The world’s top 20 international airports in 2025 will mostly reflect hub connectivity expansion

There is a variety of factors that will influence the evolution of international airport leaders over the next decade.

Inevitably, given the nexus between economic growth and airline activity, the global economy will play a major part in defining the overall outcome.

But to project which specific airports will grow over that period requires an overlay of other elements, partly derived from local influences, partly from regional and global developments.

Thus, for example the rise of the Gulf hubs over the past two decades has resulted from a combination of factors: aircraft technology, allowing long haul connectivity; supportive government strategies, generating a climate in which traffic growth can thrive; and a more liberal global access regime.

There are many other factors in the mix, but it is reasonable to assume that the future airport leaders in international market growth will be those that accentuate transfer traffic.

The main determinants of airport hub growth

|

Global and local economic development

Overall air travel growth correlates with economic expansion; but local/national GDP fluctuations generally have a larger impact on traffic at individual airports. In countries where there is significant end-to-end traffic, this helps underwrite connecting frequencies, in turn influencing international throughput. |

Aircraft range and characteristics

Ultra long haul aircraft have reshaped how hub systems work in some markets. And, against this trend, a new breed of smaller ("hub bypass") long haul aircraft (eg Boeing 787s, A350s, A330s) is also helping new airlines and city pairs become prominent. For the time being there are not sufficient of the aircraft types in operation to make major inroads, but a combination of hub congestion and business travel convenience is supporting establishment of new routes. |

|

Economic regulation, global and bilateral

Liberalisation of market access has done much to change the shape and availability of air travel. It has also allowed a shift away from the older hubs, allowing new airports to grow faster. It may be however that we have passed the zenith of liberal times. |

Environmental impact

Environmental concerns are limiting airport development, notably in Europe. Indecision and consumer objections increasingly prevent new airports and airport expansion. On short haul international routes in Europe, the role of high speed rail is increasing. The impact of China's HSR is mostly domestic, but can help feed international hubs. |

|

Geography

Geographic positioning has always been an important determinant of a hub airport's effectiveness. As aircraft technology has changed, so the profile of geography has evolved. |

Airport ownership and investment

In many countries, funding of infrastructure is problematic. The US in particular, where private funding is limited to airlines owning their own terminal, is lagging dramatically in airport development. |

|

A national airline

Having a strong national airline based at the hub has typically been a vital characteristic. That this was due to the protective nature of bilateral aviation regulation means that this may be changing - for example in the EU, where foreign airlines are able to establish across borders, or in Asia, where cross border JVs achieve a similar change. |

Local demographics

Substantial origin and/or destination traffic provides a sound foundation for transfer traffic operations over a hub, given a sound geographic position. |

|

Global alliance presence

The established hubs tend to have a major member of a global alliance present, so that other members converge on it. This is more a case of chicken and egg though, as it was often the largest, established airlines which formed the core of the alliances. Clearly the Gulf carriers have changed the nature of global networks, so that the alliances have only minimal presence at their hubs (even though their open skies regimes allow foreign operations freely. |

Political stability, local and regional

Predictable government and a secure airport environment are a more recent predictor of successful hub operation, but sadly appear likely to become more relevant in future. |

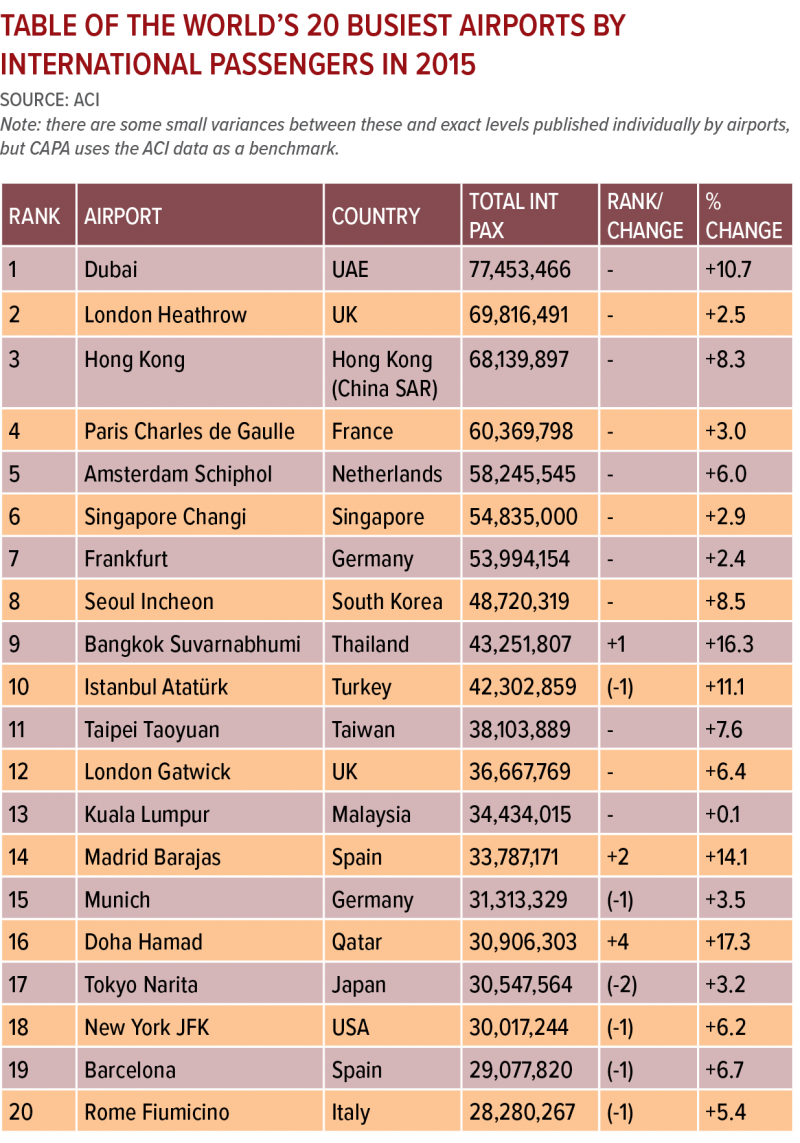

There has been little movement in the rankings of the world's busiest international passenger airports in recent years. While there has been a discernible shift towards the east in the overall airport rankings, the biggest percentage gainer in terms of airports ranked by international passengers has been Qatar's Doha Airport, part of the Gulf carrier expansion phenomenon.

However, compared with 20 years previously, airports in the Middle East and Asia Pacific have now established themselves in the rankings. Dubai has occupied the #1 spot for a second year in 2015 and a group of Asia Pacific airports represented through to 17th place.

Naturally there is a contrast between domestic and international airport size, even where there has been substantial local expansion. For example, Beijing, world's second busiest airport overall, does not appear in the table and the only representative from the US is New York's JFK International Airport, despite the fact that Atlanta is the world's busiest airport overall; 87% of Atlanta's seat capacity is domestic.

The intriguing question though is not what sort of short term changes to the table can be expected but rather what the longer term ones might be, and why. What will the picture be like in 2025?

20 years is often the maximum period for which an airport will even attempt to forecast because so many of these variables are so unpredictable. Even a 10 year period allows for the unanticipated introduction of variables. Thus, in addition to the relatively exhaustive listing of influential features, matters such natural events and pandemics impact airport planning.

There are short and long term influencers. For example the US economic recovery gave a boost to airports such as New York JFK in 2015, even if it did not improve its ranking. On the other hand the US is beset by problems of congestion and under-investment, constraining infrastructure growth.

In a small number of countries, airports are being built which will replace the existing leaders. For example the new Istanbul Grand Airport is likely to have superseded the main Istanbul Atatürk long before 2025. It is intended to host 200 million passengers p/a eventually. Istanbul Grand will slow or displace the expansion of the city's other airport, Sabiha Gokcen Airport, accelerating its own role as a super-connector.

A new airport for Mexico City is under construction, with ultimate capacity of 125 million ppa, 24 million more than Atlanta handled in 2015. Both of these airports have a large focus on transfer traffic and are replacing airports that are currently at capacity - the implication being that they are likely to expand faster than others, all other things being equal.

New, supplementary, airports are being constructed elsewhere in cities that will probably feature in the table before long, such as Beijing (Daxing) and Chengdu, as international business and leisure travel to/from China starts to grow again. Supported by farsighted construction, the sheer size of China's various domestic markets prompts synergistic growth of international operations. In Dubai more use of being made of Al Maktoum Airport but when and whether or not it will take over from Dubai International is not clear. Depending on its timing, on current growth trajectories, it should become established as global front runner.

No European hub airport is increasing in global importance. It is evident that while the European airports are growing, apart from Istanbul (which is on the Europe-Asia boundary) airports in the Middle East and Asia Pacific are growing more substantially; only Madrid is actually moving up the earlier table (+2 places). The European continent has its own economic problems, it is no longer the world's natural aviation hub and politically it faces the prospect of breaking up, led by Britain's exit from the EU following the referendum on 23-Jun-2016.

While there will always be international travel to/from Europe for both business and leisure reasons it appears as if that hub role will continue to diminish over time. Moreover, there are political issues preventing the addition of runways, the prime examples being at London and Munich.

And it is not only within Europe that runway infrastructure has a controlling say in future growth patterns. Hong Kong for example, where the international passenger increase was 8.3% in 2015, like Heathrow, needs a new runway; there is strong opposition in both places, although Hong Kong has at least gone through a process which might end in going ahead.

There is a crossover between the ideal size for an airport. But it depends on the ingredients of a particular airport. There is no template for determining how big an airport can get before its operations become impractical. This has not really been tested yet. Atlanta's 100 million passengers p/a travel mainly on Delta, concentrating the control more narrowly. An airport handling 125 or 200 million ppa on a range of airlines, many of them international is a different proposition; and operating more than six runways can pose organisational problems of its own.

Another question, as the industry evolves, is whether or not the existing hub and spoke system and the three branded global alliances (BGAs) will continue to prevail or whether the more recent practice of ad hoc, often promiscuous alliances, often involving smaller airlines that were previously 'unaligned,' will influence passengers towards hub by-passing (which will adversely affect the established hubs in Europe more than their counterparts elsewhere). The growing importance of selective partnerships is a theme of this series of reports, but in many cases they continue to operate in parallel with the BGAs. The underlying causes of limited and artificial cross border relationships are in the archaic bilateral system and its essentially mercantilistic restrictions; as these evolve, the need for and shape of international partnerships changes.

Interacting with this is the performance of the new aircraft types that enable these hub by-passing operations such as the now established Boeing 787, the newer A350 and the Boeing 777x.

Even the Airports Commission in the UK, which spent GBP25 million over three years trying to establish whether an additional runway should be built at London Heathrow or Gatwick airports, or somewhere else, or not at all, stopped short of predicting future major alliance trends. It admitted in its final report that it could not be certain that its assumptions about the survival and continuation of the formal airline alliances and their hub and spoke systems were accurate.

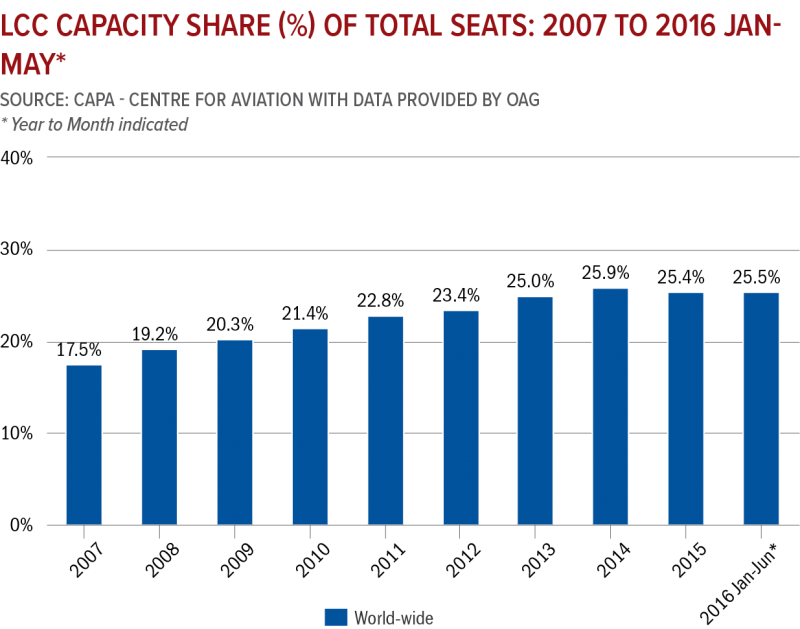

ACI Europe however reported in Jun-2016 that most of the growth in air connectivity in Europe in 2016 is happening at smaller hubs and other mid-sized airports. The continued rise of LCCs and point to point services and the relative retrenchment of legacy carriers and hub and spoke services has led to an unusually strong increase in direct connectivity.

Meanwhile, very large airports - and especially the major hubs - are experiencing a decrease in both their total air connectivity levels (direct and indirect connectivity) and hub connectivity levels. These developments are pointing to a rebalancing in connectivity between the different segments of the airport industry, which is indicative of increasing airport competition, as evidenced for example by the increase not only of savvy 'self-connection' passengers (who purchase two separate tickets that are cheaper than a through ticket and make their own transfer at an airport) but also of airport provision for that activity.

If that trend were to be repeated worldwide it would have at the least a limited impact on the primary and hub airports within the decade timescale of this report.

The future for long haul low cost is becoming easier to assess. With the rise of this form of new entry comes questions of the scale of its growth and whether its likely historic propensity in some (not all) regions to avoid primary airports will continue. If the short haul industry segment leader globally is Ryanair then others might follow its decision to open more bases at primary airports and grow route networks there. Or they might not.

In the long haul arena there is more clarity. After a very slow start, long haul LCCs have established a working model, are becoming more numerous and are staying in business longer. Importantly they can finally access the new, more economic aircraft that they need. They are certainly using primary airports. Norwegian Air UK for example has almost 7%

of all seat capacity at London Gatwick Airport (#12 in the table), where it operates seven trans-Atlantic services.

While most long haul LCCs will seek out non-hub airports first the fact that some of them are talking to short haul LCCs about agreements on connecting passengers suggests that another major change in commercial and operating procedures may again be on the way; one that sees a bigger presence of both these carrier types at primary hub airports where the capacity is adequate and where the economics can be justified.

As for the now 20 year old LCC 'movement' overall - short and long haul - it shows no sign of abating despite the propensity for LCCs to morph into hybrid carriers, although the ratio of global LCC capacity did fall by 0.5ppts in 2015, possibly the first time ever that it has done so. But that may have more to do with the changing shape of the LCC model itself.

Emerging economies will progressively translate into rapid airport growth. Provision also has to be made for countries that might have been considered low on the potential growth scale until recently. For example, the outlook for Iran, a country that, it was assumed, would continue to descend the global GDP table, has greatly changed with the ending of many economic sanctions in Jan-2016. Since then a raft of business representatives from across the world has been flooding into the country, including those from the aviation sector, and large aircraft orders are being placed along with the negotiation of PPP deals to expand airports.

It is unlikely that either of the Tehran airports will enter the top 20 busiest international airports by 2025, but the airline world can change in a decade. On a smaller scale the same applies to airports in Cuba and Myanmar - countries that have also re-entered the global economic mainstream - as unlikely as that may also sound.

Another factor is what the global population is likely to be in 2025. Most surveys, including those of the United Nations, estimate it will be slightly over eight billion, an additional one billion of them added since 2013. Males will slightly outnumber females in most age ranges. The highest fertility rates are in Africa, followed by Oceania, then South America (none of which have an airport in the top 20), followed by a tie between North America and Asia, with Europe coming in last.

No firm conclusion can be drawn from this other than that most of the population growth in the future, whatever the rate, will come from developing and emerging countries. Asia will remain the most populous region, and population increase is likely to be at its lowest in Europe.

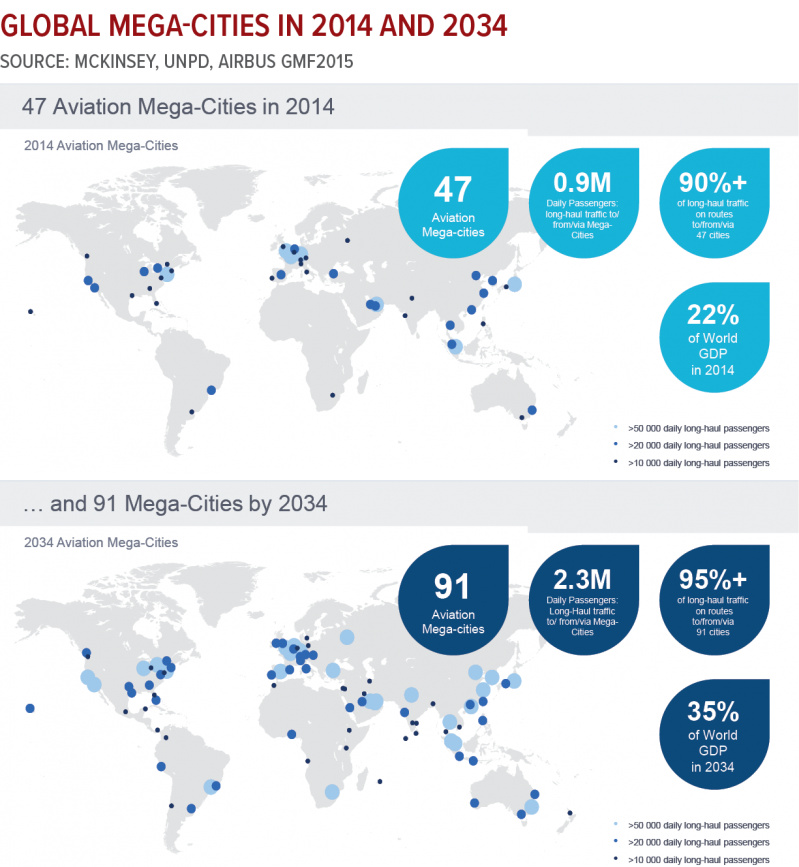

Arising out of population growth the shift towards urbanisation is another important factor; the rise of aviation mega-cities. Airbus predicted that the existing 47 'Aviation Mega-Cities' in 2014 will increase to 91 by 2034, with 95% of long haul traffic travelling between airports in these mega-cities, which collectively will represent 35% of world GDP. A mega-city airport is defined by the number of daily long haul passengers, in three categories, as in the chart on the right.

2034 is nine years after the relevant date here, so an assumption is made that there will be 69 of these cities by 2025, with a similar degree of influence on long haul travel and global GDP to that of 2034.

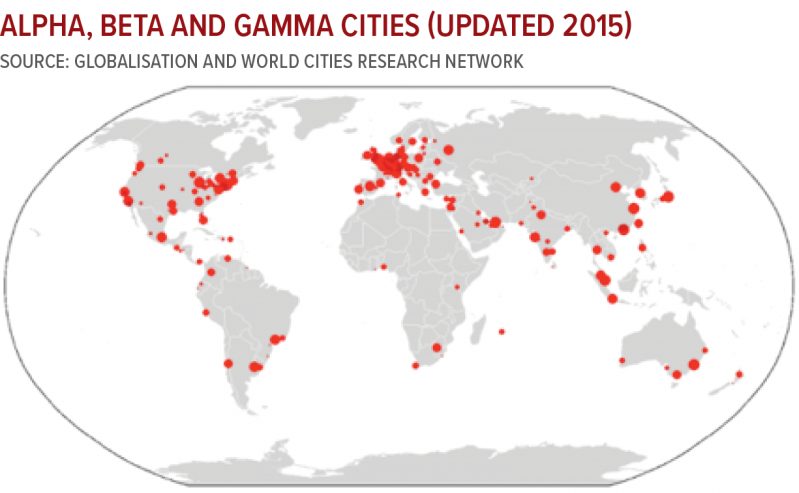

The contrast between the two maps is stark: the focus is on Europe in the 2014 map (and growth continues there to 2034) but most of the growth of the mega-cities takes place in the Asia Pacific region though the Americas gain several of them, Istanbul and Moscow appear for the first time and Africa gets its first one.

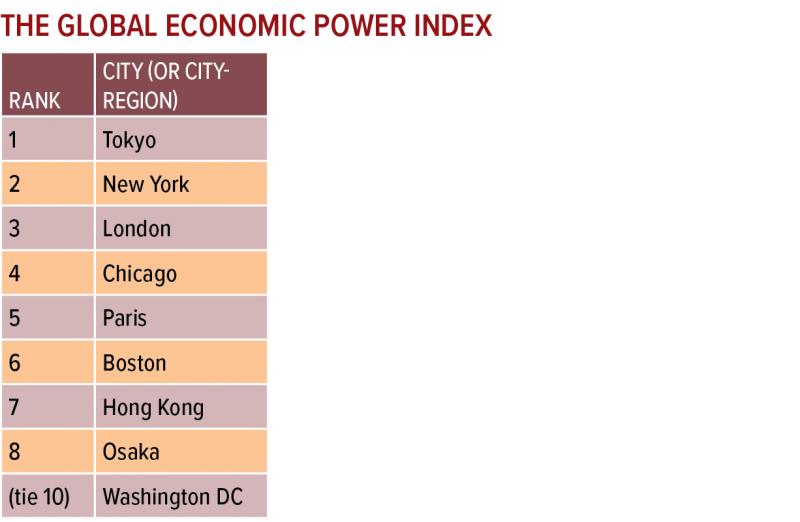

One interesting point about the Airbus (2034) chart is how it correlates with that of the rankings issued by the Globalisation and World Rankings Research Institute.

Both organisations agree with where the economic focus is, and will be - the northern part of Asia Pacific, North America (mainly east coast) and Europe.

There is an argument that the economic power of cities and city-regions should be viewed in a wider context.

The Global Economic Power Index (shown on the next page) reflects three key three dimensions of economic power - economic, financial, and innovative (expressed as the number of patents issued) and lists the top 25 cities by that measure.

Assuming that the calculations are accurate and allowing for the difference in the year of measurement, it is particularly interesting that, while four of the top 10 economic cities figure in the top 10 airports list (London, Paris, Hong Kong and Seoul) the majority do not.

There is a greater correlation with second tier cities such as Stockholm, Vienna and Dublin with Dublin at #23 and Vienna at #28 in the international passengers table but Montreal's main airport only hosted 15.5 million passengers in 2015 and local politicians consistently complain about its lack of global importance.

One conclusion would be that transfer traffic has become the predominant element at so many airports now. That would certainly be the case with Dubai for example (#1 international airport) and to a lesser degree with Istanbul (#10), neither of which figure in the economic city table.

So there are many, many variables involved in attempting to estimate which will be the busiest international airports in 2025, these are merely a handful of them and many are quite contradictory.

For all the many variables listed, two of the most significant are regulation of the industry and - an adjunct to population rates and the emergence of global aviation mega-cities - development of global traffic flows.

In this context, no airport can achieve significant growth in the absence of a liberal access regime. In an ideal world a globally multilateral open skies regime would apply, with aircraft from economic unions such as the EU able to fly to, from and possibly within the US, ASEAN, Mercosur and any of the other active or proposed economic unions and vice versa. While there are senior figures in the industry who believe that such an accord is achievable none will commit to a date when it might become reality.

On the other hand bilateral open skies agreements between blocs can fall apart. There is currently tension in the US-Europe agreement, over US reluctance to permit operations by Norwegian Air International from Ireland to the US; there are also numerous forces in the US pushing back against free trade. And, since the British vote to leave the EU, the UK's future participation in that multilateral agreement is being questioned. There are many 'unknown unknowns' here.

Frontier requirements inevitably have a limiting impact on origin and destination traffic - and, for countries like the US, even for international transfer traffic. But otherwise, apart from the impact of wars and territorial disputes, the trend appears to be greater co-operation between nation states in visitor regulation as evidenced for example by many countries relaxing visa requirements for Chinese visitors to enable them to tap into both business and leisure tourism.

The shape of regulation plays a large part in determining airline network planning. Where deregulation occurs, legacy airlines have tended to move towards a hub and spoke system. But that is mainly historical. If not for the advent of low cost carriers and the design of new aircraft that can support thin long haul routes economically it would remain the case with any further instance of deregulation. But today both the LCCs and their more efficient aircraft are entrenched and influence the travel plans of leisure and business travellers alike.

This has the implication that if, say, the EU and the ASEAN blocs made a bloc to bloc aviation agreement (tentative discussions began in 2015) there is no guarantee that traffic arising from it would route mainly between the four biggest European airports of Frankfurt, London, Amsterdam, Paris and their equivalents in ASEAN, Jakarta, Bangkok, Singapore, Kuala Lumpur and Manila. Indeed it is more likely that the increase in traffic that almost inevitably follows these deals would see the advent of more direct flights by budget carriers connecting smaller airports at one end at least, such as Singapore-Birmingham, Bangkok-Berlin and Kuala Lumpur-Copenhagen. Perhaps even Chiang Mai-Dusseldorf or Manchester. At the same time it would inevitably also help bulk up the major hubs, at least where capacity constraints do not apply.

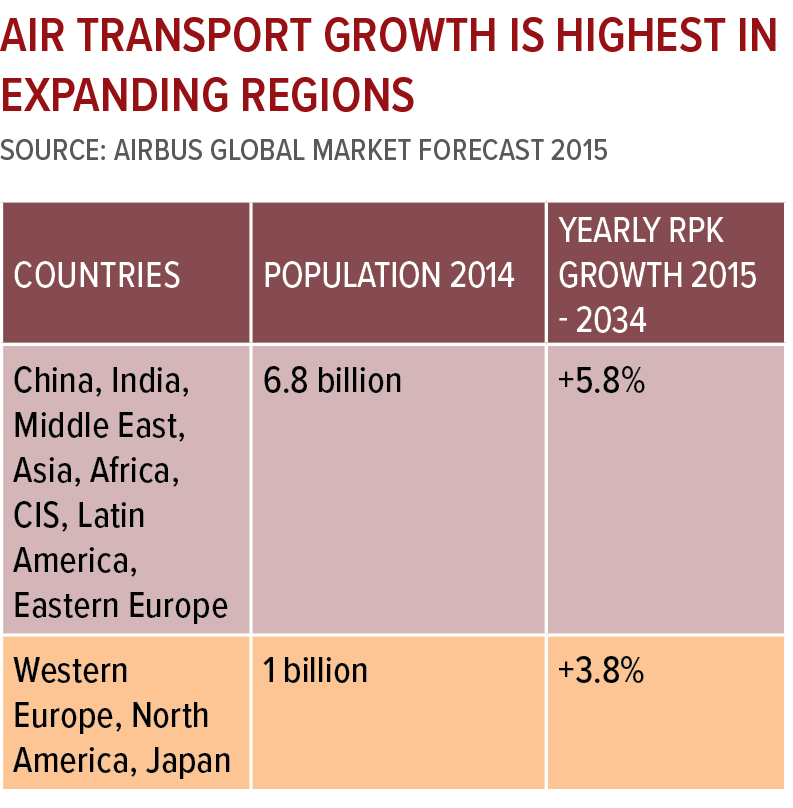

In determining future global traffic flows it is necessary first to understand how different authorities anticipate air traffic growth by continent in the following 10 years or longer. There is a degree of commonality amongst them. Airbus and Boeing project average 4.75% passenger growth from 2014 to 2034, mainly in emerging countries.

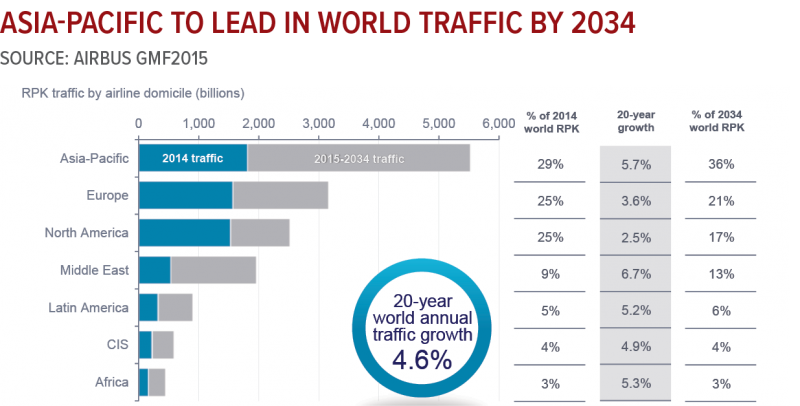

Both airframe manufacturers produce regular long term forecasts for global, market and airframe growth. They understandably tend to be broadly similar. The Airbus Global Market Forecast of 2015, covering the period 2014-2034 correlates with IATA forecasts and anticipates average passenger growth of 4.6% in that period, indicating a doubling of RPKs in that period. Boeing, in its forecast for a similar period, envisages 4.9% passenger traffic growth.

In both cases and significantly for regional market development, growth is expected to come more from economically expanding regions rather than advanced nations and Asia Pacific will be the leader.

Airports Council International (ACI), in its 2012-2031 Global Traffic Forecast Report has made a bold statement for passenger traffic growth in the period 2011-2031, which had

average passenger growth running at 4.1%, slightly less than the more recent Airbus and Boeing RPK forecasts which were also for a slightly different time period. Again, the largest growth was envisaged in Asia Pacific, but on this occasion the Middle East ranked just behind Latin America (the ACI forecast was made before economic difficulties beset Brazil and other countries in Latin America - a warning of how quickly winds can change). Overall there are broad similarities between these forecasts and it is clear that much of the growth is going to come from Asia Pacific and the Middle East.

Moreover the Middle Class - from which the bulk of new travellers come - will continue to grow much faster in emerging countries, more than doubling there from 1.1 billion to 3.9 billion to 2034, while remaining close to static in North America and Europe. (The total percentage of the Middle Class will reach 55% of the global population by 2034 from 37% in 2014 according to Oxford Economics.)

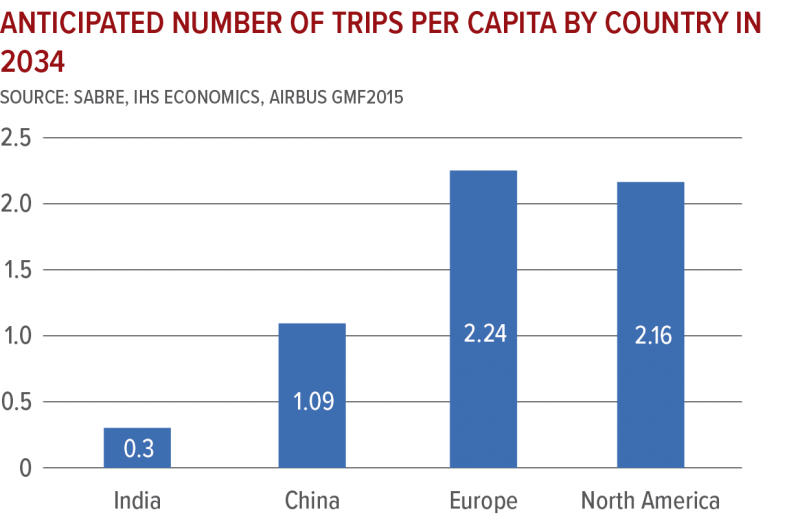

Another interesting statistic is that while propensity to travel remains at its highest in Europe and North America, 25% of the population of the emerging countries took a trip a year in 2014. By 2034 it is anticipated that in China the number of trips taken per head of population will have risen close to current (2016) European levels.

This calls into question not only global growth but the traffic flows that growth will stimulate.

Perhaps this is why Delta Air Lines is focussing so strongly on the China market, despite lacking a nonstop flight to the country from its home city of Atlanta (which as previously reported does not figure in the top 20 international passenger airports).

Capacity growth in the US-China aviation market has been explosive in the last few years and 2016 should be the largest on record for US-China air traffic flows. Delta's new CEO, Ed Bastian, recently said the airline foresees shifting its focus from Tokyo to Shanghai, its likely future Asia hub, as the city grows as a regional financial centre and the country's massive internal population grows ever more internationally mobile. Shanghai Pudong airport's international passenger traffic increased by 18.3% in 2015 as it gained four places in the busiest international airports league to #25.

These individual route examples are interesting in their own right but are part of a much bigger picture of course. These all form part of how

international traffic flows in general will change over the next decade.

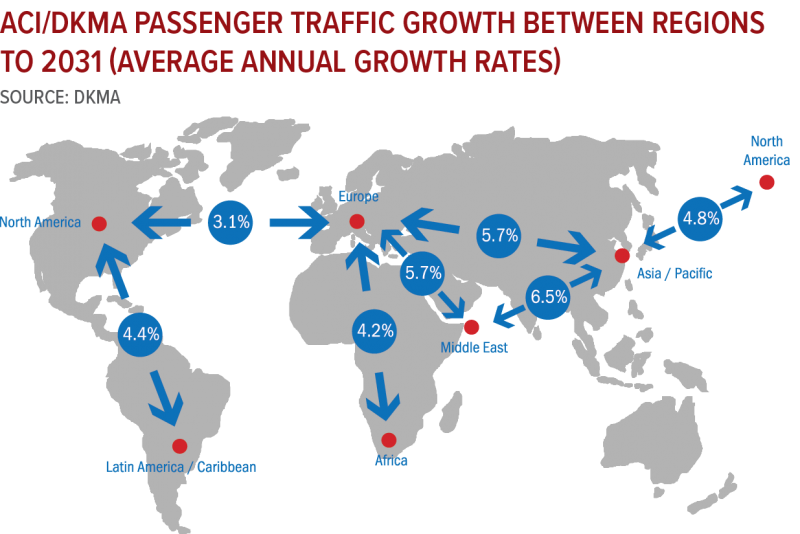

The chart below is from ACI's Global Passenger Traffic Forecast 2012, in association with DKMA. Again, a new forecast is in production but not yet available. The report claimed: "In line with global economic development, international traffic will post healthy growth over the next twenty years, especially in Asia Pacific, Latin America, and Africa, while the Middle East, taking advantage of its geographical position, will continue to expand. The transatlantic route area is currently the largest in terms of volume but, by 2031, it will be surpassed by the Europe-Asia Pacific route."

Actually, while Europe-Asia Pacific and Europe-Middle East have suggested average growth rates of 5.7% to 2031, the largest growth posited is Middle East-Asia Pacific at 6.5%. The Asia Pacific-North America flow would only grow by 4.8%, running contrary to the suggestion arising out of Delta's expansion to China, which goes to show how quickly things can change in a matter of a few short years.

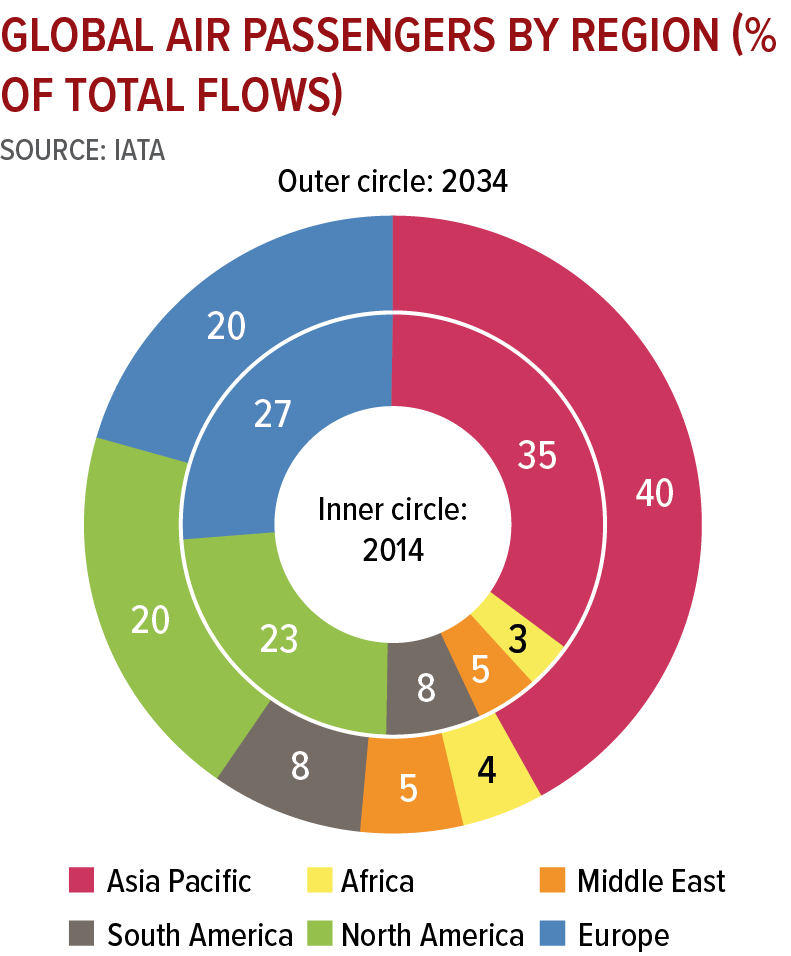

While the chart below, from IATA, does not deal with flows between specific regions, rather flows from and to individual ones, it tells a fairly similar story (this time from 2014 to 2034) with Asia Pacific gaining while Europe and North America retrench (and the Middle East remaining constant on this occasion).

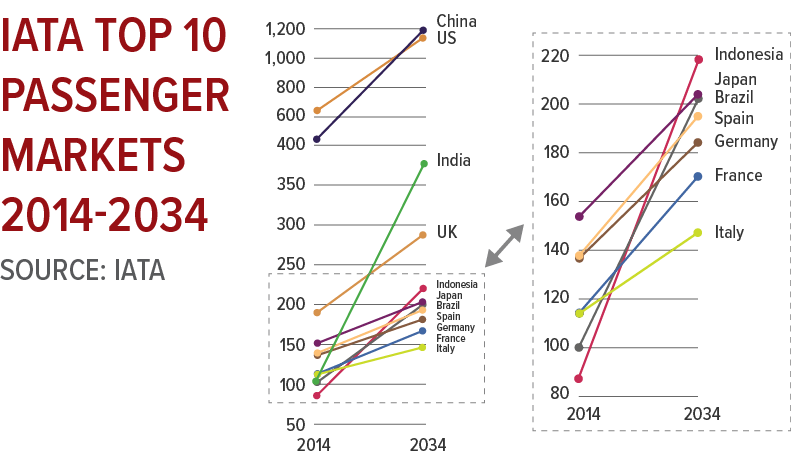

IATA O&D forecasts reinforce positive projections for China, US, India and Indonesia. The final chart is an IATA forecast that looks at passenger growth between 2014 and 2034 from the perspective of origin and departure passenger journeys to, from and within countries, which includes domestic traffic and which therefore shows how the top 10 passenger markets will expand in that period. It is a traffic flow projection by country rather than by region.

This chart confirms much of what has been indicated previously with both Chinese and US passenger journeys increasing strongly and Chinese ones marginally overtaking US ones by 2034. While growth is expected this is a powerful statement for one very mature market and another that is heading towards maturity.

India also climbs dramatically from 100 million journeys p/a to 380 million while Indonesia climbs from 85 million to 220 million. Another climber is Brazil, doubling from 100 million to 200 million ppa. The current turmoil in Brazil has mainly taken place since this forecast was produced and may or may not have a longer tern effect.

The losers so to speak are again the European countries such as France, Germany and Spain, which continue to grow but in most cases not as quickly as the emerging countries mentioned previously. The UK shows a slightly higher growth rate to 290 million ppa but one wonders how that will be impacted by the UK referendum result which has already forced a further delay to the construction of an additional London runway.

These predictions have much in common, with growth in and between Asia Pacific and the Middle East the focus of attention in coming years. Interestingly Airbus believes that 70% of traffic growth until 2034 will be coming from existing networks rather than from new routes. As many new routes presently are in the point to point LCC domain, that lends support to the theory that says that the hub and spoke principle will continue to prevail and this backs up Airbus' prediction that 95% of long haul traffic will travel between airports in mega-cities.

This often contradictory data makes conclusive findings on future directions a hazardous task. But some conclusions can be drawn:

Long haul LCCs and ad hoc alliance hub by-passing will redirect traffic from global hubs but not sufficiently to have a material traffic effect on the larger primary airports within this timescale;

New airports may be built to replace or part-replace those in the 2015 busiest airports table;

The physical size of airports may be restricted - the industry is entering new territory beyond 100 million ppa;

Runway infrastructure may be enhanced at some leading airports but not others. Existing hubs where infrastructure growth is constrained for one reason or another will lag competitors;

Political decisions will affect traffic flows both within and between regions;

The global population will increase by up to one billion by 2025, with Africa increasing at the fastest rate but with Asia Pacific easily remaining the most populous area, while the European population will stabilise;

Analysts suggest the trend towards the congregation of air services within an ever-increasing number of aviation mega-cities, which will number around 70 by 2025. While they are located across the globe many of the new ones will be in Asia Pacific;

The economic power of a city or city region does not however necessarily correlate with the size of its airport(s), indicating the importance of transit traffic;

The regulatory trend is generally still mainly towards deregulation, notably in Asia; and there has been an easing of travel restrictions for international travel, from China in particular. But the ever-changing political landscape does encourage contrary measures in some influential countries. Bloc to bloc travel need not feed through hubs at each end but the influence of point to point budget travel that bypasses regional hubs is, again, unlikely adversely to influence those hubs;

The main airframe manufacturers envisage growth of around 5% p/a throughout the period and beyond and that it will be centred on emerging countries, specifically in Asia Pacific. ACI, in its last forecast, concurred but added the Middle East as a high growth area;

The Middle Class is expected to continue to grow at a faster rate in these countries, notably India and China, and the number of trips per capita, especially international trips, will increase with it;

Traffic flow projections by Canadian analysts (DKMA) suggest that the Europe-Asia Pacific and Middle East-Asia Pacific zones will be the fastest growing flows by the end of the next decade. This prediction is largely supported by IATA, which additionally focuses on individual country flows and which anticipates strong growth involving China, India and Indonesia, and, outside Asia Pacific, in Brazil.