to accelerate this summer to 8%, up from 6% in summer 2015. According to IATA, total RPK growth in Europe was 5.1% in 2015, faster than ASK growth of 3.9%. Europe's RPK growth in 2015 was higher than the 10 year average of 4.0%, in spite of unspectacular economic growth, possibly stimulated by lower yields.

In 2016, economic and geopolitical uncertainties are certainly not decreasing, so there must be at least some risk that traffic growth may slow a little. Even if Europe maintains the same 5.1% growth rate in 2016 as in 2015, this is lower than seat supply growth projected for summer 2016, which suggests that unit revenue is likely to fall once again. The positive impact of lower fuel prices will offset this, but only provided that there is not a more significant weakening of economic growth.

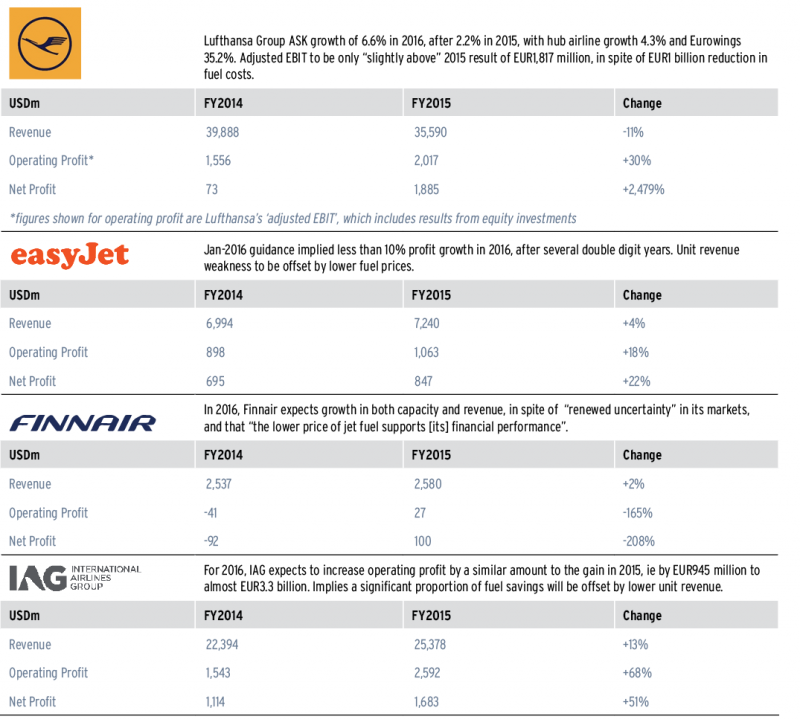

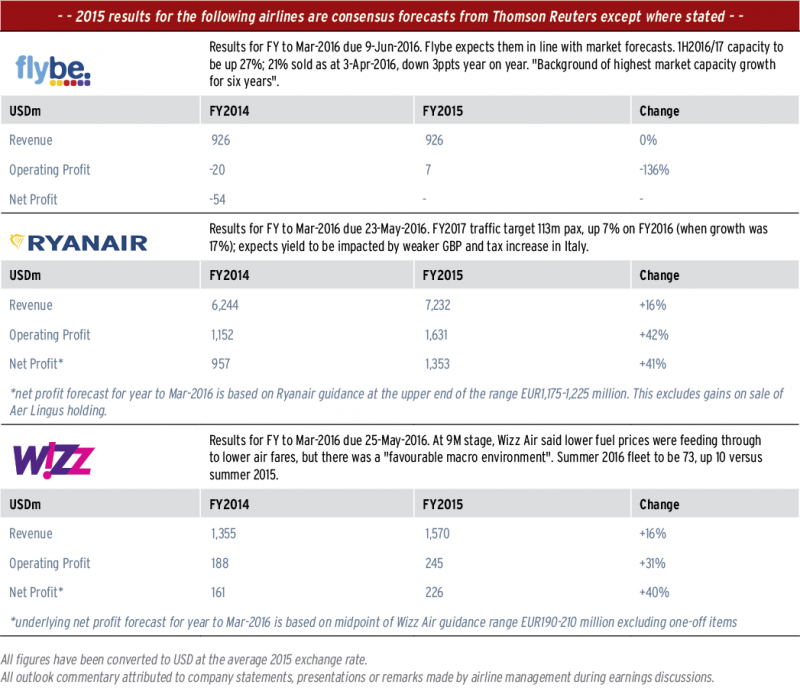

In 2015, Europe's three most profitable airlines, in terms of operating margins, were Ryanair, Wizz Air and easyJet, all of which are LCCs. Icelandair and Aeroflot were the highest margin FSCs, followed by IAG, which continued to be the most profitable of Europe's big three legacy groups. Among the listed companies, only airberlin was loss making in 2015, although 2015 margins for Finnair (reported) and Flybe (forecast) are only around 1%.

In 2016, all European airlines should enjoy a further improvement in margins, subject to the caveat that the macroeconomic and geopolitical backdrops do not produce an unexpected demand weakening. The operating margin rankings will probably retain a similar order to that of 2015, with pan European LCCs leading once again.