SkyTeam overlaps extensively with Etihad

The second largest of the three alliances overall, but the largest by domestic seats, SkyTeam has a particular strength in Northeast Asia and is the only one of the three alliances to include a cargo alliance. Its North Atlantic joint venture is to some extent complemented by SkyTeam member Delta's JV with Virgin Atlantic.

Major gaps in its coverage include South Asia, Upper South America and Southern Africa and it is also the smallest of the three by seats in Western European international markets.

There are significant numbers of SkyTeam member codeshares with airlines in oneworld, Star and those outside the alliances (led by Etihad). New members do not currently appear to be imminent, but possibilities at some stage might include Jet Airways, Gol and Virgin Atlantic. Meanwhile, Alitalia appears to be mulling a possible exit and Aeroflot's relationship with SkyTeam has not always been convincing.

The last of the three main global alliances to launch, SkyTeam alliance was founded in 2000 by Aeromexico, Air France, Delta and Korean Air and now has 20 passenger airline members. Five of its members are based in Northeast Asia and two in Southeast Asia (with none in South Asia). Four of its members are based in Western Europe and three in Eastern/Central Europe. It has two members in each of Latin America (but none in Upper South America) and the Middle East and one in each of North America and Africa.

Czech Airlines and Alitalia joined in 2001 and KLM joined after its merger with Air France in 2004. Aeroflot became a SkyTeam member in 2006, followed by Air Europa, Kenya Airways and China Southern in 2007. Vietnam Airlines and TAROM joined in 2010, China Airlines and China Eastern in 2011, while 2012 marked the admission of Saudia, MEA, Aerolineas Argentinas and Xiamen Airlines to the alliance. The newest member is Garuda, which joined in 2014.

SkyTeam's 20 passenger airlines operate a combined fleet of 3,440 aircraft on 17,343 daily departures to 1,062 destinations in 177 countries, carrying a combined 665 million passengers annually.

The alliance contains the only global cargo alliance, SkyTeam Cargo, also launched in 2000 by the founding members of SkyTeam. It now comprises the cargo operations of Aeromexico, Air France-KLM, Delta, Korean, Aeroflot, Aerolineas Argentinas, Alitalia, China Airlines, China Southern, Czech Airlines and the freight airline China Cargo Airlines.

For all three of the branded global alliances, there is an inner circle of alliance membership. This is defined by those airlines participating in the immunised JVs on the North Atlantic.

The Star Alliance's Atlantic++ JV (United, Air Canada, Lufthansa, SWISS, Austrian, Brussels Airlines) is the largest competitor, with 29% of all ASKs between Europe and North America in summer 2016 (according to CAPA analysis of OAG data). The JV within SkyTeam (Delta, Air France, KLM, Alitalia) is second, with 23% of ASKs, just ahead of that inside oneworld (America, BA, Iberia and Finnair), which has 22% of ASKs.

In addition to the three JVs within the global alliances, there is also a separate JV between SkyTeam's Delta and Virgin Atlantic (in which Delta owns a 49% equity stake). Virgin is not a member of SkyTeam and its North Atlantic capacity, which accounts for 5% of ASKs, is not part of the JV involving Delta and its three alliance partners. Nevertheless, all five airlines cooperate on traffic flows in this market and this gives SkyTeam's core members something of a turbocharge on the North Atlantic.

SkyTeam's North Atlantic JV notably does not include Aeroflot, which reportedly even considered leaving the alliance in 2013 after being denied entry into the JV. Aeroflot Deputy Director for Strategy and Alliances Giorgio Callegari told a CAPA event in 2013 that SkyTeam was "basically run by Air France-KLM and Delta".

Although it then reaffirmed its commitment to SkyTeam, Aeroflot successfully argued for a more relaxed approach to cooperation with airlines from outside the alliance. Meanwhile, it has focused much of its long haul growth on connecting traffic between Europe and Asia, a market offering potential for better cooperation between SkyTeam and Aeroflot.

Even within the immunised JV in SkyTeam, there appears to be a two tier structure. Alitalia feels very much like a junior partner to the other three. Its Chairman Luca Cordero di Montezemelo reportedly complained that the Italian airline was not free to increase its frequency to North America without the permission of its JV partners.

Since Etihad acquired a 49% stake in Alitalia at the end of 2014, it has found renewed ambition for its long haul network, but has suggested that the constraints of SkyTeam are limiting its expansion opportunities. CEO Cramer Bell reportedly said that SkyTeam had brought significant benefits, but that "Alitalia is changing and wants to be master of its own destiny" (Air Journal, 10-Jul-2016).

Although this kind of thinking aloud does not represent a concrete strategic decision, it should alert SkyTeam to the possibility that Alitalia may at least want to leave the North Atlantic JV, or even the alliance all together.

SkyTeam is the number two alliance overall, ranking between leader Star and third placed oneworld on seats, ASKs and frequencies. According to data from OAG for the week of 22-Aug-2016, SkyTeam has 17% of worldwide scheduled seats, just behind Star's 19% and comfortably ahead of the 13% share held by oneworld.

As a proportion of its total seat capacity, SkyTeam is the most domestic focused of the three. Only 51% of Star's capacity and 58% of oneworld's is in domestic markets, whereas the corresponding figure for SkyTeam is 65%. SkyTeam is the leader in domestic markets, with 20% of seats (Star has 17% and oneworld has 13%).

This means that SkyTeam's share of international seats, 14%, is only slightly ahead of oneworld's 13% and much further behind Star's 22% share of international seats.

In Asia Pacific, SkyTeam is the biggest alliance by overall seat numbers, with 21% of the total, versus 18% of Star and 9% for oneworld. This is mainly based on its strength in the region's domestic markets, whereas Star is bigger overall in international markets in the region.

SkyTeam is the biggest alliance by seats in Northeast Asia, both domestically and internationally, but is the smallest of the three in international markets in South Asia, where it has no members (and also no domestic presence). In Southeast Asia, it is number two overall, but first in domestic markets.

In Europe, SkyTeam is number two by overall seat numbers, but only fractionally bigger than oneworld in international markets and this is only due to its superiority against oneworld in Eastern/Central Europe. In Western European international markets, SkyTeam is a little smaller than oneworld and considerably smaller than Star.

SkyTeam and oneworld are neck and neck in North America by total seats, with 20% each, behind Star's 23%. They also both have this same share in both domestic and international markets in North America. Star is more dominant in international markets, with a seat share of 33%, but trails the other two by 1ppt in domestic North America. On the North Atlantic, the immunised JV between SkyTeam's Delta, Air France, KLM and Alitalia ranks behind the Star Alliance's Atlantic++ JV, but ahead of the JV inside oneworld.

SkyTeam trails the other two alliances in Latin America, where it has 14% of seats versus Star's 18% and oneworld's 23%. It is particularly weak in Upper South America, where it has less than 4% of seats (versus 23% of Star and 29% for oneworld). In Africa, where alliances have a lower share than in any other region, SkyTeam has 10% of seats, in between Star's 24% and oneworld's 5%. It is weakest in Southern Africa, where it has just 6% of seats (Star has 32% and oneworld has 11%).

All 20 SkyTeam passenger airlines have codeshare partners outside the alliance. Air France has the most extra-alliance codeshare partners, with a total of 37, followed by its sister airline KLM, which has 26 (17 of which are in common with Air France). Alitalia has 21 and Korean Air has 19 codeshare partners outside SkyTeam.

Six other members also have a double digit number of partners from outside the alliance: China Eastern, Garuda, CSA Czech, Delta, Kenya Airways and Vietnam Airlines (data source: OAG, week of 22-Aug-2016).

SkyTeam members: number of codeshare partners outside the alliance, Aug-2016

|

Airline |

Number |

Airline |

Number |

|

37 |

China Southern Airlines |

9 |

|

|

26 |

China Airlines |

8 |

|

|

21 |

Aerolineas Argentinas |

6 |

|

|

19 |

Air Europa Lineas Aereas |

6 |

|

|

15 |

TAROM |

6 |

|

|

14 |

Xiamen Airlines |

6 |

|

|

13 |

Aeromexico |

5 |

|

|

12 |

Middle East Airlines |

5 |

|

|

11 |

Saudia |

3 |

|

|

11 |

China Cargo Airlines |

1 |

|

|

10 |

All but one SkyTeam member has at least one codeshare partner that is a member of one of the other two alliances. Saudia is the only one not engaging in cross-alliance partnerships, while SkyTeam's biggest airline Delta has only one such relationship (with Star's TAP Portugal).

Kenya Airways and Xiamen Airways each only have one cross-alliance codeshare with a oneworld member, while Aeromexico and Air Europa each only have one Star partner.

Air France has the highest number of codeshare partners that are members of the other alliances, with four in each of oneworld and Star. Its sister airline KLM has two in each (including with Aer Lingus, which has not yet joined oneworld), as does Alitalia.

Korean Air has four oneworld codeshare partners and one in Star, while Garuda has three in Star and one in oneworld. CSA Czech and Vietnam Airlines both have three partners in oneworld.

Between SkyTeam and oneworld, there are at total of 32 codeshare relationships, involving 16 SkyTeam members. Between SkyTeam and Star, there are 22 codeshares, involving 14 SkyTeam members.

The oneworld airlines that have the highest number of SkyTeam codeshare partners are Japan Airlines, with six, followed by Qantas and Malaysia Airlines, with four each.

By contrast, in the Star Alliance, Croatia Airlines has three SkyTeam codeshare partners and no other member has more than two. In addition, Star's ANA has recently become a strategic shareholder in SkyTeam's Vietnam Airlines, with a 9% stake. Closer cooperation can be expected between the two airlines, but Vietnam Airlines has also reiterated a commitment to coordinating with SkyTeam partners.

This illustrates Star's lesser degree of tolerance of extra-alliance relationships compared with oneworld's more relaxed attitude. SkyTeam, in its stance on extra-alliance relationships as with many other things, sits between the other two alliances.

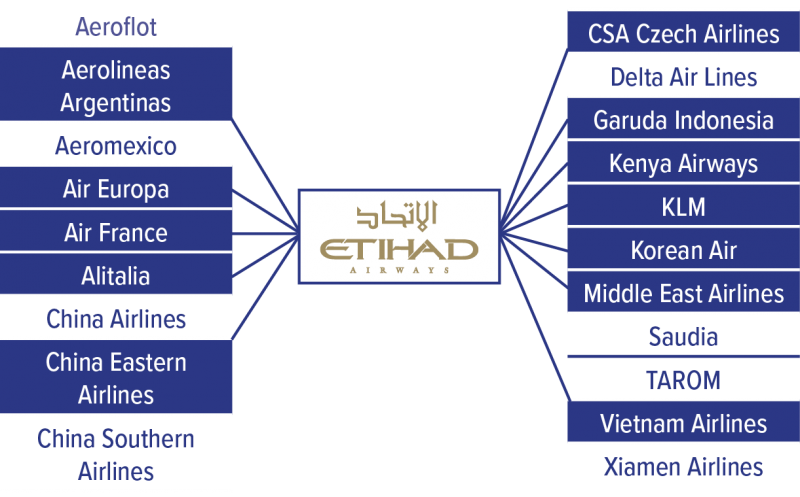

Airlines outside SkyTeam with the highest number of codeshare partners in the alliance tend not to be part of any of the three global alliances. Etihad Airways has more SkyTeam codeshare partners than any other airline. It also has a greater concentration of codeshares with SkyTeam than it has with the other two alliances.

SkyTeam members: codeshare partners with members of oneworld and Star, Aug-2016

|

Airline |

Star |

|

|

(1) Adria |

||

|

(1) LAN |

(1) Air NZ |

|

|

(0) |

(1) Avianca |

|

|

(0) |

(1) Avianca Brazil |

|

|

(2) airberlin, Sri Lankan |

||

|

(0) |

||

|

(1) ANA |

||

|

(1) Asiana |

||

|

(0) |

||

|

(0) |

(1) TAP |

|

|

(1) Malaysia |

(3) ANA, Singapore, Turkish |

|

|

(1) Comair* |

(0) |

|

|

(2) Aer Lingus**, Malaysia |

(2) Adria, Croatia |

|

|

(1) Air Canada |

||

|

(1) Royal Jordanian |

(1) Air Canada |

|

|

(0) |

(0) |

|

|

(1) Royal Jordanian |

(2) Aegean, Brussels |

|

|

(0) |

||

|

(1) Malaysia |

(0) |

Etihad codeshares with 12 SkyTeam members, more than half of the total, including five of its European airlines: Air Europa, Air France, Alitalia, CSA Czech and KLM (Aeroflot is the only European member not to codeshare with Etihad).

Etihad also has 12 codeshare partners in the Star Alliance (but this represents a smaller proportion of Star's 28 members) and only five in oneworld. Etihad's influence over alliance members can also be seen in its 49% stake in SkyTeam's Alitalia and its 30% stake in oneworld's airberlin.

The other two big Gulf airlines do not feature prominently among SkyTeam members' codeshare partners. Emirates' codeshare with Korean Air and Qatar Airways' with Middle East Airlines are the only other examples of Gulf-SkyTeam partnerships.

After Etihad, the two airlines with the next highest number of SkyTeam codeshare partners are Jet Airways and WestJet, each with eight.

SkyTeam members that codeshare with Etihad, Aug-2016

Non-SkyTeam Airlines that have four or more codeshare partners in SkyTeam, Aug-2016

| Airline | Number | Airline | Number |

| Etihad | 12 | Alaska Airlines | 5 |

| Jet Airways | 8 | Bangkok Airways | 5 |

| WestJet | 8 | Air Malta | 4 |

| Air Serbia | 6 | 4 | |

| airBaltic | 6 | 4 | |

| Bulgaria Air | 6 | Qantas | 4 |

| Gol | 6 | 4 | |

| Japan Airlines | 6 | 4 |

Etihad equity partner Jet Airways codeshares with Air France, Alitalia, Delta, Garuda, Kenya Airways, KLM and Vietnam Airlines. It is interesting to note here that, although Delta publicly complains about Gulf airline competition and has no codeshares with them, it is happy to cooperate with a close associate of Etihad.

Jet Airways has more partners in SkyTeam than in the other alliances (it has four Star codeshare partners and three from oneworld) and SkyTeam CEO Perry Cantarutti has been quoted as saying that the Indian airline was attractive to the alliance.

Jet would certainly fill the gap that SkyTeam has in South Asia. Its Etihad relationship would need to be accommodated, but would not necessarily be a barrier to SkyTeam membership, especially given that other Etihad equity partners are alliance members.

Canadian LCC WestJet's network is primarily domestic and North American, with some capacity in Central America and the Caribbean and a small, but growing, trans-Atlantic operation to the UK and Ireland.

WestJet's eight SkyTeam codeshares (Aeromexico, Air France, China Airlines, China Eastern, China Southern, Delta, KLM and Korean) outnumber the six it has with oneworld members (although it is part of oneworld's 'Global Explorer' round the world fare product.). Nevertheless its LCC point to point model limits the need for it to join any alliance.

There are five non-SkyTeam airlines with six codeshare partners inside the alliance - Air Serbia, airBaltic, Bulgaria Air, Gol and JAL. Among these, only JAL is already a member of a global alliance (oneworld). Although it has six partners from within SkyTeam, its 11 oneworld codeshare partners are more numerous.

Gol has the closest relationship with SkyTeam member airlines. Its shareholders include both Delta (which holds 9.5% of Gol's stock and guarantees a part of its debt) and Air France-KLM (1.5%). As with Jet Airways, Mr Cantarutti has reportedly identified Gol has being potentially attractive to the alliance. Gol would plug the hole that SkyTeam has in Upper South America.

Air Serbia is another Etihad equity partner and its five SkyTeam codeshares are all with European airlines in the alliance, reflecting its strong focus on short/medium haul routes. It launched its first long haul service, to New York, in summer 2016 and has a codeshare agreement with airberlin, a oneworld member and also an Etihad equity partner, on some of the German airline's trans-Atlantic routes.

As Air Serbia looks to add more North American destinations, it may seek new partners in that region on a bilateral basis, but seems unlikely to join one of the three global alliances in the near term.

Latvia's national airline airBaltic has an extensive series of bilateral relationships, encompassing 21 codeshare partners in total. Its six SkyTeam codeshares, exclusively with European members, are almost matched in number by its five Star alliance codeshares and it also has three oneworld partners. These bilateral agreements are more suitable for a small airline such as airBaltic than alliance membership.

Bulgaria Air's codeshares with airlines in alliances are mainly concentrated in SkyTeam, where it has six partners, compared with two in oneworld. However, as with airBaltic, it is probably too small to justify alliance membership.

Apart from the three big Gulf airlines and LCCs, Alaska Airlines is the biggest unaligned airline in the world by seats (Aug-2016, source: OAG). This could make it attractive to the global alliances, although its primarily domestic US west coast-based network would not add much in terms of plugging gaps for any of the three.

Alaska's five SkyTeam codeshare partners (Aeromexico, Air France, Delta, KLM and Korean Air) are matched by five oneworld codeshares (American, Cathay, JAL, LAN and Qantas). Alaska Airlines is also a partner of oneworld's round the world 'Global Explorer' fares.

It is currently awaiting regulatory approval for an agreed acquisition of Virgin America. If approved, the execution of this deal seems likely to be Alaska Airlines' priority for the time being.

Bangkok Airways was reported to have been in talks to join SkyTeam back in 2010, but, since then, it has pursued a range of bilateral relationships. Like Alaska Airlines, it has five SkyTeam codeshare partners (Aeroflot, Air France, China Airlines, Garuda and KLM).

However, these are outnumbered by its seven oneworld codeshare agreements (airberlin, BA, Cathay Pacific, Finnair, JAL, Malaysia Airlines and Qantas). Moreover, in 2015, Bangkok Airways joined oneworld's 'Global Explorer' product.

Virgin Atlantic is another significant unaligned airline that has an important relationship with a SkyTeam member. Although it codeshares with only one SkyTeam airline, Delta, the bond between the two is probably closer than any other between an unaligned airline and a SkyTeam member.

As noted above, in addition to their codeshare agreement, Delta has a 49% equity stake in Virgin Atlantic and the two operate a revenue sharing JV on trans-Atlantic routes between the US and UK (the JV is the factor that makes this relationship closer than the Etihad-Alitalia link).

Elsewhere, Virgin Atlantic's codeshares give it bilateral relationships with a number of important partners in the Asia Pacific region (including four Star members: Air China, Air New Zealand, ANA and Singapore Airlines). Since Delta's investment in 2013, Virgin Atlantic has further strengthened its focus on the North Atlantic and reduced its capacity in Asia (and Africa), where it relies more on partners.

In the early days of the Delta-Virgin pact, the UK airline was mulling whether or not to join SkyTeam, but this question now seems to be very much on the backburner. As a primarily point to point airline with a strong focus on routes from the UK to North America and the Caribbean, its Delta partnership is much more meaningful than potential alliance membership.

SKYTEAM SWOT

|

STRENGTHS |

WEAKNESSES |

|

Biggest alliance in Asia Pacific overall by total seats Largest alliance in North East Asia Biggest alliance in domestic markets Only global cargo alliance Immunised JV on the North Atlantic (Delta, Air France, KLM, Alitalia) is complemented by Delta-Virgin Atlantic JV Larger overall than oneworld |

Lowest proportion of seats in international markets No representation in South Asia North Atlantic JV trails seat share held by Atlantic++ JV (Star) Smallest by seats in W. Europe international markets Smallest by seats in LatAm, particularly in Upper South America Smallest by seats in Southern Africa Smaller overall than than Star |

|

OPPORTUNITIES |

THREATS |

|

Addition of new members in South Asia and Latin America, eg Jet Airways and Gol Possible addition of Virgin Atlantic (although unlikely to be imminent) Better cooperation on Europe-Asia between Aeroflot and other SkyTeam members |

Any expansion by oneworld in N. America would push SkyTeam into third place in the region Possible exit of Alitalia from trans-Atlantic JV or even SkyTeam all together |