Europe Fleet Outlook

Europe Fleet Outlook: Long haul strategies account for much narrowbody and widebody newgen fleet orders.

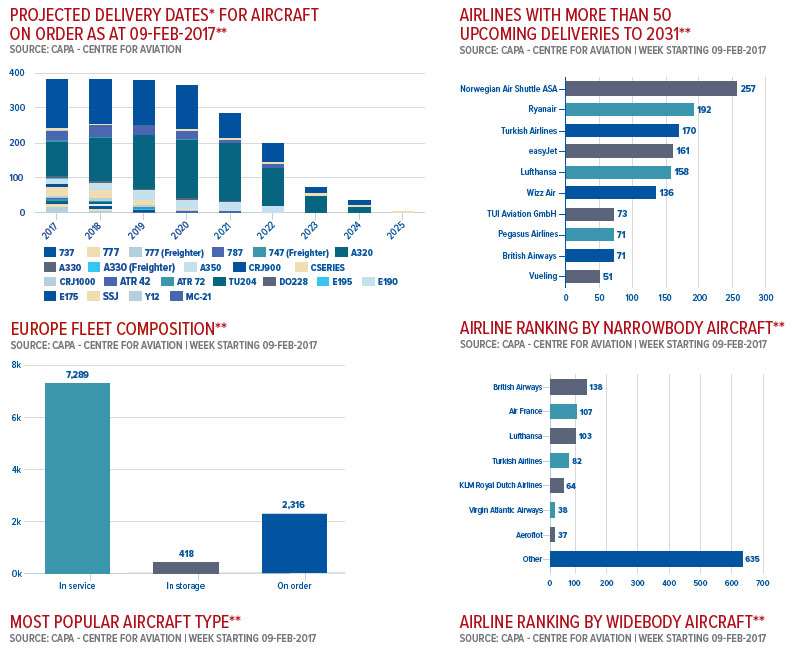

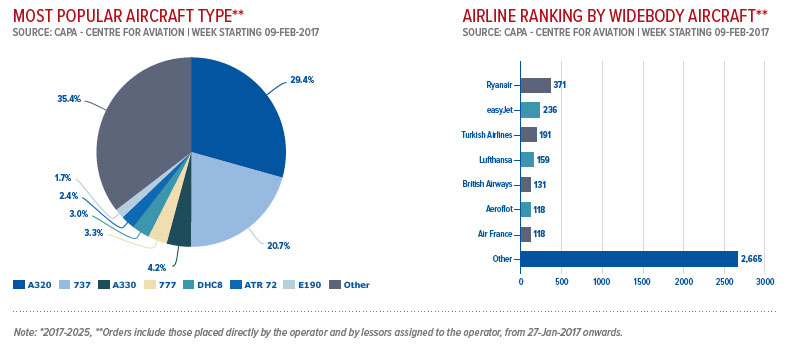

Europe has the third largest fleet by region behind North America and Asia Pacific, while it has the second youngest fleet after Latin America. As with other regions, narrowbodies make up the largest category of aircraft, accounting for 53% of the European fleet. New generation Boeing 787s and A350s make up 75% of Europe's widebody orders. The 787 has already opened up new routes, led by LCC Norwegian's 37 long haul routes in 2016 (with 50 planned in 2017), mainly on the North Atlantic, but also including examples such as British Airways' new London Heathrow services to San José Mineta (launched May-2016) and New Orleans (Mar-2017 launch). The first European A350 operator, Finnair, has so far only deployed the aircraft to lower unit cost on existing routes.

In addition to the impact of new generation widebodies, long haul route development will also be stimulated by new generation narrowbodies, such as 737 MAX 8 and A321neo LR. Norwegian plans to add trans-Atlantic services from Edinburgh and other regional UK cities to the US east coast, including "never before seen routes" made possible by single aisle aircraft.

A strong clue as to which airlines will drive growth in the future can be found in the ranking of European airline groups by the number of outstanding aircraft orders. The top 10 includes five LCCs: Norwegian, Ryanair, easyJet, Wizz Air and Pegasus.

Within the three leading legacy groups - Lufthansa, IAG and Air France-KLM - the main growth platforms are their LCC subsidiaries. Turkish Airlines and Aeroflot, the next two largest legacy airline groups, have a stronger growth record, but operate in markets with more volatile demand fluctuations.

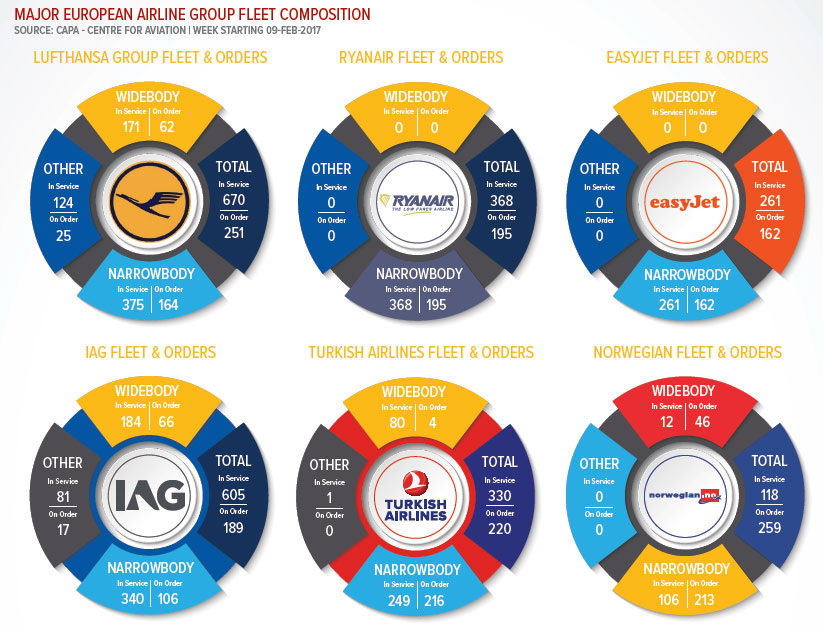

Lufthansa's major strategic project is the growth of its low fares Eurowings brand, both through partnerships (e.g. wet lease of airberlin A320s) and acquisition (e.g. Brussels Airlines). For its network airlines, where margin improvement is the focus, new aircraft are both for replacement and for modest growth of around 3%. Orders mainly consist of new generation types (A320neo family, 737 MAX, A350-900, 777-9, Bombardier C Series). It is in the early stages of a new commercial partnership with Etihad.

IAG plans group ASK growth of 3% p/a to 2021, trimmed in late 2016 from its previous plan for 4% p/a. Its orders are almost all new generation aircraft (A320neo family, 737 MAX, A350, 787, CRJ1000). However, for further long haul fleet development, it is leaning towards exercising options over current generation A330s rather than A350s or 787s, in order to increase capital efficiency. It is also extending the life of four British Airways 747s, seeking to improve aircraft utilisation and implementing seat reconfiguration/densification programmes. 2017 will be the first full year of Qatar Airways' codeshare with Vueling and revenue-sharing JV with British Airways.

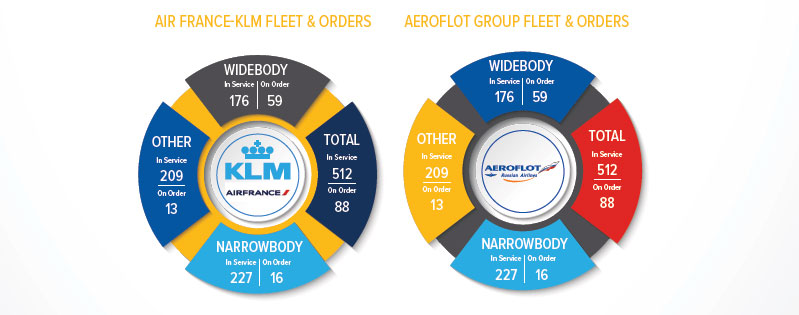

Air France-KLM has a much smaller aircraft order book than either Lufthansa or IAG, reflecting its greater struggle to restore sustainable profitability. Its widebody orders are almost entirely new generation A350s and 787s (it also has two A380 and two 777-300ER orders), while its narrowbody orders are current generation. It is in the process of discussing with unions regarding a new lower cost long haul airline at Paris CDG. Currently, the group's main growth vehicle is short/medium haul LCC Transavia, but this is pulling back from previous plans to develop new bases outside France and the Netherlands.

Already Europe's largest airline group by annual passenger numbers, Ryanair aims to grow from 119 million in FY2017 to 200 million annual passengers by FY2024, an average growth rate of 8% p/a. The last of its 737-800 deliveries is due in Dec-2018, while its 95 737 MAX deliveries are expected from 2019 to 2024. Since initiating its 'Always Getting Better' programme in 2014, Ryanair has increased its presence in primary airports, improved customer service and reinvigorated its digital interfaces, driving a load factor gain of more than 10ppts.

In response to weaker international demand, Turkish Airlines implemented an unprecedented capacity cut in winter 2016/2017 and plans to lower ASK growth from 11% in 2016 to 3% in 2017. Due to planned load factor gains and faster domestic than international capacity growth (no growth is planned to Europe or the Americas), it expects to raise passenger growth from 3% to 10%.

In Oct-2016, it announced the rescheduling of 165 aircraft deliveries from 2018, cutting its planned fleet size in 2021 from 439 to 400. Still one of Europe's leading buyers of new aircraft, its orders mainly consist of new generation narrowbodies (A321neo and 737 MAX 8).

With passenger growth of 10% in 2016, Aeroflot was the fastest growing legacy airline group among Europe's top 10 airline groups, by contrast with falling traffic in Russia overall. The group's multi-brand strategy splits the market into premium, regional and low cost segments. Its narrowbody orders are current generation (mainly 737-800s), while its widebody orders consist mainly of new generation A350s and 787s and it also has 19 Sukhoi RRJ-95B.

easyJet's strategy is built around a strong network focusing on Europe's primary airports and using its unit cost advantage versus legacy airlines to grow market share at those airports. In spite of falling unit revenue, it is accelerating its seat growth from 6% in FY2016 to 9% in FY2017. The airline's orders include 32 more A320ceos, for delivery until Dec-2018, and 130 A320neos, for delivery from Jun-2017 until 2022. It plans to grow the fleet from 257 aircraft in FY2016 to 357 in FY2021.

Although not in the top seven (or even the top 10) by current fleet numbers, LCC Norwegian tops the aircraft order ranks by European airline groups. Its 259 orders include 46 787 widebodies and it has plans for significant additions to its long haul network in 2017, including trans-Atlantic services from Ireland and Barcelona (which may include South American routes).

It also plans long haul routes from Edinburgh and other UK cities outside London using narrowbody 737 MAX aircraft, with secondary US airports as possible additions to its network. Its narrowbody orders are mainly new generation 737 MAX and A320neo family aircraft. It plans to deploy A321neo LR aircraft on long haul routes, but its first four A320neos are to be leased out.

Two others, both narrowbody-only ultra-LCCs, are in the top 10 European airline groups by number of aircraft orders, but not by current fleet size. These are Wizz Air, which has 138 orders (and a fleet of 75 aircraft) and Pegasus, with 71 orders (and a fleet of 80).

Europe Data" width="750" height="619" />

Europe Data" width="750" height="619" />

Europe Data 2" width="750" height="332" />

Europe Data 2" width="750" height="332" />

Europe Fleet Composition" width="750" height="576" />

Europe Fleet Composition" width="750" height="576" />

Europe Fleet Composition 2" width="750" height="296" />

Europe Fleet Composition 2" width="750" height="296" />