Middle East Fleet Report:Middle East is high on growth aircraft orders, mostly widebodies

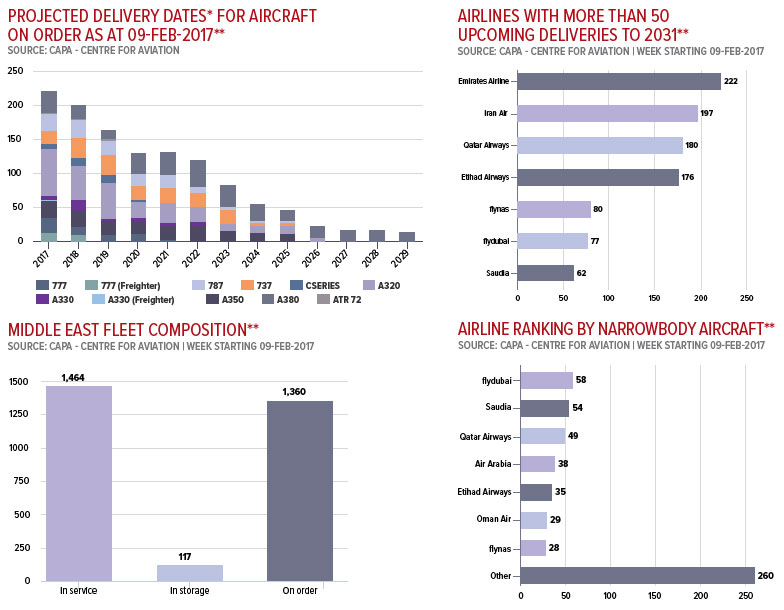

The Middle East region has the highest ratio of in service to on order aircraft (1.0 to 0.94). For every one aircraft in service in Feb-2017 (1459) there is nearly one on order (1368). The Middle East has the fourth largest regional backlog, much lower than the 4600 aircraft on order in Asia Pacific and lower than the 2200 aircraft on order in each of North America and Europe. Unlike North America and Europe, most new aircraft in the Middle East are for growth, not replacement.

The Middle East region has the highest ratio of in service to on order aircraft (1.0 to 0.94). For every one aircraft in service in Feb-2017 (1459) there is nearly one on order (1368). The Middle East has the fourth largest regional backlog, much lower than the 4600 aircraft on order in Asia Pacific and lower than the 2200 aircraft on order in each of North America and Europe. Unlike North America and Europe, most new aircraft in the Middle East are for growth, not replacement.

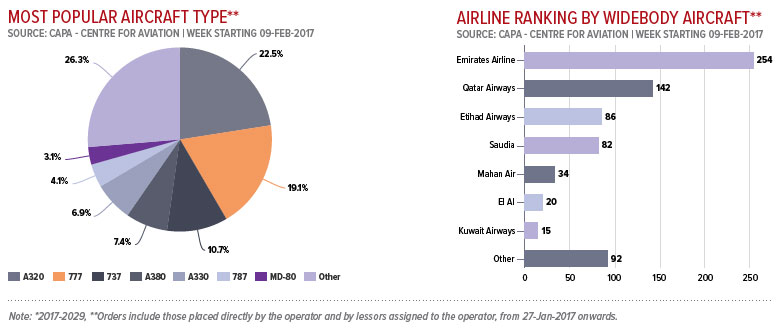

Although the Middle East has the fourth largest total aircraft backlog, it is approximately tied with Asia Pacific for the largest widebody backlog.

The epicentre of the Middle East and widebody aircraft is all-widebody Emirates and its scores of A380s doing turnarounds at its home of Dubai International. Gulf airlines are adjusting to a slowdown in revenue from their high yielding oil and gas resource sector, but infrastructure is becoming a challenge to growth. Besides frequent runway and air traffic constraints, Emirates is running out of A380 parking stands at Dubai International. For a number of reasons, Emirates deferred a dozen A380s in 2016.

There is some congestion relief as flydubai moves its operations from Dubai International to the new Dubai World Central. The all Boeing 737 operator will be one of the first airlines to receive the 737 MAX, bringing efficiency improvements and giving more range.

Another notable delivery for the region in 2017 is the world's first A350-1000, due to Qatar Airways. The industry is still feeling the impact of Qatar's refusal to take delivery of A320neos in 2016 due to engine performance. Qatar converted its A320neo order to A321neos and committed to 737 MAXs. It is to be seen if Qatar will take delivery of both types.

Emirates faces fleet decisions of its own. It is overdue to place an order for A350s or 787s. Emirates has no medium-sized widebodies; its smallest aircraft for regular use is the 777-300ER, no small machine. Emirates has felt the constraint of being unable to grow in thinner markets or better match capacity with demand.

Another question is its relationship with flydubai, which has the same shareholder as Emirates but is managed separately, with little cooperation and less coordination between them. flydubai could bring Emirates a large expansion to its network and the advantages of narrowbody aircraft, which Etihad and Qatar already use.

A narrowbody operator gaining attention is Saudi LCC flynas, which ordered 60 A320s in late 2016. Its local full-service competitor, Saudia, is transforming. Riyadh and Jeddah could be new hubs for Gulf and global traffic flows. Saudia is establishing its own LCC, flyadeal, while Omani LCC Salam Air launched in 2017 with A320s.

Kuwait Airways is also transforming: immediate re-fleeting reached a milestone with its first 777-300ER. Iran remains an aviation market to watch, for opportunity but also possible political interference. Even if all goes well, it is still to be seen if Iran Air and others grow with the market or can start claiming transfer traffic.

Middle East Data" width="750" height="584" />

Middle East Data" width="750" height="584" />

Middle East Data 2" width="750" height="320" />

Middle East Data 2" width="750" height="320" />