North America Fleet Outlook

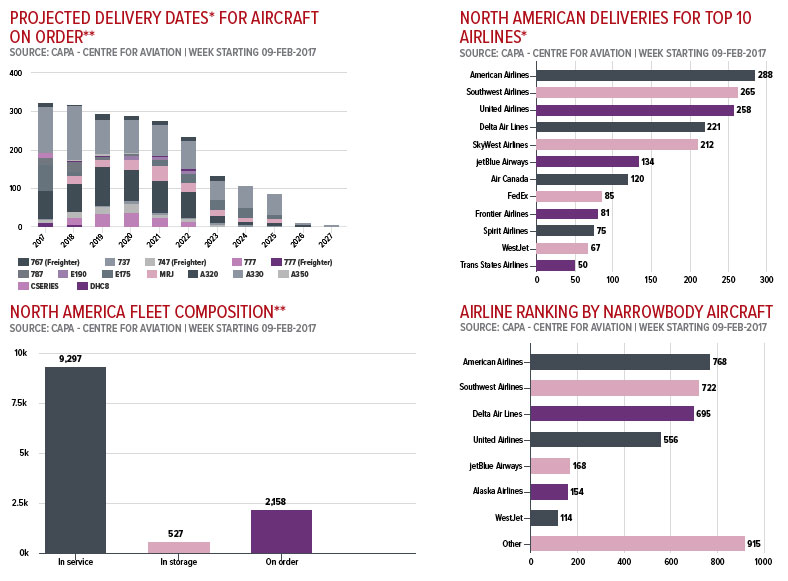

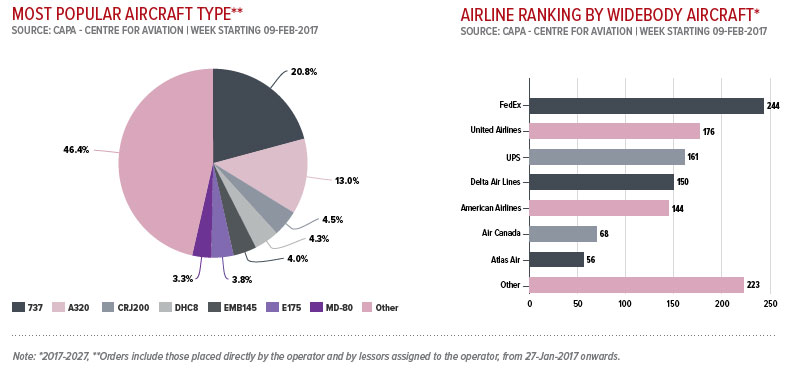

North American airlines have roughly 2132 aircraft on order, of which nearly 61% are narrowbody jets pegged for replacement and aircraft upgauge as the region's large global network airlines continue their strategy of shedding 50 seat jets.

North American airlines have roughly 2132 aircraft on order, of which nearly 61% are narrowbody jets pegged for replacement and aircraft upgauge as the region's large global network airlines continue their strategy of shedding 50 seat jets.

The region's largest airlines - American, Delta, Southwest and United - represent the bulk of aircraft on order from North America with a consolidated total of 1032 jets. Narrowbodies represent a large portion of those orders as airlines look at replacing current aircraft technologies with next generation A320neo and Boeing 737 MAX families.

American, which leads North American airlines with a total of 288 aircraft on order, is in the midst of concluding the retirement of its MD-80 jets, and has 200 orders for the A321neos and 737-8 MAX jets.

Larger regional jets such as the Embraer E175 are not only gaining prominence in the fleets of American and United, but are also serving a strategic purpose for smaller airlines including Alaska Air Group. Alaska is using E175s on thin routes not large enough for its fleet of 737s, but outside the operating envelope of its 76 seat Bombardier Q400 turbroprops. Regional jets account for 25% of North American aircraft on order, followed by widebodies with a nearly 9% share.

Southwest Airlines is preparing to take delivery of its first 737MAX in 2017 while retiring its 737-300 Classic jets. United Airlines, which has 257 aircraft on order, is in the midst of reviewing its widebody, narrowbody and regional aircraft needs. The airline has deferred 61 737-700 current generation jets indefinitely, and has converted those to MAX aircraft with unspecified delivery dates. It opted to convert four -700s to the larger -800 version scheduled for delivery in 2017. The carrier converted the remaining 61 into orders for 737 MAX aircraft, with delivery dates to be determined.

Delta's narrowbody order book is composed of A321s, 737-900ERs and CSeries aircraft, which largely reflects its strategy of waiting for new aircraft to gain a certain level of market maturity while capitalising on cheaper pricing for current generation models.

All three of the large US global network airlines are A350 customers, and Delta is scheduled to accept delivery of its first next generation narrowbody aircraft in 2017. American has deferred deliveries of its A350s, and United's A350 order is likely under review as it works to determine its long term widebody needs. Both Delta and United are in the midst of retiring their 747 widebodies.

Delta is the only large North American airline without a 787 delivery pipeline after cancelling an order for the widebody jet that was a carry-over from its merger with Northwest Airlines. Roughly 80 787s are in service with North American operators, and United operates the largest number at 32.

United has put the 787's mission profile of optimally serving long thin routes to the test, operating service to secondary cities in China including Chengdu and Hangzhou from its San Francisco hub.

In mid-2016, United launched service from San Francisco to Singapore, the longest route operated by the 787.

Both American and United operate 787s to Auckland from their hubs in Los Angeles and San Francisco. American has used the 787-8 to close the competitive gaps in Asia with Delta and United, operating the aircraft to Shanghai from its hubs in Dallas and Chicago O'Hare, and from Los Angeles to Tokyo Haneda. American also uses the 787-9 on service from Dallas to Madrid, Paris and Sao Paulo.

No North American operator has yet to use the 787 as hub bypass aircraft, and the trend for the foreseeable future is operating the widebodies from hubs to long haul Asian markets.

Delta's moves with its A350s in Seattle will be closely watched given the company's international expansion from its primary Asian market hub is on hold until the airport can handle increased international passenger capacity.

One of the most interesting developments to watch in the long haul, low cost trans-Atlantic market is jetBlue's potential launch of flights from its Boston focus city with A321LRs. jetBlue would be the first US low cost airline to inject its form of low cost competition across the Atlantic to combat what it deems as unfair competitive concentration held by members of trans-Atlantic JVs.

The more mature North American airlines are all at various phases of fleet replacement as their network needs evolve while the region's younger airlines are examining potential forays into longer haul routes, adding another layer of competition for entrenched carriers.

American Data" width="750" height="553" />

American Data" width="750" height="553" />

American Data 2" width="750" height="351" />

American Data 2" width="750" height="351" />