Latin America Fleet Outlook

Latin America's Recession has greatly slowed fleet growth, but LCCs start to assert themselves

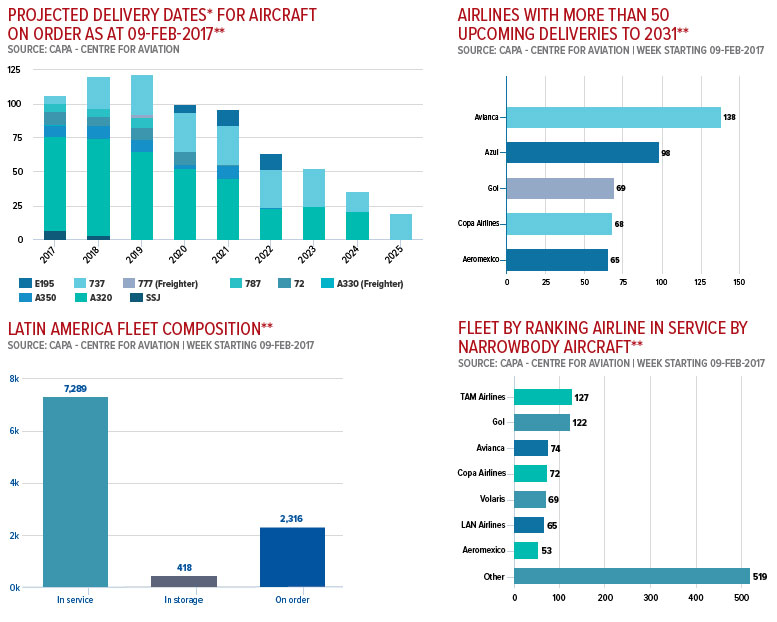

A two year long recession in Latin America has forced the region's largest airlines - LATAM Airlines Group, Avianca Holdings, Copa and Gol - to defer aircraft deliveries to sustain their respective balance sheets in order to weather tough economic circumstances But over the long term Latin American airlines are capitalising on new aircraft technologies to broaden their competitive reach within, and to/from, the region.

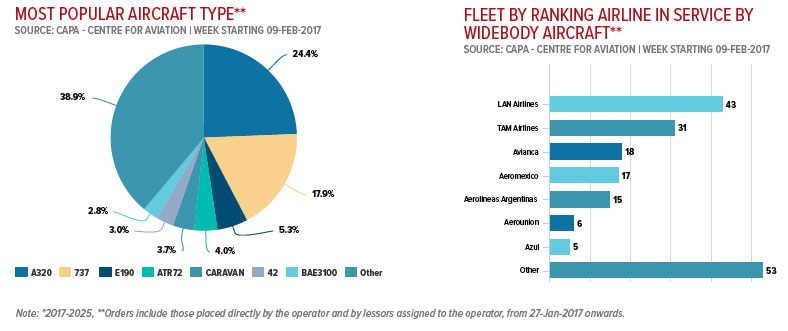

Airbus remains the dominant manufacturer in Latin America, representing nearly 27% of aircraft in service compared with Boeing's 25% share. Airbus' reign as the manufacturer of choice among Latin American airlines will stay intact for quite some time. It represents roughly 60% of the aircraft on order - 791 shells - among those operators.

Although Avianca, Copa and Gol have all opted to adjust their order books to reflect Latin America's current economic reality, each of those airlines has more than 50 aircraft deliveries planned between 2017 and 2032.

Avianca holds the lion's share with 138 (CAPA includes Avianca Brazil and Avianca Argentina in the fleet profile, even though those airlines are not technically part of the Avianca group).

A319neo and A320neo narrowbodies represent the bulk of Avianca's aircraft order book. Some of those aircraft are likely pegged for replacement of older Airbus narrowbodies and others will help Avianca grow within South America and on routes to North America from hubs in Lima, Bogota, and San Salvador.

Copa and Gol are all-Boeing operators, and Copa's order for 65 737 Max aircraft are suited for more dense routes from the airline's hub at Panama City Tocumen. Copa has a certain level of fleet flexibility in terms of lease renewals, and the next generation narrowbodies can be used either for growth or replacement aircraft. Gol is taking a break from deliveries in 2017, but once a fully fledged economic recovery gets underway in Brazil, Gol will revamp its fleet with more efficient narrowbodies to sustain its position as the country's largest domestic operator, and grow its footprint within South America.

Latin operators of next generation widebody aircraft - the 787 and A350 - are using the twin aisle jets on a mix of new and existing missions. The route profiles reflect dual strategies for the new generation widebodies of replacing older aircraft and opening up previously unviable routes.

LATAM Airlines Brazil operates its A350s on flights from its Sao Paulo Guarulhos hub to Orlando International, Madrid and Milan while LATAM flies the 787-9 from its Santiago hub to Los Angeles, Madrid, Cancun, Orlando and Auckland.

New 787-9 service from Santiago to Melbourne starts in Oct-2017, marking the longest flight for LATAM at 6,111nm. The Melbourne route fits the 787-9's mission profile of long thin routes, and opens up opportunities for LATAM to leverage its Santiago hub for nonstop service from the Southern Cone to Australasia as demand between the two regions grows.

Aeromexico uses its 787 widebodies on routes deep into South America from its Mexico City hub including Buenos Aires and Santiago as well as trans-Atlantic service to London, Madrid and Paris. It operates 787s on service to Tokyo Narita and one-stop 787 flights through Tijuana to Shanghai.

The airline is launching new 787-operated flights from Mexico City to Seoul in May-2017. Aeromexico is using its 787s as replacement aircraft for older 767 and 777 widebodies; but the range of the next generation aircraft open up new possibilities from Mexico City to Asia as Aeromexico capitalises on its improved connectivity at Mexico City Juarez to position the airport as a connecting hub to both North and South America.

Despite the promise that new generation widebodies offer Latin American airlines in broadening their network scope, the bulk of the region's orders - 84% - are for next generation narrowbodies as low cost airlines including Volaris, Interjet, Azul and Avianca Brazil all line up for new aircraft technologies.

The new narrowbodies open up possibilities for Azul and Avianca Brazil on intra-South American markets and give Mexican airlines Volaris and Interjet options for additional US transborder flights and service to the Caribbean and upper South America.

Latin America appears to be embarking on a slow economic recovery, and the region's airlines are working to adjust their fleet strategies for the short term challenges and long term opportunities for traffic growth inherent in South and Central America.

Latin America Data" width="750" height="600" />

Latin America Data" width="750" height="600" />

Latin America Data 2" width="750" height="315" />

Latin America Data 2" width="750" height="315" />