Middle East is aviation’s most diverse market

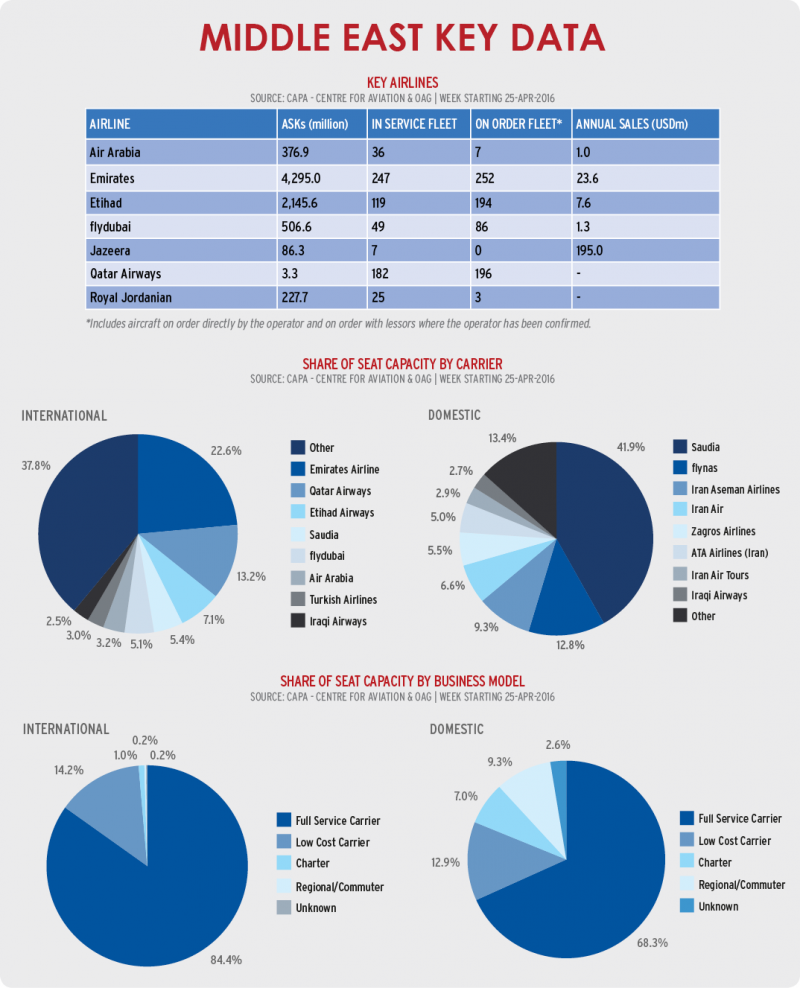

Despite being a relatively compact geographic area, the Middle East is aviation's most diverse market. The region is home to three airlines - Emirates, Qatar and Etihad - that link traffic from all parts of the world but also makes them disruptors and opposed by many competitors.

Protectionism is a key worry from them, emanating not just from those on other continents but closer to home too as Royal Jordanian cites its neighbours as a challenge. Royal Jordanian, a oneworld member, is one of the smaller flag airlines, along with Gulf Air and Kuwait Airways, which are looking to define their role. Point to point traffic is limited but a play at connecting traffic can be tempting. Oman Air, much smaller and ostensibly a boutique airline focused on the Omani market, has high and growing transfer traffic. One of the region's largest airlines is Saudia, which focuses on the very large Saudi market but in the future could look more at the transit segment.

Then there are the regional airlines - Air Arabia, flydubai, Jazeera - that are a blend of LCC/hybrid/boutique models. They rely on intra-regional traffic, which is relatively stable in demand but under yield pressure as competition grows. They also serve more obscure points, which can be handsomely profitable but have a degree of aeropolitical uncertainty. Nearly every airline in the region waits for the day Indian traffic will further open to them, either for local or transit opportunities. Etihad went to the extent of acquiring a share in Jet Airways to support its Indian presence.

IATA expects Middle East airlines overall to underperform European airlines financially; the latter are the strongest group outside their North American peers that are multiples ahead. A growing concern is capacity outpacing demand. Feb-2016 was the sixth consecutive month where this occurred. RPKs exceeded ASKs for all but one of the first nine months of 2014. In the following 17 months, from Oct-2014 to Feb-2016, RPKs were ahead of ASKs in all but two months (Jul-2015 and Aug-2015). Since then, in the 20 months between Jul-2014 and Feb-2016, load factors have decreased for 16 of those months, including the six consecutive months since Sep-2015. It is difficult to break this down; monthly performance results are scarce in the region. Emirates is largely continuing on its growth trajectory while Qatar is accelerating, adding almost as many ASKs as Emirates in 2016. Etihad is in a slow phase of expansion as it looks to bed down growth and investment airlines.

The three Gulf airlines are the most globally visible, but the aggregate IATA Middle East figure is shaped by other airlines in the region. Strategic route launches with poor performance could be dragging down strong performance elsewhere on the network. When viewing network performance as a total, a few poor performers can drag the average down significantly. Yet from the perspective of governments, which typically guide the region's airlines, a long term focus remains supporting aviation's growth engine.