Latin America: Brazil’s economy casts a pall over the region

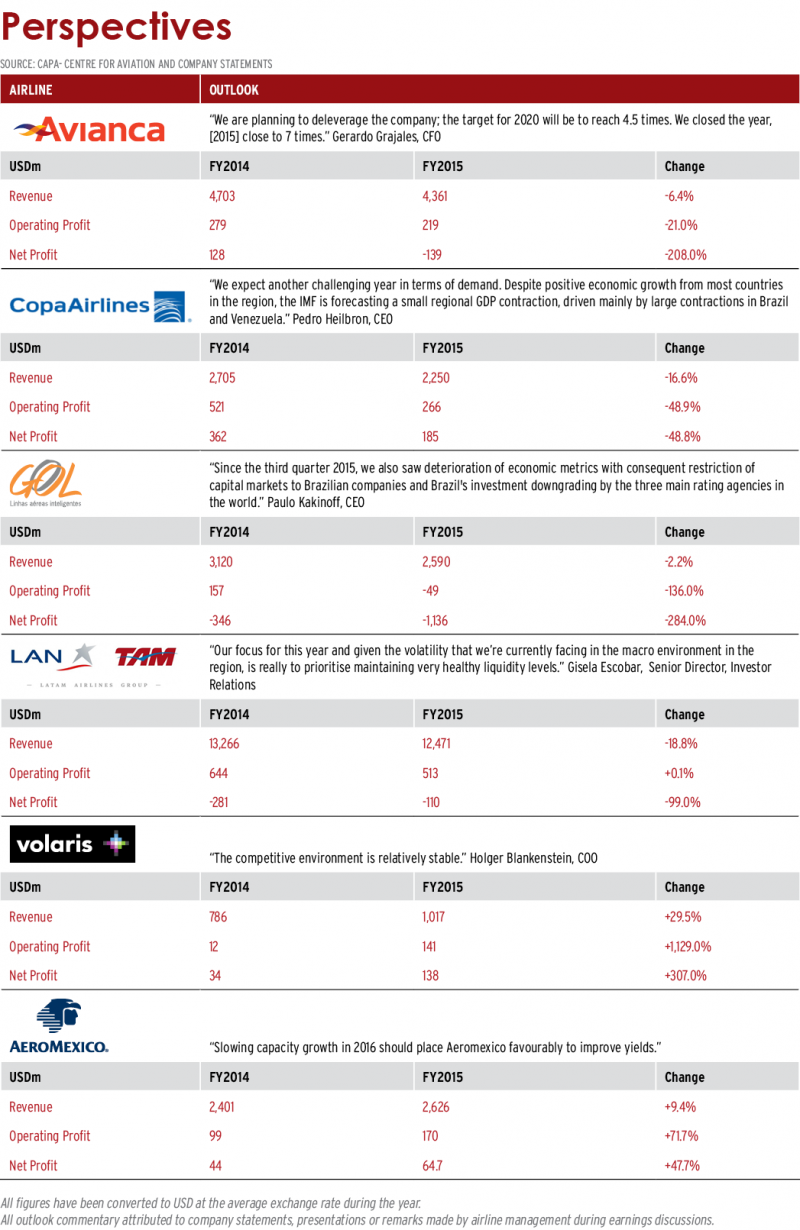

Many airlines in Latin America are suffering from the effects of a recession in the largest market, Brazil, that is driving overall economic weakness in South America - although Pacific coast markets are performing better.

Weaker economies in several South American countries and deep currency devaluations are battering the financial results of publicly traded airlines in the region, and markedly improved fortunes are not likely in 2016.

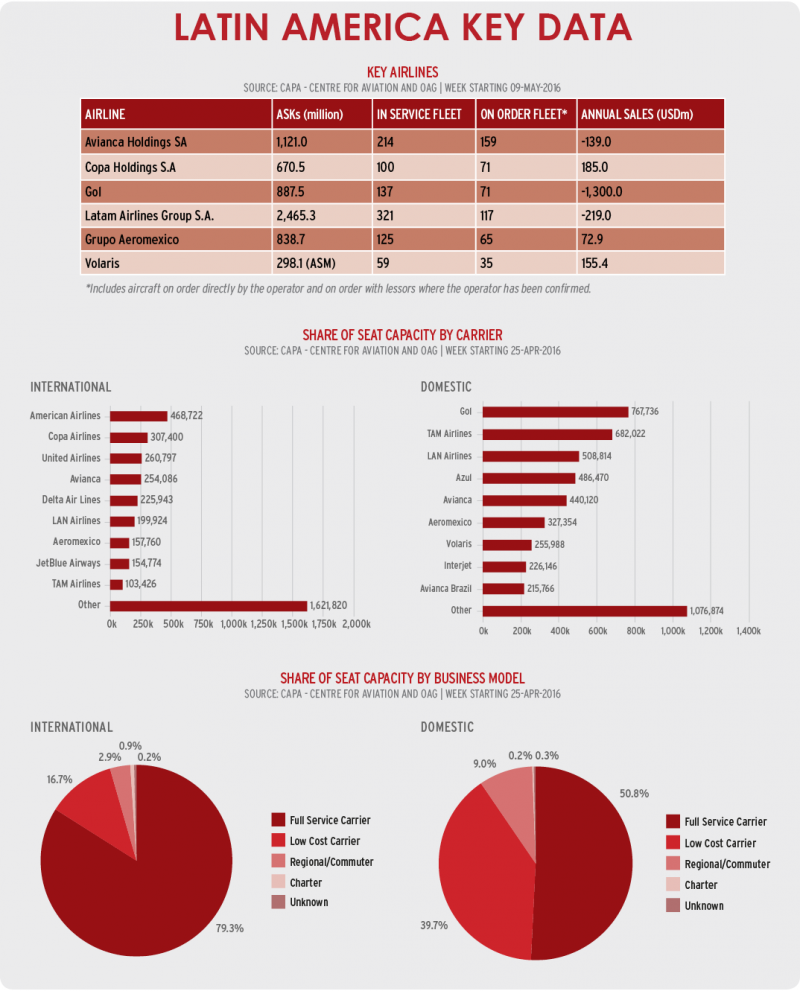

Airlines operating to and within Brazil are taking all the necessary measures to adjust to the country's second consecutive year of economic contraction in 2016. Avianca, LATAM, Gol and Copa are working to reduce their respective fleets to combat diminished pricing and demand. As a result of Brazil's weak economy Gol has endured credit downgrades, and credit markets are closed to any Brazilian company. The airline is working with two advisory firms to examine ways to maximise its capital structure and review its aircraft lease obligations under existing contracts.

LATAM has reduced its capital fleet commitments by USD4.8 billion for the period spanning 2016 to 2018, and has outlined specific liquidity targets as drastic economic weakness lingers in the airline group's largest domestic market. The company plans to maintain liquidity levels between USD1.4 billion and USD1.5 billion. Avianca, meanwhile, has declared its intent to reduce capital expenditures by 50% on 2016.

Both TAM and Gol, Brazil's two largest airlines, project deep capacity cuts in the country during 2016. TAM plans to slash its Brazilian domestic capacity by 8% to 10% in 2016, which is deeper than original projections of a 6% to 9% reduction. Gol, largely a domestic operator, is cutting ASK growth by 5% to 8% in 2016.

In early 2016, Copa Airlines estimated its capacity to Brazil had fallen 30% year-on-year. At that time most of the capacity was idle as the airline was working to redeploy it into other markets. On a system wide basis Copa plans to expand capacity by 3% in 2016. Most of the growth is driven by the full year effects of new route additions and upgauging some routes from Embraer E190s to Boeing 737-800s.

LATAM's system wide capacity range for 2016 is a drop of 1% to growth of 2%, with an operating margin of 4.5% to 6.5% after posting a 5.1% margin in 2015. Avianca is forecasting capacity expansion of 3% to 5% in 2016 with an EBIT margin of 5% to 7%.

Prospects for Mexico's airlines are more promising in 2016. The country's two publicly traded airlines, Aeromexico and Volaris, believe demand is holding up reasonably well, and are encouraged by Mexico's economic growth forecast for 2016. However, Aeromexico has cited some uneven demand across different business segments, and those airlines face some challenges during 2016 in navigating Mexico's falling currency.

Airlines with a higher network concentration in South America are taking the proper steps to withstand some of the toughest economic conditions they have faced in decades. At this point, none of those companies are projecting a recovery in the near future, leaving them to keep close tabs on capacity growth, work to defer aircraft deliveries and ensure their balance sheets are strong enough to weather what appears to be prolonged economic weakness.