Africa Fleet Outlook: Illustrates Continuing Under-achievement

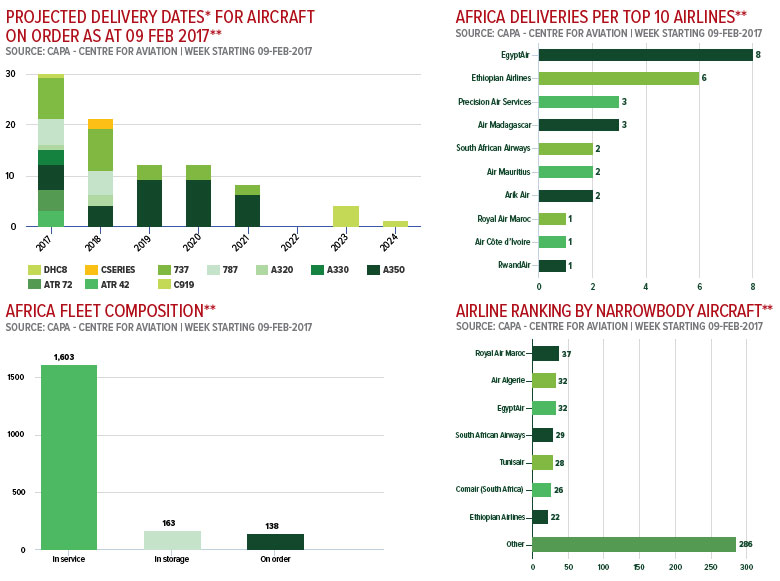

African airlines currently have less than 150 aircraft on order compared to an active fleet of approximately 1,600. In the neighbouring region of the Middle East, there is a similar sized fleet but 1,400 orders. Fast expansion from Middle East airlines have made it extremely difficult for African airlines to compete. But this is hardly an excuse for African airlines falling short; over many decades they have demonstrated their capability to do that without any help from outsiders. Given the diverging order books of the two regions the outlook for the African airline sector remains relatively bleak.

African airlines currently have less than 150 aircraft on order compared to an active fleet of approximately 1,600. In the neighbouring region of the Middle East, there is a similar sized fleet but 1,400 orders.

Fast expansion from Middle East airlines have made it extremely difficult for African airlines to compete. But this is hardly an excuse for African airlines falling short; over many decades they have demonstrated their capability to do that without any help from outsiders. Given the diverging order books of the two regions the outlook for the African airline sector remains relatively bleak.

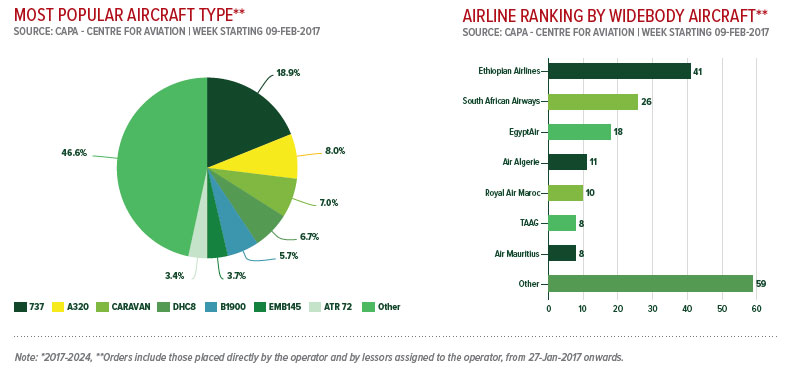

African airlines are generally small and unprofitable. With protectionist and unhelpful government intervention, most of the region's airlines lack the scale to compete effectively against foreign airlines and the financial position to order new aircraft. Most African airlines therefore rely on the second-hand aircraft market.

There are a few exceptions, most notably Ethiopian Airlines, CAPA's Airline of the Year in 2015. Ethiopian is now the largest and most profitable airline in Africa. Ethiopian accounts for approximately one quarter of all African orders, although its order book is also very modest - at 35 aircraft.

Ethiopian has the largest fleet in Africa with almost 80 aircraft - or almost 90 at the group level. There are only four other airline groups with at least 50 aircraft: Air Algerie, EgyptAir, South African Airways and Royal Air Maroc.

There are only 14 airlines in Africa with 20 or more aircraft. This group has a combined fleet of less than 500 aircraft. As a result, approximately 70% of Africa's fleet is with small flag carriers and regional operators.

Nearly 50% of the African fleet is turboprops. Only slightly more than 10% of the fleet consists of widebody aircraft. Ethiopian and South African Airways are the only African airlines with at least 20 widebody aircraft.

In 2017 only approximately 35 new aircraft will be delivered to African airlines. Ethiopian and EgyptAir will account for approximately half of the deliveries. EgyptAir is renewing its narrowbody fleet with new Boeing 737-800s while Ethiopian is continuing to expand its widebody fleet with additional A350s and 787s.

Most African airlines will again rely on second-hand aircraft to renew their ageing fleets in 2017 and - in few examples - grow. This trend is expected to continue for the foreseeable future.

There are currently 30 or fewer aircraft deliveries projected for African airlines in 2018 and beyond. The delivery figure will inch up as a few African airlines are now looking to place new orders with the manufacturers or commit to leasing new aircraft.

However, Africa is not about to see any big orders or any significant ramp up in overall aircraft order activity. Africa will remain under-represented in the global order book. Africa's airlines will continue to struggle against much bigger foreign airlines with order books that in some cases, are larger than the entire African order book.

Africa Data" width="750" height="559" />

Africa Data" width="750" height="559" />

Africa Data 2" width="750" height="358" />

Africa Data 2" width="750" height="358" />