Uncertainty, unpredictability – and unprofitability? – in 2017

Uncertainty usually spells bad news for economic growth, for business and discretionary spending and, in turn for airlines. There is plenty of uncertainty in the air as 2017 gets under way.

Whether the negative impacts will be offset by good news will go a long way to deciding the sort of year it will be. An important element will be fuel prices, but soft demand remains a challenge. As if further evidence were needed, the events of 2016 have only served to emphasise the importance and unpredictability of external factors in shaping the fortunes of the aviation industry. Political and economic uncertainty is now casting a long cloud over much of the world. Brexit offers a lose-lose scenario in Europe, the incoming Trump Presidency offers only the certainty that nothing can be predicted, other than a strong likelihood of confrontation in many regional and global markets; and the Middle East appears poised more precariously than ever before.

And even the good news has often been steeply mingled with the bad. Thus, cost savings on fuel have been at least partly responsible for many airlines losing sight of their previous strict cost disciplines as the savings from a halving in fuel prices made the odd two or three percent off outgoings suddenly seem less important - and staff became harder to convince of the need for austerity. With demand softening, yields have slipped almost across the board - there has been an almost inverse correlation with fuel costs - and more capacity has found its way into the market, whether through new equipment, increasing utilisation or keeping older aircraft flying. This is a dangerous and near-irreversible process; getting fares back up when costs increase is a much more difficult equation.

In a generally profitable environment, airlines have also found it difficult to resist labour pressures which inflated salaries. For the US airlines in particular, following a decade and more of difficult relations through many bankruptcies, record profitability has inspired a hectic rush to increase pay, especially for flying crew. This seems certain to come back and bite management in this all-too cyclical industry.

Despite the negatives, 2016 has been one of the more profitable years for the industry, mostly thanks to lower fuel prices - although again, much of that aggregate is accounted for by US airlines, down to the effects of domestic airline consolidation making it possible to secure (perhaps abnormally) large rents. Asia, where the strongest growth has occurred, and with many relative newcomers to the market, has been among the least profitable, with a seemingly relentless trend to disruption of the major flag carriers.

Latin America has plumbed the depths economically in 2016, although it does appear to be bouncing off the bottom; the large market of Mexico is a major unknown, particularly if President Trump acts in the same vein as candidate Trump.

The IMF remains positive about the global outlook, at a 3.4% GDP forecast, although "uncertainty" caused its growth forecast to be, in Oct-2016, "revised down by 0.1 percentage point for 2016 and 2017 relative to [its] April [outlook], reflects a more subdued outlook for advanced economies following the June U.K. vote in favour of leaving the European Union (Brexit) and weaker-than-expected growth in the United States". This was before the US presidential election, so had no uncertainty factored in for the eventual outcome.

Oil prices are as expected making a steady increase - if a near doubling in price year on year can be described as gradual. From the early-2016 lows in the high USD20s, Brent crude ended the year in the mid-USD50s a barrel, close to its level of two years previously, with jet fuel roughly USD10 more. This is a significant increase, but still well within reasonable limits and the Jan-to-Jan comparison overstates the real impact, after levels through the year continued within a band above USD40, to where prices had recovered by Mar-2016.

In fact, in global terms the price approaches the "Goldilocks" zone, where consumption costs are still acceptable, but where producers are not driven into recession. It is a difficult balance, the one side affecting costs, the other allowing some market stimulation.

Recent moves by Saudi-led OPEC to contain oil production have prompted some predictions of prices above USD60 and, despite US shale producers' ability to maintain output that would keep a lid on the upside, political uncertainty is such that almost anything is possible.

But 2016 has also been a difficult year for airlines in terms of yields. Low fuel costs have been a two edged sword: with demand generally tepid, fares chased costs down, and yields fell, in some cases significantly. So, while lower fares allowed traffic growth to remain positive to strong, with global load factors above 80%, there is limited wriggle room to stimulate additional demand.

The effects of the markedly lower oil prices were not evenly distributed, as currency fluctuations and locked-in hedging prices left some airlines behind. This meant US airlines, whose costs and revenues were predominantly in the same currency and who were lightly (or in American's case not at all) hedged, were in the box seat for profitability.

Aviation and airports in particular have again unfortunately become terrorist targets, affecting tourism and airport traffic. Following the horrendous attack on Brussels Airport, traffic declined steeply, although it again trended slightly above 2015 levels by the end of 2016. Istanbul Ataturk Airport however remains in substantially negative territory after a serious airport attack and separate incidents in public places in Istanbul and other Turkish cities. Inevitably too this is hurting the growth aspirations of the super-connector, Turkish Airlines. Turkish has, as a result, been forced to postpone delivery of some of its planned expansion fleet.

Brent Crude prices, USD. Jul-2015-Dec-2016

China has stamped its global credentials internationally in 2016.

The early impact of China's international airlines spreading their wings is damaging the longstanding sixth freedom operators who have fed off the Chinese market while direct services lagged. Cathay Pacific is directly in the firing line and, other than diversifying away from flying revenues, seemingly has few options to adapt. It is also creating challenges for predominantly third and fourth freedom operators like the American airlines, unable to match the cost levels and the behind-gateway reach of the Chinese carriers.

The Chinese aviation eruption is highly disruptive and there will be many other casualties as the world order changes. A very positive spinoff for many tourism bodies is the rapid boost to tourist numbers that several hundred million aspiring international travellers can bring. Much of this is being distributed within the region, but increasingly the Chinese airlines are embarking on long haul operations, and from increasing numbers of Chinese cities. Part of the dispersal of routings can be attributed to congestion at major gateways, hardly surprising given the sustained high growth rates over a long period.

Partnerships are evolving in style and form as partnership opportunities become more important for survival. There has been much said about the efficacy of the closed anti-trust immunised joint ventures of the North Atlantic and some other regions. There are signs of regulatory weariness with the market impact of the JVs, as parallel pricing becomes more unpopular with consumers and, towards the end of 2016, the US authorities rejected a Qantas-American Airlines application that would probably have been approved a couple of years ago.

On another direction, the Dec-2016 move by Etihad and Lufthansa seemingly to bury the hatchet could spell a tipping point in the Gulf carrier demonisation campaigns led by the US big three and by Air France (and until now Lufthansa) in Europe. Qantas and Emirates led the way in a close partnership, followed by IAG and Qatar Airways, which has also joined oneworld. The Lufthansa deal makes the continuing EU-Middle East air services negotiations even more compelling. "Fair competition" will continue to be aired as a protectionist mantra, but its interpretation, as always, will bend to fit the convenience of those who use the expression.

For Lufthansa, as with many other airlines in Europe and the US particularly, much management decision making is shaped by the reluctance of labour unions to adapt to market-driven changes. But there is much to be said, in a fast changing world, for adopting the strategy of if you can't beat them join them.

Protectionism does remain an important feature in trans-Atlantic activity and some of the US voices against the Gulf carriers are hopeful that a Trump Administration will hear them and move to curtail their activity in the US. The outcome of that can only be guessed at, but it will only take one major American airline to break ranks before this negative episode can be disposed of and the world can move on. Each of the big three has a relationship with the Gulf airlines, codesharing and otherwise; and smaller airlines like jetBlue are keenly partnering with Emirates.

It is significant that United, in late 2016, refocused its strategy, establishing a greater reliance on domestic operations, feeling presumably that international markets could not deliver the sort of financial returns that Wall Street expects of it. United has struggled to keep up with its merged rivals and is just beginning to reap some of the rewards of domestic consolidation.

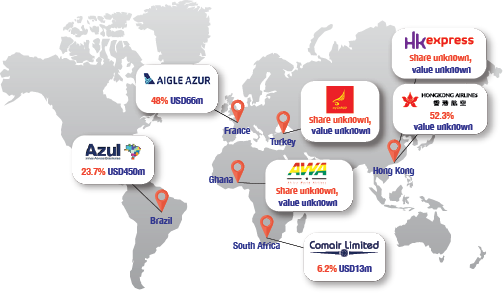

Cross border acquisitions by the HNA group

As a side note to the US' attitude to liberalisation, after far too many months of obfuscation, the US DoT and DoS finally approved the application of Norwegian International Airlines to operate to the US from its Dublin base. This may well eventually have been a response to the concerns about the North Atlantic JVs' impact on competition.

Cross border airline acquisitions are quickly becoming a feature of the industry. Qatar Airways expanded its equity investment in IAG, and acquired a significant share in LATAM, as well as planning smaller purchases. Etihad of course has been a serial acquirer and the ubiquitous cross border JVs so popular in Asia show no sign of diminishing.

In aviation and travel (as with many resource sectors) China's airlines and other investors have been acquisitive across borders, in a trend that may well contribute to significant changes in the way airlines operate in future (see Airline Leader, Nov/Dec-2016, Disruption in the airline industry: It is coming, faster and bigger than you think). The independent HNA Group has been a leader in this respect, but others will follow.

Another strategy for dealing with the combined impact of the Gulf carriers on long haul and LCCs on short haul has resulted in the formation of Asia's airline groups, which are now evolving into more streamlined combinations as experience with them grows. Qantas set the trend with its Jetstar subsidiary, in its various forms.

Singapore Airlines for example in 2016 consolidated two of its low cost subsidiaries, one short haul, the other long haul. The group now includes a mid-market short haul operator, SilkAir, along with Scoot (both short and long haul) in addition to the flagship Singapore Airlines.

Long haul low cost airline operations are spreading outside Asia, where the phenomenon began and is now well entrenched. After watching the growth of Asia's long haul low cost airlines from afar, Europe began undergoing a slow evolution of the model, although examples of the genre remain limited in number. Norwegian started its long haul operations in 2013 and Lufthansa added long haul routes to its Eurowings LCC in 2015. WOW Air commenced widebody operations in 2016.

In 2016, Air France-KLM announced plans to launch a new long haul airline at Paris CDG within the Air France side of the group. Given the project name Boost, this "will operate with lower costs". Its launch is, at least in part, a response to new low cost competition on long haul routes to/from France by the likes of Norwegian and Groupe Dubreuil's French Blue. Yet the fact that Mr Janaillac was constrained from even describing the new airline as "low cost" speaks volumes for the pressure this genuinely legacy carrier faces from its organised labour. Boost modestly aims to have 10 long haul aircraft by 2020.

In addition to Norwegian's established long haul routes from Scandinavia and London Gatwick, the LCC is pursuing long haul growth from Paris CDG, from where it will add Orlando as a new destination in Jul-2017 to its New York JFK, Los Angeles and Fort Lauderdale services.

Iceland's WOW Air joined the ranks of LCC operators of widebody aircraft in 2016 with the launch of routes from Reykjavik to Los Angeles and San Francisco deploying A330-300. It will add Miami to its A330 network in Apr-2017.

Canada now has two low cost operators flying long haul routes over the Atlantic: WestJet and rouge, Air Canada's low cost arm. And jetBlue is talking of trans-Atlantic operations using single aisle aircraft, another opportunity made possible as aircraft technology improves.

The impact of these operations can be seen in Lufthansa's attempts to establish a lower cost operation for its lower yielding long haul services.

As the combination of short and long haul low cost (including the Gulf airlines) operations closes in on the continental European majors, it is becoming increasingly evident that changes around the margins will not be adequate to deal with the upheavals that are occurring. It is not so revolutionary that Ryanair is talking of providing short haul feeder services for the hub carriers, but it will generate another form of revolution once this activity begins, as it apparently inevitably must.

Amid this the staunchly legacy nature of Air France stands in clear contrast to the need for radical changes in direction. 2017 will produce severe strains for Air France in particular, as these forces close in.

Distribution developments and third party data activities are at an interesting stage of their evolution. As travel-related providers and other aggregators of data establish powerful data sets - and, vitally, the ability to apply it for commercial purposes - so the potential for disrupting the traditional forms of airline marketing and distribution seem likely to change, perhaps very quickly. This will emerge more potently in 2017 and beyond as the major social media and online retailers begin to leverage their knowledge.

For Air France and some others, lower fuel prices have delivered a lifesaving breath of air. But to use the crude analogy, even turkeys can fly in a strong wind; once the wind drops, reality must be faced.

|

But to use the crude analogy, even turkeys can fly in a strong wind; once the wind drops, reality must be faced. |

|

REGIONAL OUTLOOKS IN BRIEF

|

EUROPE Europe faces a growing range of geopolitical risks and uncertainties. These range from the presidential election in France and the federal elections in Germany to the UK's (only) likely triggering of the formal process of leaving the European Union. Political instability in Italy and a general feeling of a move to populist politics raise a tendency towards protectionism and resistance to some of the core principles of the European Union. They also include possible shifts in Russia's relationship with the West under a Trump Administration in the US. Indeed, Mr Trump's presidency also raises questions over Europe's own relationship with the US, notably his attitude towards free trade and to NATO. The threat of terrorist activity remains real in Western Europe, where both Belgium and France were targeted in 2016. Turkey also suffered from frequent terrorist outrages and an attempted coup in 2016. The civil war in Syria and an unstable political backdrop in other parts of the Middle East and North Africa have drawn in a number of European nations to a greater or lesser extent and contributed to an influx of refugees across Europe. The refugee crisis has fuelled wider concerns about immigration, adding to a climate of political anxiety. Within Europe's airline industry, lower fuel prices have provided a breathing space for the less efficient legacy airlines, but independent LCCs, long and short haul, have meanwhile taken renewed strides to dominate across the market. Lufthansa and, in particular, Air France are serious laggards and enter 2017 under a dark cloud. |

|

LATIN AMERICA After battling dismal economic conditions for the past two years, Latin America is poised to begin pulling itself out of fiscal decay in 2017. Near the end of 2016, forecasts tilted toward a return of modest GDP growth between 1.5% and 2% for 2017 after the region endured an economic recession for the prior two years. But the emerging optimism was significantly clouded when the US selected Donald Trump as its next president in Nov-2016. An already weak MXN plunged against the USD on fears of a Trump Administration abolishing NAFTA, engaging in mass deportation and following through on plans to erect a wall on the US-Mexico border. Economists have already issued revisions to Mexico's projected economic growth for 2017, and the benefits of a new liberalised bilateral between the two countries are in jeopardy as airlines have to adjust their growth prospects to reflect a potential new era of protectionism. |

|

NORTH AMERICA A sense of optimism prevailed among North American airlines as 2016 drew to a close. It was driven by the beginning of stabilised pricing in the US domestic market and an improved outlook for Western Canada after a marked drop in oil prices triggered a collapse in demand. After two years of recession triggered plummeting demand to Latin America, the largest North American airlines serving the market starting reporting positive revenue trends at the end of 2016; but the outlook for trans-Atlantic and trans-Pacific markets remained far more subdued. Uncertainty over the UK Brexit vote, heightened competition and overcapacity were weakening airline performance in the trans-Atlantic and excess supply was also creating pressure in trans-Pacific markets. And, as profitability and labour pressures provoke significant wage growth, the groundwork is being laid for another cycle of cost increases. |

|

NORTHEAST ASIA Northeast Asia continues to drive growth large in size and complexity, with future implications inside and outside the region. China is a singular attraction and remains in its golden years of expansion, with opportunity mostly constrained by infrastructure. If not for runway, terminal and air space congestion, China would already be much larger. Northeast Asia is not just China, and the other vast territories in the region are substantial in their own right. Flag carriers are expanding in size and footprint while seeing their domestic/regional networks fall under greater pressure, often due to LCCs. LCCs are burgeoning in Korea, Japan and Hong Kong despite local governments and partners hardly giving full support. Pressure is on at full service airlines from mainland China but also themselves as they have greater overlap with each other. |

|

SOUTHEAST ASIA Southeast Asia is a region with enormous growth potential but a relatively cloudy outlook for airlines given the intense competition and overcapacity concerns. Demand is on the rise, boosted by a growing middle class, rising discretionary incomes and relatively strong economies. Nearly every country in Southeast Asia continues to post GDP growth above the global average. The Philippines, Vietnam, Myanmar and Cambodia have been particularly strong with GDP growth in the high single digits. However, GDP growth slowed to less than 5% in the rest of Southeast Asia in 2016 and is expected to only pick up slightly in 2017. In several Southeast Asian markets, capacity has been growing faster than demand, impacting yields as competition has intensified. With an order book that equals the size of the current active fleet and several airlines pursuing strategic expansion, capacity may again be added at a rate exceeding demand in 2017. |

|

SOUTH ASIA Aviation activity in South Asia in 2017 is expected to be dominated once again by India, currently the fastest growing large market in the world. As India goes through one of the brightest periods of its economic and aviation growth, the prospects look more positive for sustainable growth than recent history has delivered. Nothing is ever wholly predictable in India's market, but the country does seem to have turned a corner. While domestic growth has surged, the addition of India's LCCs to more international routes in 2017 will help promote the country's international profile. As this rapid aviation growth occurs however, the inadequacy of India's infrastructure is building to become a major stumbling block. |

|

MIDDLE EAST Aviation is fundamentally a business of cycles and the Middle East has been slowly transitioning from a long upswing in traffic growth and airline profitability into a plateauing that brings with it new initiatives in partnerships and profile. Although the UAE and Qatari airlines are usually the focus of attention, it is a region with vastly differing attitudes and policies. Persistent traffic growth, lower fuel costs and aviation friendly investment policies are keeping the underlying fundamentals in the Middle East generally positive. However, there are strong signs that the run of regional profitability is fading and growth rates have already retreated considerably. At the same time, Saudi Arabia is beginning to liberalise its market, perhaps promising a future larger global role. The region is more exposed to oil price conflict and instability influences than others and this is taking its toll on GDP growth and, necessarily, on airline operations. |

|

AFRICA Africa remains a region with huge untapped potential - as it has for many years. The long term outlook for growth is always bright, particularly if the Yamoussoukro Decision were to be implemented, bringing long overdue liberalisation. However, the short term outlook is bleak - both for growth and profitability - and over the long term profitability for Africa's struggling airline sector will be extremely difficult to achieve. While 2016 was a standout year for most regions, Africa continued to struggle. The African airline sector remained unprofitable with traffic growth of less than 5%. Demand was weak, impacted by political instability, a sluggish economy and low oil prices (as several African countries have oil based economies). |

|

SOUTH PACIFIC Australia and New Zealand enter 2017 on a different level from 12 months previously. The biggest change, not just compared to 2016 but since the global financial crisis, is that Qantas has been revelling in a successful turnaround. After the lows of 2011 and a domestic competitive bloodbath, the Qantas Group has seemingly become a solid and sustainable story, now looking forward to a new future marked by 787s, arriving later in 2017. Air New Zealand has continued along its thoroughly profitable path, while Virgin Australia and its Tigerair subsidiary have struggled to achieve profitability in the new environment - now with a more settled share registry and emerging strategy. |

|

AIRPORTS CAPA's 2016 outlook was against a background of unusually high levels of profitability for airlines. In 2017 those profit levels may be eroded as oil prices creep back up, economies falter and political uncertainty abounds over matters such as Brexit and the election of a new and unpredictable US president - along with the prospect of greater levels of protectionism and threats to open skies agreements. All of which, of course, must impact on airports. Perhaps nothing sums up this political uncertainty more than the 'decision' made - at length - by the British government that London Heathrow Airport will be expanded by the addition of a single runway, and which is not a decision at all. It must be rubber stamped by MPs by December 2017 and there is no 'certainty' about that. On a potentially more positive note however, Donald Trump's election could generate new, much need investment in US airport infrastructure. |