Southeast Asia Fleet Outlook:

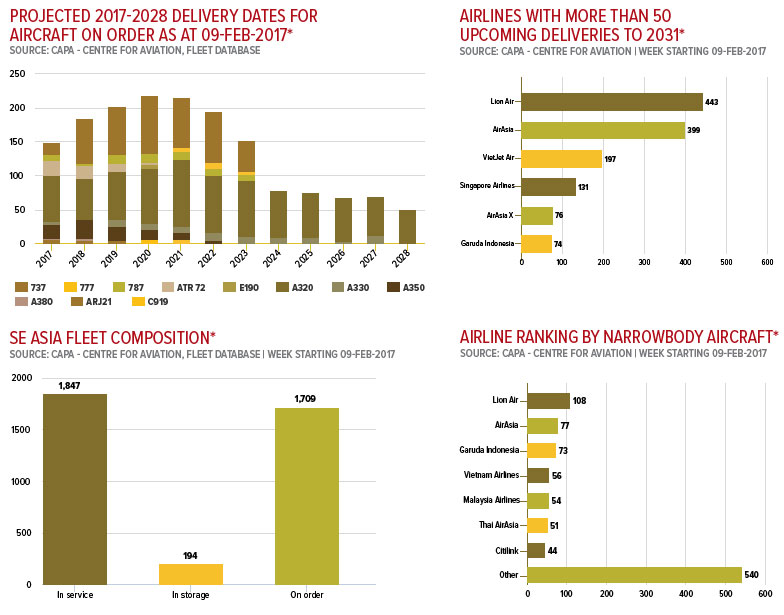

Southeast Asia, along with the Middle East, are the only two regions with as nearly as many aircraft on order as in the active fleet. Southeast Asian airlines currently have nearly 1700 aircraft on order compared to an active fleet of approximately 1800 aircraft.

Southeast Asia, along with the Middle East, are the only two regions with as nearly as many aircraft on order as in the active fleet. Southeast Asian airlines currently have nearly 1700 aircraft on order compared to an active fleet of approximately 1800 aircraft.

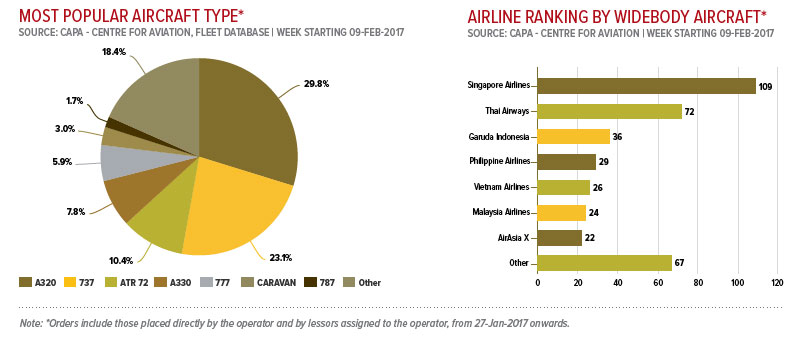

LCCs dominate the order book and have grabbed headlines and generated scepticism over the last several years by placing some of the largest orders globally. It is yet to be seen whether the sceptics will be vindicated, but these are innovative airlines in a fast growing market. Southeast Asian LCCs now operate over 600 aircraft, accounting for slightly more than one-third of the total fleet in the region, but account for more than 70% of the orders.

The AirAsia/AirAsia X, Lion and VietJet groups alone have approximately 1100 aircraft on order, accounting for nearly two thirds of the region's total order book. These three groups now operate approximately 500 aircraft, including more than 400 at LCCs and almost 90 at full service airlines (as the Lion Group includes two FSCs).

A portion of the AirAsia, Lion and VietJet orders will end up outside Southeast Asia - at JVs based in other regions or placed by their leasing subsidiaries with airlines outside the group. However, a large majority of their 1100 orders will end up in Southeast Asia and at least a few hundred are intended for growth.

The majority of Southeast Asia's order book - approximately 600 aircraft - is largely for replacements. The Garuda Indonesia and Singapore Airlines (SIA) groups both have over 100 aircraft on order. While there is some growth capacity, mainly for their group LCC subsidiaries, most are replacements.

The Thai Airways Group only has 12 aircraft remaining on order, all of which will be delivered in 2017 and 2018, and the airline will likely place a new batch of orders following the completion of a new five year plan in mid-2017. Thai Airways is hoping to take advantage of favourable pricing in what is generally expected to be a down year globally for orders. Thai Airways has the second largest widebody fleet in Asia (after SIA) and is one of seven Southeast Asian airline groups with at least 90 aircraft (along with AirAsia, Garuda, Lion, Malaysia Airlines, SIA and Vietnam Airlines).

Garuda, Malaysia Airlines and SIA could also potentially order new generation widebody aircraft in 2017. However, Southeast Asia's LCC sector is not likely to see significant order activity for some time given the huge backlog.

Growth of Southeast Asia's LCC fleet slowed in 2016 to a relatively modest 7%, following 13% growth in 2014 and 2015. However, fleet growth should again be in the double digits in 2017 - and beyond - as some of the region's LCCs have decided to accelerate expansion.

The AirAsia Group in particular is picking up the pace and now plans to take delivery of 32 A320s in 2017 compared to an initial plan of only 10 deliveries. Across the four AirAsia branded short haul airlines the newly revised fleet plan for 2017 envisions net growth of 20 A320s after declining by two aircraft in 2016. Long haul sister AirAsia X is also resuming expansion in 2017 with two used Boeing 777-300ERs to support the resumption of flights to London.

VietJet is accelerating deliveries from 11 aircraft in 2016 to a planned 16 in 2017. The Lion Group will likely take delivery of more than the 36 aircraft it took in 2016 but less than the record 57 aircraft it took in 2015.

Overall, Southeast Asian airlines are expected to take over 150 aircraft in 2017 and a similar number in 2018.

The pace of deliveries is expected to pick up in 2019 to 2021, crossing the 200 aircraft p/a threshold, as airlines gradually chip away at the gigantic backlog.