Southeast Asia: A dismal 2014 was followed by a much better 2016

Southeast Asian airlines experienced a significant improvement in profitability in 2015 as fuel prices dropped and market conditions became more favourable after a dismal 2014. However, Southeast Asia's airline sector continues to underperform compared to other regions in Asia Pacific and particularly to Europe and North America.

The Southeast Asian airline sector had been unprofitable in 2014 following several years in the black. Market conditions were extremely challenging in 2014 as capacity growth continued at a rapid clip despite slumping demand. Airlines were impacted in 2014 by overcapacity along with weaker economic growth and political instability in some of Southeast Asia's largest markets.

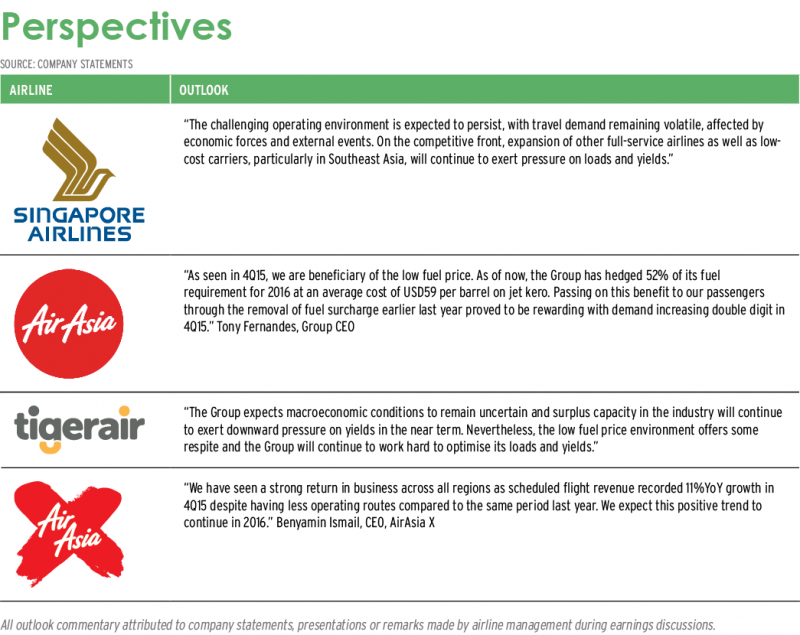

Market conditions remained relatively challenging in 2015 but more positive than 2014, with further improvements expected for 2016. Slower capacity growth has led to a more rational environment as LCCs adjusted their rate of fleet growth and some of the main flag carriers embarked on restructuring initiatives. Lower fuel prices have also clearly helped but this benefit has been offset by local currency devaluation and hedging.

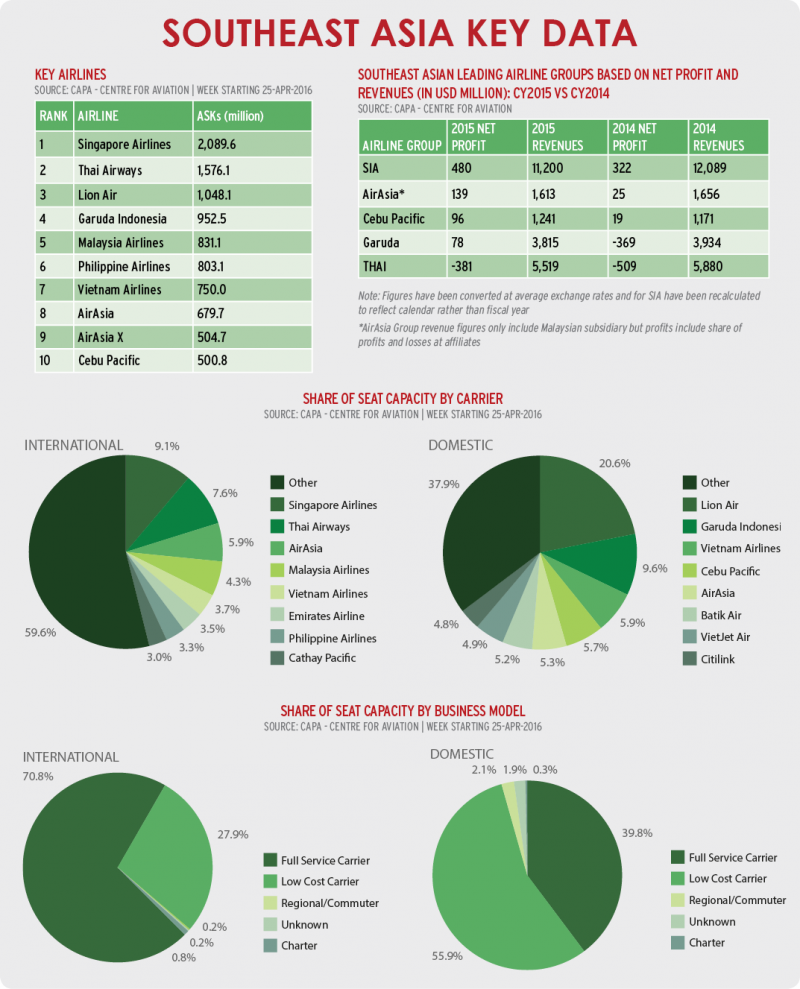

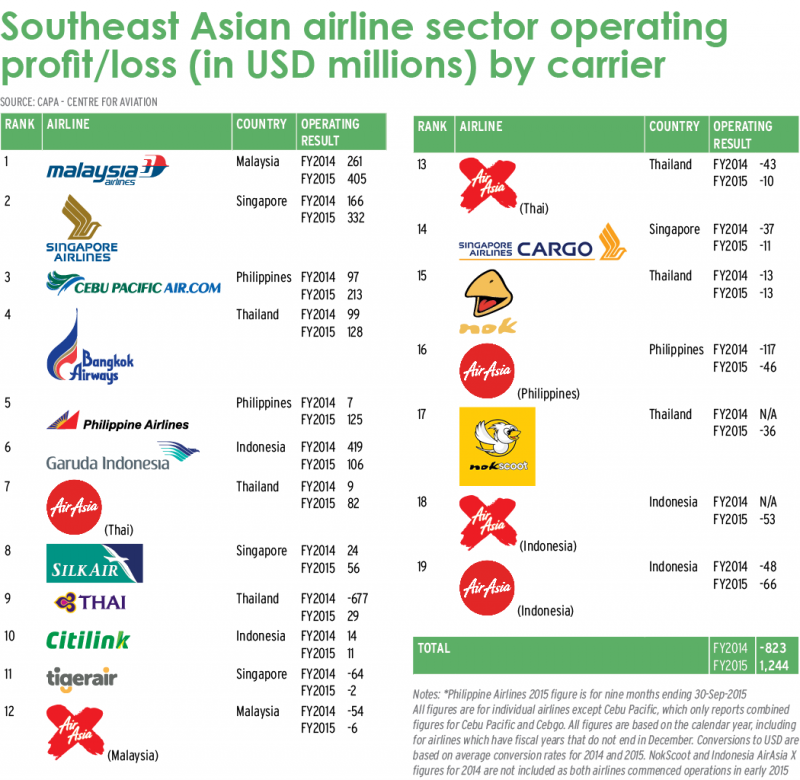

A sampling of 19 publicly traded Southeast Asian airlines or affiliates combined generated an operating profit of over USD1 billion in 2015. There was an approximately USD2 billion swing compared to the 2014, a clear indication that conditions have improved. All but two of these airlines recorded a year over year improvement in profitability.

Despite the tailwinds nine, or nearly half, of the 19 airlines in the above sampling remained unprofitable in 2015, including eight LCCs and the one cargo airline. Intense competition and overcapacity continues to impact Southeast Asia's LCC sector while cargo demand remains sluggish. (See chart on page 30)

AirAsia particularly had a challenging 2015 with five of the seven AirAsia or AirAsia X branded airlines based in Southeast Asia incurring losses. There are currently 23 LCCs in Southeast Asia with as many as six competing head to head in some markets.

Only approximately one third of Southeast Asia's LCC were profitable in 2015 - although this represents an improvement compared to the roughly 20% of LCCs that were profitable in 2014. Citilink, Jetstar Asia and Jetstar Pacific all swung from losses in 2014 to profits in 2015. (Jetstar Asia and Jetstar Pacific are not included in the sampling because exact figures have not been reported. Scoot, which was roughly break even in 2015, is excluded from the sampling as the Singapore Airlines long-haul LCC only began financial disclosures in the quarter beginning 01-Apr-2015.)

Most of Southeast Asia's main full service airlines are now profitable but margins are still lower than a few years ago. Of Southeast Asia's six main flag carriers only Malaysia Airlines, which underwent a major restructuring, was unprofitable in 2015 (Malaysia Airlines is not included in the sampling because it stopped releasing financial results after delisting in late 2014).

Thai Airways, which implemented a much smaller restructuring in 2015, posted a small operating profit at the airline level (a loss was reported at the group level). Garuda Indonesia swung back to profitability while Philippine Airlines reported a large jump in profits following a small profit in 2014 and a large loss in 2013. SIA the parent airline and Vietnam Airlines both roughly doubled their profits compared to 2014. (Vietnam Airlines is not included in the sampling because the airline has not made any formal financial disclosures despite completing an initial public offering in early 2015.)

Of the airline groups SIA was by far the most profitable. SIA is also by far the largest Southeast Asian airline group based on revenues.

Independent regional airline Bangkok Airways was also in the black in 2015 and had one of the highest operating margins in the Southeast Asian airline sector. However most of Southeast Asia's second tier full service airlines, including flag carriers from smaller markets, remain unprofitable.

Overall the Southeast Asian airline sector remains less profitable than most other regions. Southeast Asia's airline sector accounted for less than 20% of total Asia Pacific airline profits in 2016 and only 2% of global profits. However the region accounts for approximately 25% of seat capacity in Asia Pacific and 5% of global capacity.

Southeast Asia's airline sector needs higher profit margins and a much larger number of profitable airlines. Otherwise the region's huge order book could be in jeopardy.

'

'