North America: bad news and good news: yields chase lower fuel prices down

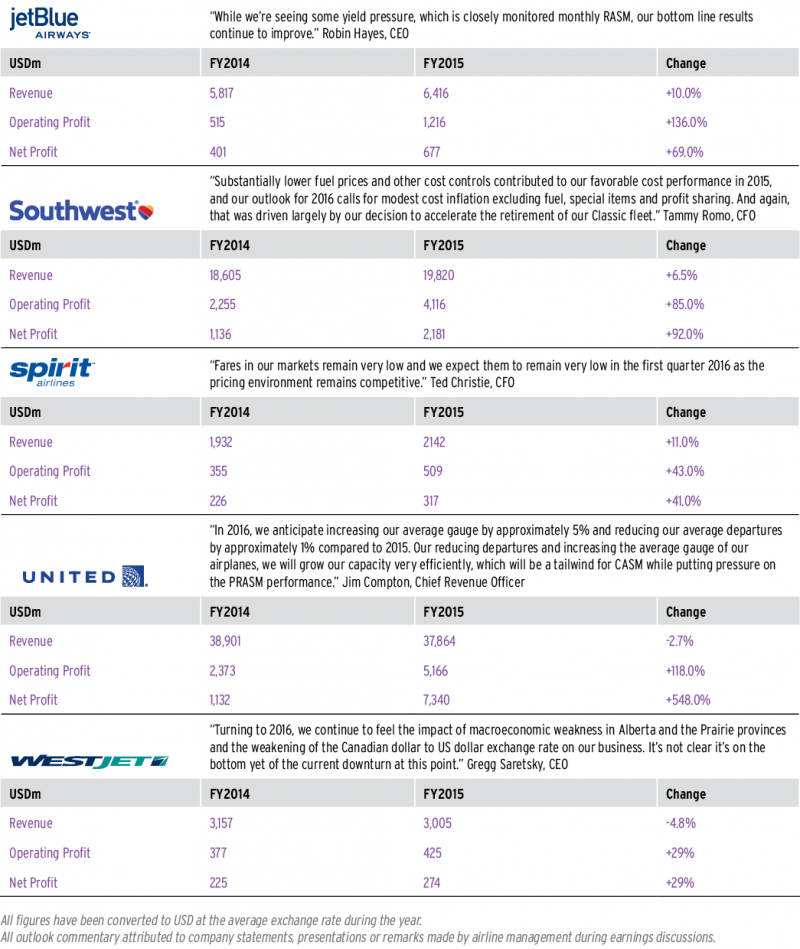

A continued reprieve from higher fuel costs should again yield healthy profits for North American airlines during 2016.

But investors seem to be looking for signs of a rebound in pricing in the Canadian and US domestic markets, which has been one factor driving negative unit revenue performance for most of the region's airlines during the last year. An inability by airlines to restore their positive unit revenue growth also pressured stock valuations of many of those companies in 2015.

Most US airlines feel positive about levels of demand in early 2016, but yields remain soft as lower fuel prices allow for lower pricing on marginal capacity. US airlines offering intercontinental networks also feel reasonably confident about demand, and during 2016 those companies will start to lap the pressure on unit revenues created by lower fuel surcharges on long haul flights, and currency challenges spurred by the appreciation of the USD against most global currencies.

Airlines with a higher level of route exposure to areas reliant on the oil and gas sector are also working to mitigate the effects on changes in demand as those economies feel the impact on their business segment. During 2016, United Airlines is shifting capacity from its hub at Houston Intercontinental to hubs in San Francisco and Denver. Originally, the airline planned 2% capacity expansion from Houston, but did not forecast flat growth.

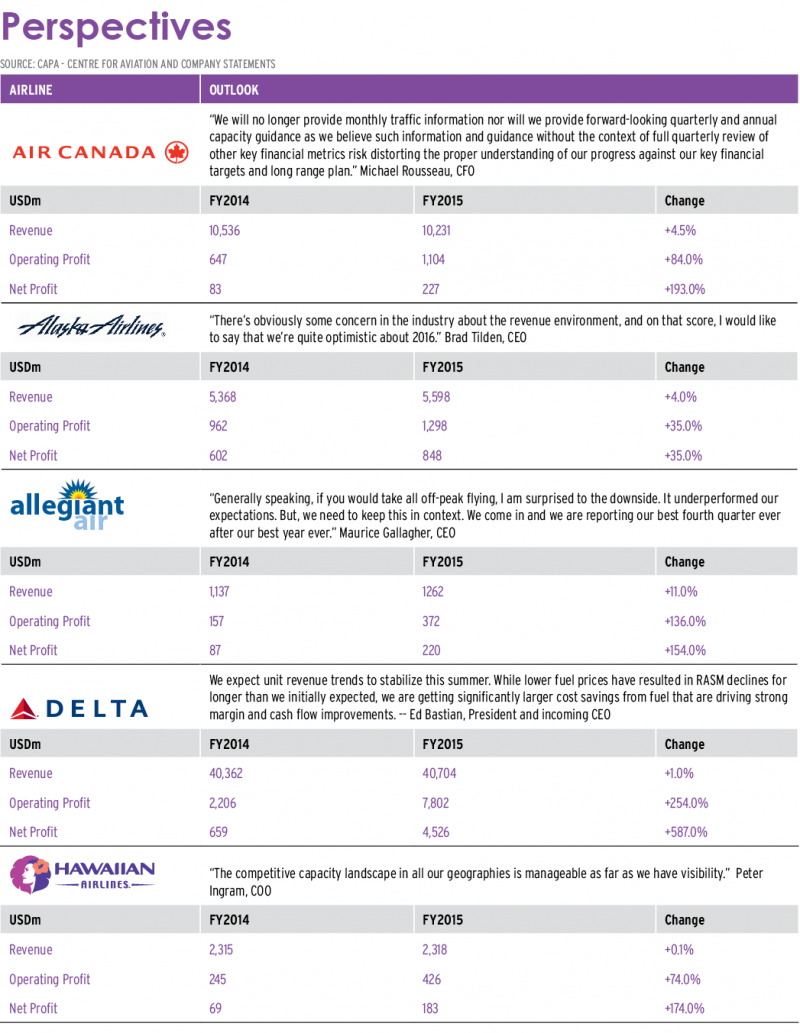

Canada's second largest airline WestJet has warned its unit revenues will plummet 7% to 10% in 1Q2016, driven by weak conditions in the oil dependent western province of Alberta, home to the airline's headquarters of Calgary. WestJet plans to cut its capacity in Alberta by 5% in 3Q2016. The company has revised its 2016 capacity targets downward to a still healthy increase of 7% to 10%.

WestJet's rival Air Canada cut some capacity in western Canada during 2015, and similar to last year, plans to direct the bulk of its capacity growth in 2016 to international markets. However, the airline has stopped providing capacity guidance, and instead aims to offer investors updates on how it is benchmarking against its stated ROIC and EBIDTAR margin targets.

Few US airlines are opting to definitively state when there passenger unit revenue or total unit revenue will reach a flat or positive trajectory. But Delta and United are hoping for some positive momentum by YE2016. Delta originally believed it could reach flat to positive passenger unit revenue growth by YE2015.

Although Air Canada is the only North American airline to have opted not to offer unit revenue guidance going forward, most of those companies during the last year have tried to talk down the metric's importance. Delta is the only airline to step forward and acknowledge the importance of regaining lost ground in its unit revenue performance.

Underlying the strong top line profits North American airlines are expected to achieve in 2016 is that there exists a lingering choppiness in revenues that is sustaining investor uneasiness. For now, most airlines in the region are sticking to current capacity growth targets for 2016; however if demand conditions take a turn for the worse, those airlines may need to revisit their growth targets.